Published on: July 18, 2024

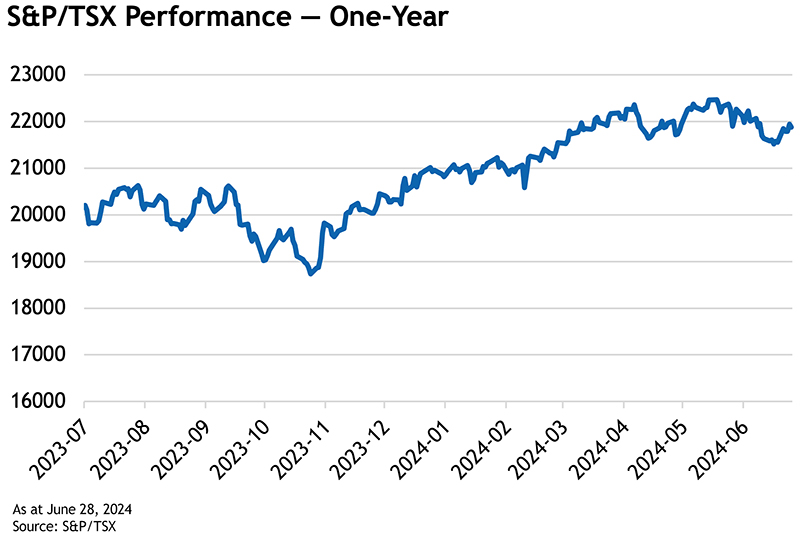

After a tumble in late spring 2024, Canadian equity markets resumed their upward journey. At the end of June, the S&P/TSX Index was up 6.1% this year. Still, with a slowdown in Canadian economic growth, a first rate cut by the Bank of Canada and strong commodity prices, investors may be wondering how to see through the fog for the rest of 2024. For a higher-level view of market dynamics, we turned to Kim Chafee and Todd Kapala, both Vice President and Co-Head, Canadian Equities.

What should investors be looking out for in Canadian equity markets in 2024?

We’re reasonably constructive on the Canadian equity markets at this point. Earnings estimates have declined significantly over the last year and now look reasonable. In terms of valuation, our view is that the Canadian market is still reasonably priced.

Given the strength in oil and some commodities, companies in the Energy and Materials sectors may see upward revisions to earnings. For their part, the banks have been challenged to deliver earnings growth, but we expect that to look better going into 2025 as well. Combined, Energy, Materials and Financials represent about 60% of the S&P/TSX Composite Index.

On June 5, 2024, the Bank of Canada announced its first rate cut in four years. What does this mean for publicly listed Canadian companies?

Many investors were indeed surprised that the Bank of Canada decided to move as quickly as it did. The central bank’s governor, Tiff Macklem, said during a press conference after the decision that if inflation continues to move sustainably toward the 2% target, it would be reasonable to expect further cuts. The Bank of Canada said that its Governing Council “is taking our interest rate decisions one meeting at a time.”

We’ll have to see how the rest of year unfolds, but generally speaking, a scenario featuring rate cuts, and therefore lower bond yields, has historically been favourable to equity markets.

Inflation is easing in Canada and the Bank of Canada has cut rates. Is the outlook for consumers bright ? Given inflation pressures that have been weakening in Canada and a slowing economy, how should investors view banks and discretionary retail stocks?

Next year will be an important one for Canadian consumers with a significant wave of mortgages coming up for renewal at higher rates (even if the Bank of Canada provides a few rate cuts). It is estimated that the average mortgage holder could face payments that are 20-25% higher on renewal. Canadians tend to be good borrowers and pay their debts, especially home and auto loans. However, adapting to higher mortgage costs will undoubtedly squeeze out some other discretionary spending.

The Canadian market does not have a lot of publicly listed luxury retail companies, but many retailers could be impacted from slowing sales and the “trade down” effect. As an asset manager, we currently favour value-oriented and necessity-based retailers. An example of this is Loblaw Companies Ltd., which has a strong presence in discount banners and value-oriented private label products.

What About the Banks?

The banks have experienced a challenging couple of years with higher regulatory capital requirements, higher interest rates resulting in slower loan growth, stress in some segments of the loan books, and the impact of inflation on their cost bases. They have underperformed the S&P/TSX Index in each of the last two years, and four of the last five years, which is fairly unusual.

We expect some of these headwinds to ease going forward, with some even potentially reversing. Capital has been built up to reflect the higher regulatory requirements and many banks will likely be back in excess capital positions soon. Rate cuts could stimulate lending activity again and many banks have embarked on significant cost and restructuring programs to reduce the cost base. In terms of credit quality, we are now seeing the impact of higher rates in their loan books, with impaired loans rising and credit losses reverting to more normal levels. The banks are well prepared for some weakness, with significant reserves already taken, but credit will be lumpy for the next few quarters. Based on our economic outlook, we expect credit losses to peak early in 2025.

We expect the outlook for the Canadian banks to improve and the stocks to make up some ground relative to the S&P/TSX. This is based on our economic outlook, which assumes that the economy continues to deliver low growth, interest rate cuts materialize over the next 18 months and unemployment remains reasonably stable.

Why have U.S. equities outperformed Canadian stocks during the past three years?

We see a few key reasons for this. For starters, market composition. Financials, Materials and Energy sectors account for 60% of the S&P/TSX’s weight. They are considered “value” stocks that are cyclical. It just so happens that this segment of the market is out of favour. Meanwhile, growth stocks are in vogue, tech in particular. To illustrate, tech and health care have a 50% weighting in the S&P 500, compared to 8% in Canada.

Second, the Magnificent 7 (Nvidia, Microsoft, Meta, Google, Amazon, Apple, and Tesla) make up the majority of S&P 500 gains since the beginning of 2024. The Canadian market doesn’t benefit from AI the same way the U.S. market does.

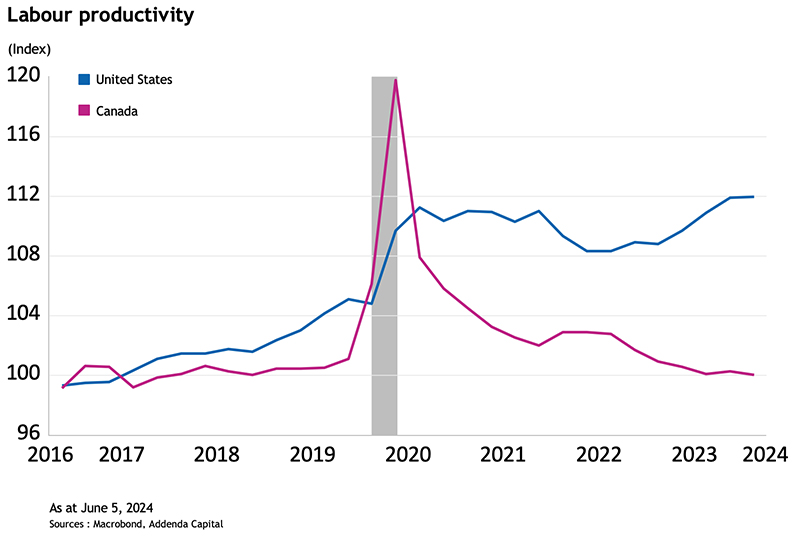

A third issue is the gap in productivity. The United States has seen a 12% increase in productivity since 2016 (figure 1 below), while Canada has been flat. This is a headwind. It provides a key reason to stay diversified with global stocks in addition to Canadian ones. High productivity allows you to have your cake and eat it too, because it means faster non-inflationary growth. However, we are seeing the opposite phenomenon in Canada.

Figure 1

How Should Canadian investors position their portfolios?

We think both international and domestic stock markets look attractive on a risk/reward basis. In other words, the potential gains for investors appear to be compelling given the potential risks associated with investing in markets.

Addenda’s team of economists is forecasting policy rate cuts in both the United States and Canada and a slowdown in economic growth. However, we think that growth will be sufficiently strong to allow for high single-digit earnings growth in the United States and Canada. Lower interest rates should help key sectors in Canada — Energy and Financials, for instance — as most tend to offer high dividend yields.

Related Contents

Canadian Equities

Carbon Footprint: Exploring Stories Behind a Number

Unravelling the Effects of Artificial Intelligence on Investing