Published on: October 19, 2023

Monika Freyman, Vice-President, Sustainable Investing

This year has laid bare that the climate transition is not going to be easy, but also that we are running out of time. With the backdrop of a record wildfire season and mixed signals from provincial and business leaders alike, it’s hard to stay hopeful that we will transition the Canadian economy quickly enough to mitigate the likely even bigger physical impacts from climate change.

However, there are glimmers of hope, with certain key programs and policies coming online despite the gloom and haze. We catch up with Monika Freyman, Vice-president, Sustainable Investing, who shares her thoughts on why she remains hopeful regardless of these challenges.

The federal government made a big announcement in August outlining how the country needs to aim for a net-zero electricity grid. Why is this important for investors?

A growing number of institutional investors and asset owners have made major net-zero commitments and want to allocate capital to climate transition solutions. However, we need to keep working on strong policy signals. The government’s electrification plans are a step in the right direction.

Over 80% of Canada’s power grid is non-emitting. From 2000 to 2020, emissions from the electricity sector fell by 53% to 62 Mt CO2e. Meanwhile, wind and solar have shown to be the fastest-growing sources of power in the country. In 2020, 61.7% of electricity generation originated with hydro, followed by nuclear (16.3%), gas/oil/others (9.5%), non-hydro renewables (6.3%), and coal (6.2%). There is still room for improvement, and we need all the tools at our disposal to achieve Canada’s goal of reducing carbon emission by 40-45% by 2030 from 2005 levels.

The Canadian government’s “Powering Canada Forward” plan provides a blueprint for the future on how to build on Canada’s strengths in clean energy. However, it also points out how much more work remains to integrate grids, improve transmission within and to break down barriers for interties between provinces if we are going to meet net-zero goals. The plan mentions that challenges are both technical and regulatory. For example, varying market structures can hamper the development of new projects that cross provincial lines.

The federal government’s intention sets the table for talks with stakeholders such as provinces, regional governments, communities, utilities, and experts. The Clean Electricity Strategy is expected to be published following these discussions in 2024. We need to have these “rules” in place along with clarity on the taxonomy, which defines what are green and transition projects, to allow us to invest with confidence in Canada’s net-zero transition.

What do you view as the primary challenge right now on climate change and investors meeting net-zero goals?

A major challenge has been companies walking backward on their level of commitment on climate change. In February 2023, for example, we saw BP scale back its emissions reduction goal, going from an original target of 35% by the end of the decade to what is now a 20 to 30% cut. We are also seeing some Canadian companies signal that they may be scaling back their climate leadership as well.

Looking at the bigger picture, the road to net zero will be a bumpy one. Another example is the geopolitical tension sparked by Russia’s invasion of Ukraine in February 2022, which highlighted the importance of energy security. Analysis of net-zero goals and pathways is not isolated at the company level, but also plays out in regional energy procurement, geopolitical tension or in driving economic instability.

The energy transition to net zero is as critical as ever and highlights that moving to more distributed and diverse energy sources can have the added benefit of not being reliant on politically unstable and unsavory regimes. At the same time, investors need to have a more nuanced approach and recognize that bridging energy sources will remain in the mix in the short-term, but accelerating clean energy solutions is required. Transitioning to a low-carbon economy future is a systemic change which needs consistent strong policy and structural economic drivers, such as a clear Canadian climate transition taxonomy, to support progress toward our collective net-zero goals. This need for policy and capital to align for the implementation of net-zero commitments is new and uncomfortable, but it is critical.

What lesson is 2023 teaching us in terms of climate change?

It’s that climate change impacts are not about some distant future; they’re happening now. These impacts are not incremental, but rather are hitting us as big shocks. Dealing with climate change involves avoiding tipping points, and sadly, we seem to have gone over the wildfire cliff this year. Although a certain level of wildfire activity is natural and specific forestry practices, such as planting large swaths of monoculture species, have exacerbated the situation, it’s estimated that climate change more than doubled the likelihood of hot, dry and windy conditions that drove wildfires in Eastern Canada this year.

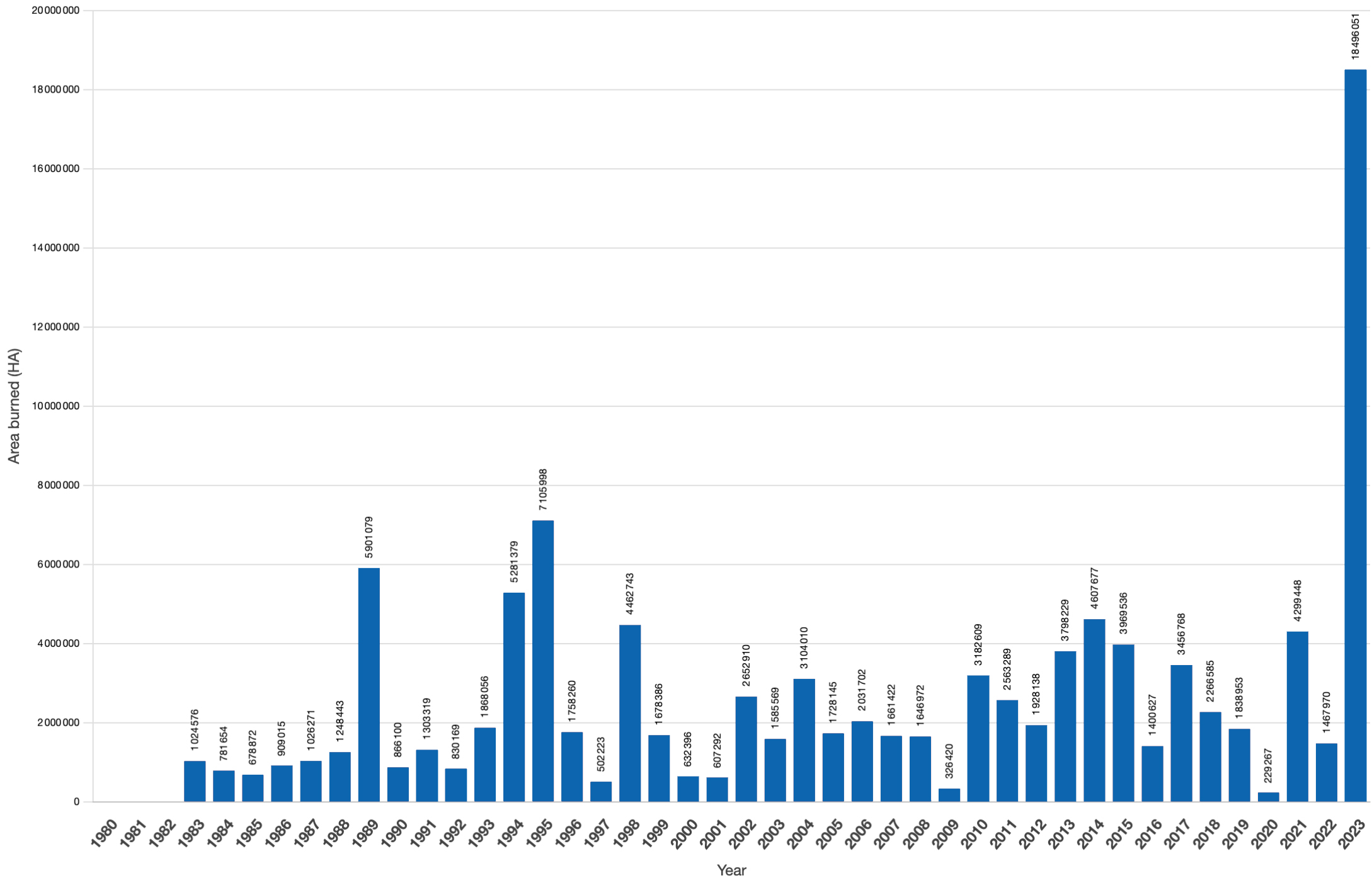

Adverse weather events have proven to become more common and intense. This year’s fires have devastated forests across Canada, from Québec to British Columbia and the North. The increase in wildfires in 2023 is unprecedented, with areas burned representing twice the size of Ireland (see below) and direct negative impacts on Canada’s GDP.

Source: Canadian Interagency Forest Fire Centre Inc.

Let’s not forget that last year was painful as well: we saw hurricane Fiona in the Maritimes, significant flooding in the Fraser Valley cutting off major transit and trade arteries in Western Canada, and catastrophic wildfires destroying parts of British Columbia well into October 2022.

We also need to remember that physical impacts of climate change are often felt by the most vulnerable. The term “just transition” is popular in signalling that the climate transition should consider the impact on workers and other stakeholders. This should also be balanced on the need to focus on an “unjust lack of transition”, where climate change impacts are disproportionately felt by those in lower economic brackets and minorities or those displaced. For example, the elderly can be deeply impacted by heat waves and wildfire smoke, especially those unable to pay for air conditioners or air purifiers. Moreover, climate disasters affect Indigenous communities, who risk losing everything or being cut off from their lands as a result of landslides and flooding. For some, these disasters have become a recurring ordeal.

Thankfully, we are seeing policy movement, corporate and investor leadership stepping up. The key question is if the ambition to act will be high enough to meet the challenge at hand. Time is indeed running out…