Published on: August 8, 2024

Our approach in selecting investments for our Impact Fixed Income Strategy is a subject that generates interest. This case study aims to shed some light on our process and our criteria.

Our Impact Fixed Income Strategy intentionally seeks to create both compelling financial returns and positive social and/or environmental impact that can be adequately measured, tracked, and reported. Launched in 2018, the Addenda Impact Fixed Income Pooled Fund reached nearly $530 million as at June 30, 2024.

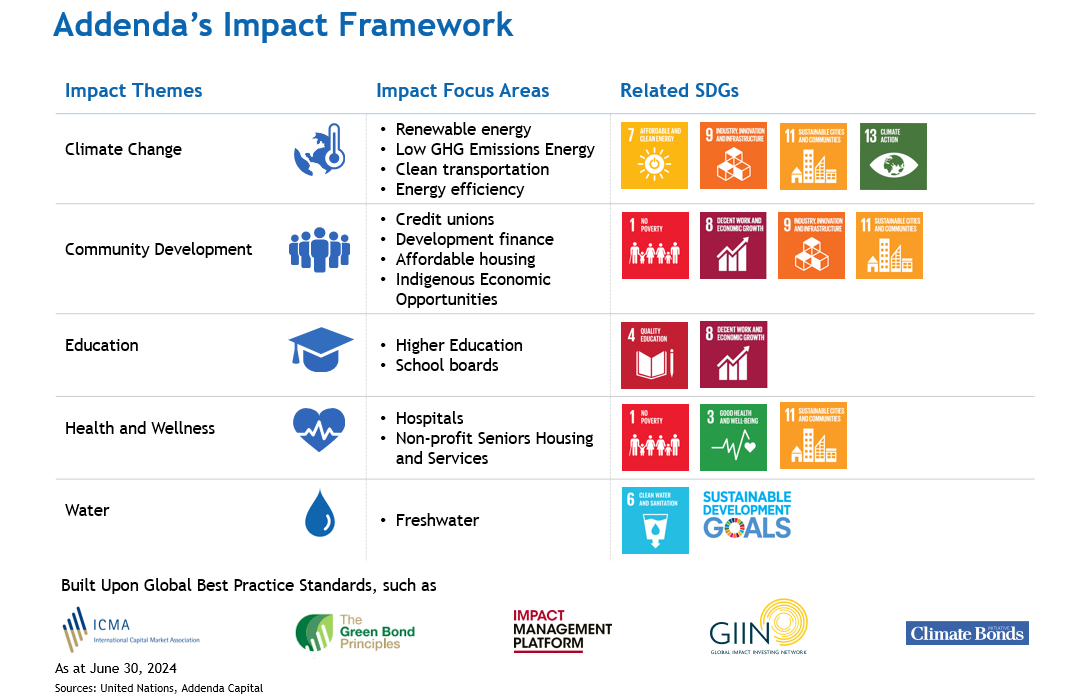

The Fund presently includes five investment themes, each of which contains specific focus areas. These themes are climate change, health and wellness, education, community development, and water, which was added in 2024. Investments made under themes and sectors of interest may align with one or more of the Sustainable Development Goals (SDGs) adopted by the United Nations in 2015.

Analyzing an Investment Opportunity

One of the investments we made in the Fund in 2022, under the climate change theme, consisted of bonds issued by Capital Power, a Canadian power producer.

The green financing framework issued by the company that year had a clear objective: to fund development of clean energy technology, including solar, wind, and energy storage, accelerating its coal power generation phase out. Capital Power now operates 10 wind facilities and three solar farms that provide approximately 1,499 MW of renewable energy to communities across Canada and the U.S. (Calculations differ depending on type and size but a common estimate is that 1 MW can power roughly 1000 homes.) (1)

Moving away from coal

Capital Power made headlines in June 2024, when it announced that its Genesee Generating Station, near Edmonton, had completed the transition from coal to natural gas as its power source. The news carried symbolic meaning: the plant housed what were the last coal units in Alberta’s electric system where coal-fired power accounted for 80 % of the province’s power grid 20 years ago . With their transition, the company has now effectively phased out using coal to make power, seven years ahead of a 2030 deadline set by the provincial government in 2015. (2)

While this milestone is notable, the path to Canada’s commitment to achieve net-zero emissions by 2050 will need more investments, regulations, and measures. Recently, Capital Power’s decision not to pursue its Genesee carbon capture and storage (CCS) project, being deemed not economically feasible, is just one example of the many challenges ahead. The CCS project was a key component for Capital Power’s net zero target by 2045. Following that announcement, Addenda had an engagement with Capital Power to better understand how they will meet their 2045 commitment with a discussion on various themes such as green capex, other CCS development in the U.S., continued optimization, research in considering small modular nuclear reactors, and other technological innovations. We will continue to monitor their progress and maintain an open dialogue.

Assessing Eligibility

To determine whether the securities were eligible for our Impact Fixed Income Fund, we conducted an impact assessment to determine whether they meet our definition of “impact.” First, we analyze if an investment fits into one of our key themes and focus areas.

Capital Power

Impact theme: Climate change

Impact Focus Areas: Renewable energy, energy efficiency

SDGs with which the company’s green framework is aligned:

- Goal 7 — Affordable and Clean Energy

- Goal 9 — Industry, Innovation and Infrastructure

- Goal 13 — Climate Action

Second, if the security passes above, we assess whether green and sustainable best practice principles are being applied. This includes examining the ring-fencing around use of proceeds, the governance system to manage these, transparency and reporting on impact at least annually, etc. We also look at additional elements such as second-party opinions regarding an issuer’s sustainable or green bond use of proceeds oversight. This helps mitigate impact investments meant for energy efficiency projects going to build highways or other purposes.

Third, we do a detailed focus area analysis of quantitative impact commitments. This involves developing a proprietary set of impact research for very specific industries such as hydropower, clean transportation, affordable housing and so on based on global best industry standards such as from Climate Bonds Initiative taxonomy or guidelines related to affordable housing development and much in between. This deepens our commitment to not only ensure that allocations are being made and tracked on impact investments, but also that the impacts will be significant. For example, we would disallow an impact investment that only has energy efficiency improvements of 5% as we would not deem this as significant enough.

Finally, we conduct an assessment based on Do No Significant Harm Principles. This helps to determine if there are major violations of the principles that would preclude the investment from being allowed into the fund. We apply the DNSH principles laid out in the Sustainable Finance Action Council’s (SFAC) Taxonomy Roadmap Report to the Government of Canada and, when needed, draw upon the European Union DNSH principles as described in its Taxonomy Regulation where the Canadian taxonomy lacks guidance.

Impact Metrics

Renewable energy generation in 2022:

- Whitla Wind facility, Alberta: 1,400,000 MWh

- Strathmore Solar, Alberta: 65,000 MWh

- Buckthorn Wind, Texas, United States: 350,000 MWh

- Cardinal Point Wind, Illinois, United States: 619,000 MWh

(1) Powering Ontario’s Growth

(2) Phasing out emissions from coal

Related Contents

Stewards of a Sustainable Future: Our Role in the Climate Transition

How cool is your portfolio?

The Ripple Effect: Recent Trends in Impact Investing