Published on: May 6, 2025

The responsible investing world converged on Toronto for the PRI in Person conference in October 2024, where the United Nations-developed Principles for Responsible Investing (PRI) network gathered to share and advocate for best practices. Taking advantage of this moment, Addenda Capital, the First Nations Major Project Coalition (FNMPC), and the First Nations Financial Management Board (FNFMB) convened Indigenous leaders, debt issuers, asset owners and sustainable finance leaders for a focused roundtable discussion.

Under Chatham House Rules, participants learned, engaged, and shared ideas on how to leverage the success of the sustainable bond market to support the financing needs of Indigenous Peoples. The roundtable explored whether developing an Indigenous Sustainable bond framework would drive more interest and capital from investors, while ensuring that proceeds would be used to finance projects with endorsed benefits to Indigenous communities.

This groundbreaking discussion led to the development of a comprehensive discussion paper and three articles examining key aspects of this initiative. The first article addressed Indigenous finance challenges, whereas the last one will look at actions required to move forward.

First Wave of Green Bonds

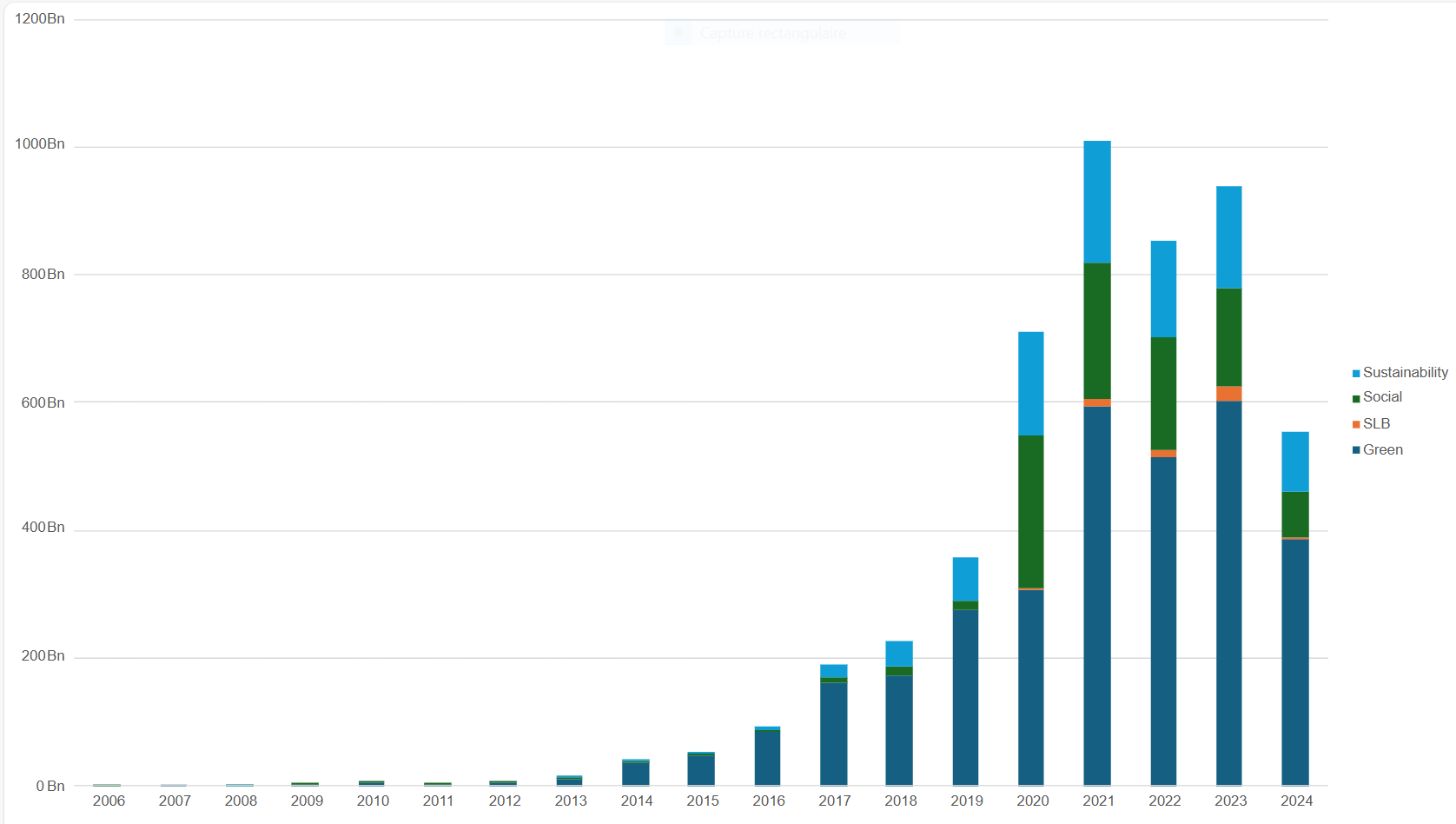

Green, social, and sustainability bonds have emerged as some of the biggest success stories of responsible investing. Since their first issuance in 2007, these debt instruments have grown to over USD 5 trillion[1], providing financing toward projects with measurable positive environmental or social outcomes, based on foundational principles and practices (see Figure 1). This success offers valuable lessons for developing Indigenous finance solutions.

Figure 1

Growth in Sustainable Bonds, by type

Source: Climate Bonds Initiative

The Power of the Sustainable Bond Market

Green bonds raise capital for funding projects with environmental benefits (e.g., energy efficiency improvements, clean transportation). The funds are ring-fenced to be applied only to designated eligible projects, and issuers of these bonds commit to reporting at least annually on their positive impacts. Social bonds operate the same way but are focused on projects carrying more societal or community benefits (e.g., healthcare, affordable housing). Meanwhile, sustainable bonds are a combination of both green and social.

Connections Between Indigenous and Sustainable Finance

As one might expect, Indigenous and sustainable finance often share common characteristics and goals:

- Both are often values-driven

- Both embrace a long-term focus (seven-generations)

- Both show concern for biodiversity and externalities to the environment as well as for people and community impacts

An estimated 36% of the world’s remaining intact forests are on Indigenous Peoples’ lands, and Indigenous communities safeguard much of the world’s remaining biodiversity[2]. Both sustainable finance and Indigenous Peoples are focused on or key for climate transition. Critical mineral resource development needed for energy transition, as well as transmission lines for power generation, run through Indigenous lands and require Indigenous consultation or consent[3].

Lessons From Green Bonds

Over time, the establishment of the Green Bond Principles (GBP) and sector-based guidelines provided a “shopping list of needs.” This helped establish best practices and credibility and draw in capital that wanted to be aligned with filling these needs[4],[5]. Core components include:

- Use of Proceeds

- Process for Project Evaluation and Selection

- Management of Proceeds

- Reporting

The combination of principles and sector guidelines (which investors often call a “taxonomy”) has helped maintain credibility and confidence in the green bond market, allowing it to raise trillions in financing for climate, social, and sustainability-oriented projects. Encouragingly, there is evidence of potentially strong demand from investors in Canada and globally for bond issuances that support Indigenous Peoples.

The demand for First Nations Finance Authority (FNFA) bonds is indicative of this interest, with many European investors interested or buying the bonds. For example, several issuers have sustainable or green bond frameworks with Indigenous targets, including federal and provincial governments, development banks, financial institutions, and companies. In Australia and Canada, companies are increasingly developing Reconciliation Action Plans (RAPs) often with measurable goals.

Indigenous financing needs can benefit greatly from lessons learned in the green bond market. The potential outcome is compelling: according to the Indigenomics Institute, Indigenous economic development could be positioned to add $100 billion a year, or 5% of GDP, to the Canadian economy.

The sustainable bond market offers crucial lessons for developing Indigenous finance. A well-designed framework, with sound principles and guidelines, could help create an Indigenous bond market that attracts capital to help close funding gaps and support the needs of Indigenous communities. The Sustainable Indigenous Bond Framework could be modified and draw on the core elements of the Indigenous bond principles to improve the issuances of any bond (even those that are not green).

For a comprehensive analysis of Indigenous finance challenges and opportunities, please refer to our full discussion paper.

[1] All dollar figures in this document are in Canadian dollars unless otherwise specified.

[3] Including, in many jurisdictions, both in Canada and abroad, Free Prior and Informed Consent (FPIC)