Published on: April 18, 2024

François Desmeules, Portfolio Manager, Fixed Income

Investors often assess their investments’ returns by comparing them to major indexes. However, to diversify their portfolios, some of them may also resort to an absolute return strategy, which aims to generate returns irrespective of market conditions.

To learn more about this strategy in the face of continued uncertainty in 2024, we turned to François Desmeules, Portfolio Manager, Fixed Income (pictured). He describes the strategy as one that seeks capital appreciation through diversifying sources of added value, managing risk prudently, and analyzing macroeconomic trends.

What are the main outlines of the strategy?

One way to generate absolute returns is to exploit a range of investment opportunities that is more varied than a traditional approach. For example, at Addenda, the approach involves using liquid fixed-income securities and currencies of developed countries.

However, this type of strategy requires close monitoring of portfolio risk, which means following precise parameters. Since it involves the use of derivatives, the strategy is leveraged. As for analysis of the macroeconomic environment, we are fortunate to have our own team of economists. Their monitoring of economic activity is even more relevant as it uses econometric analysis, which seeks to establish links between the real economy and the financial markets.

Which type of investor can an absolute return strategy cater to?

A value-added diversification approach can benefit all investors seeking long-term capital appreciation. Since this type of strategy aims to diversify the sources of return, allocating a portion of one’s assets to it can result in lowering a portfolio’s overall risk. Of course, a portfolio should be exposed to market movements, as measured by its beta which reflects its volatility relative to markets. However, our approach relies on the benefits of diversifying the sources of added value, or alpha.

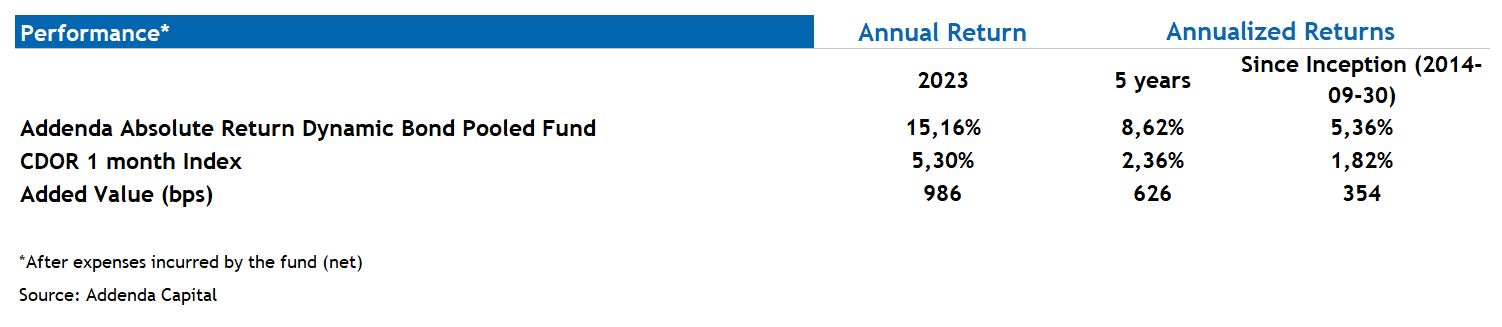

Our own Addenda Absolute Return Dynamic Bond Pooled Fund (“the Fund”) has generated a 5.36% annualized return since its inception on September 30, 2014 (as at March 31 2024). It returned 15.2% in 2023, while its five-year annualized was 8.62% (as at March 31 2024).

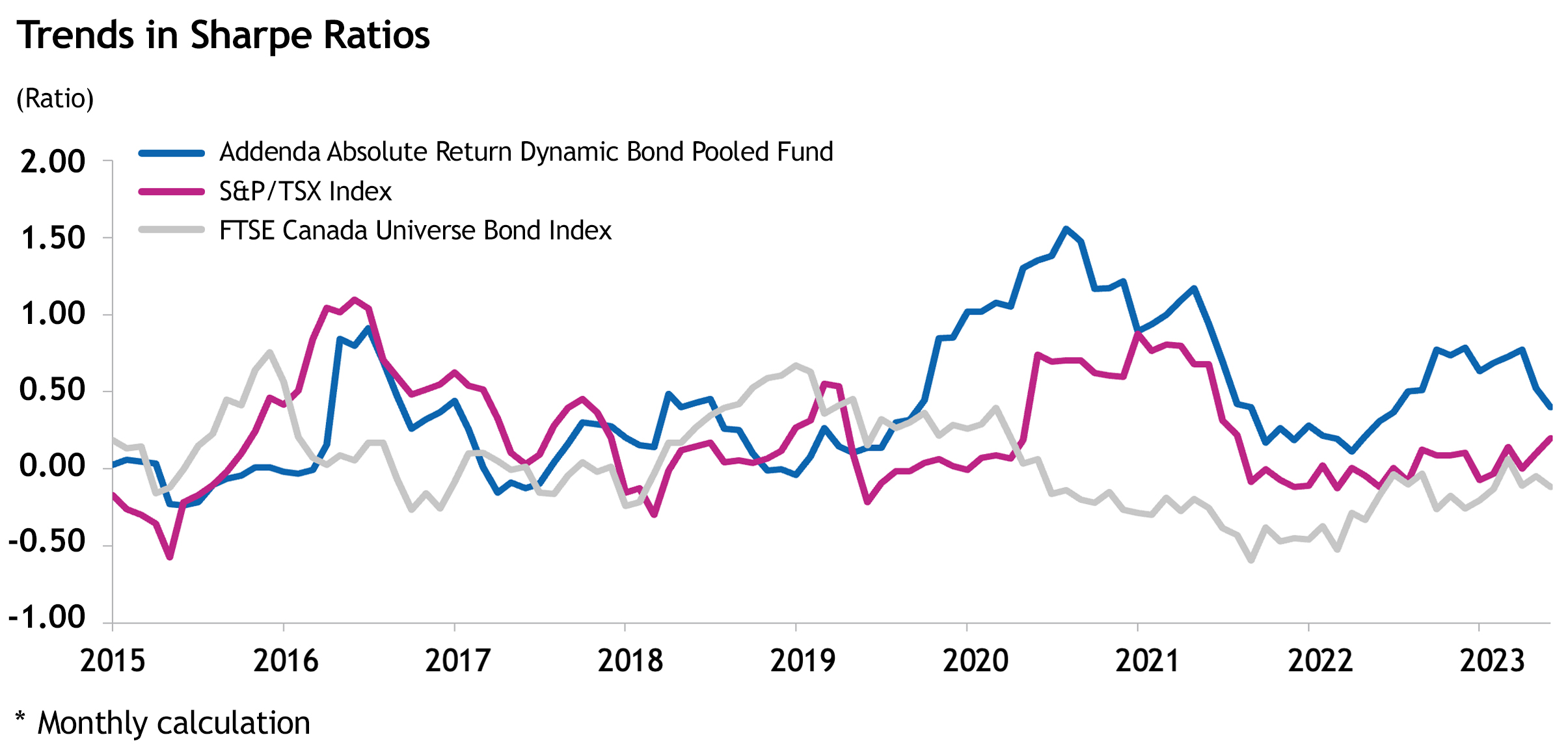

Moreover, since the Fund’s risk-adjusted return is higher, its addition to a traditional stock and bond portfolio enhances its return-risk profile. For this, we use the Sharpe ratio, which measures the relationship between value added and the risk taken to generate it. As illustrated in the chart below, the Fund often outperformed one of the two asset classes prior to 2019. Since then, it has consistently beaten both.

Source : S&P/TSX, FTSE Canada, Addenda Capital

Although our objective is not to outperform an index, for comparison, we use the Canadian Dollar Offered Rate (CDOR), which can be seen as a benchmark for return on cash. CDOR is a benchmark rate for bankers’ acceptances. In June 2024, the CDOR will cease to exist, set to be replaced by the Canadian Overnight Repo Rate Average (CORRA).

You say you closely monitor the Fund’s risk level. How do you do this?

The portfolio must respect two well-defined risk limits: Value at Risk (VaR of 95%) and leverage. We evaluate both of these parameters twice a day and every time we add new positions. Value at risk refers to the minimum potential loss that an investment may incur in certain contexts. For its par, leverage refers to the Fund’s exposure to the use of derivative instruments, which can amplify gains or losses.

The strategy requires a high level of attention and hard work. In a way, it’s a constant search for strategies that can lead to the creation of added value. We need to understand the macroeconomic backdrop and identify opportunities in the markets that match what we’re looking for.

How have the last 24 months, with rising policy rates in response to high inflation, influenced your work?

It’s a bit of an ideal environment for this kind of strategy. The level of uncertainty is high, and differences of opinion increase volatility. In this context, we rely on our macroeconomic analysis to try to establish fair value in the markets. It’s important to understand the economic environment in which we find ourselves, as its past relationship with markets is not always a reliable guide.

What are some common misconceptions about fixed-income absolute return strategies?

There are many types of absolute return funds (hedge funds) in the market, and it would be wrong to group them all together. Some of these strategies expose themselves to a higher level of risk. What characterizes our approach is its disciplined risk management and combination of several strategies, as opposed to other products where risk is more concentrated. Thanks to the multiplication of potential sources for added value, returns do not follow trends and correlation with the market stays low. What’s more, by evaluating a wide range of fundamental and quantitative factors, we achieve more consistent returns over time, while minimizing losses.

Related Contents

Infrastructure Bonds, a Hidden Gem in the Fixed Income Market

Absolute Return Dynamic

Fixed Income