Published on: April 8, 2025

The stock markets are experiencing exceptionally rough days, having suffered significant losses over the past few days. This is clearly due to Trump administration’s reciprocal tariffs, which have turned out to be much higher than expected. China has just been tariffed at 34%, the European Union at 20% and the countries of Southeast Asia at more than 45%. These tariffs are simply excessive.

A Biased Reciprocity

The formula used to calculate reciprocal tariffs basically involved taking the observed deficit as a percentage of total imports and dividing this figure by two. In reality, these are not reciprocal rates, as the Administration has not explicitly taken the rates of other countries into account. Everything is based on the extent of an observed deficit, nothing more. The list of targeted countries was exhaustive and even included countries where the United States has a trade surplus, such as the United Kingdom. As a result, these reciprocal rates are inconsistent from one country to another!

The average effective rate that the Trump Administration has imposed on trading partners is just over 23%. This means that the reciprocal tariffs imposed on the 3.2 trillion dollars of US imports would amount to approximately 750 billion dollars at constant volume. Over time, this tax should obviously reduce the ratio of imports to GDP and further close the US economy.

Splitting the Bill

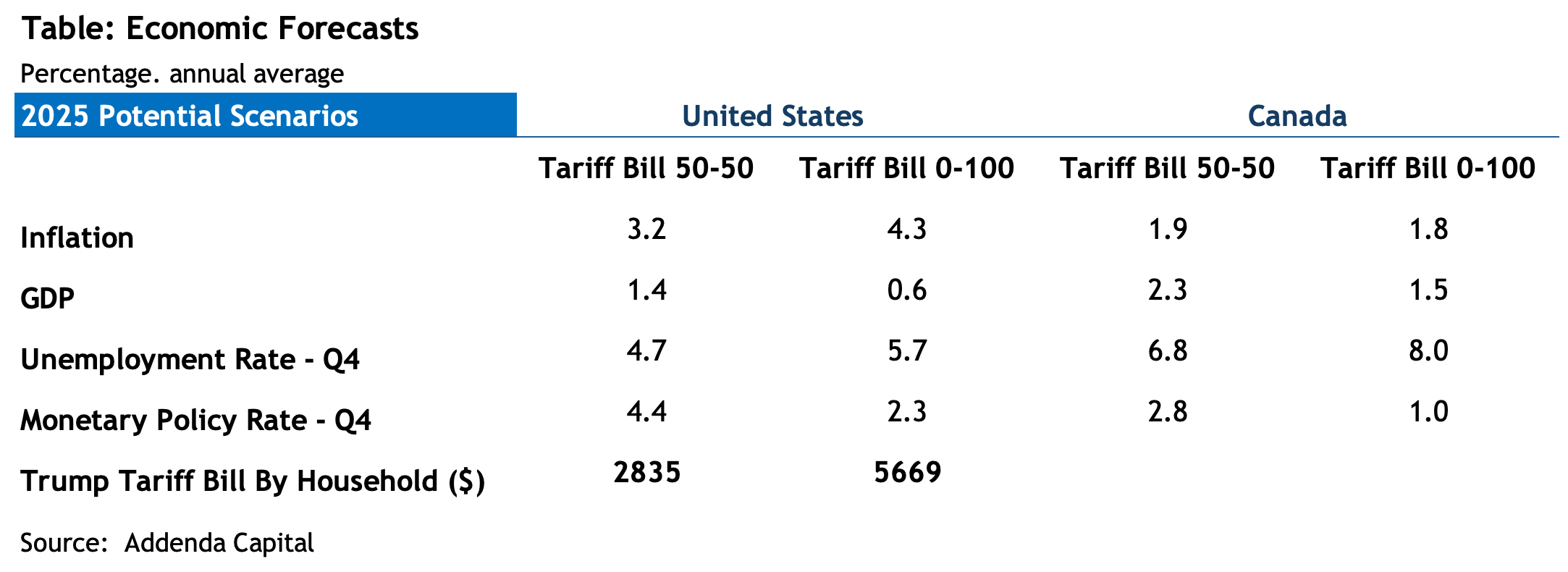

The impact on the US economy of reciprocal tariffs ultimately depends on how this bill is divided between businesses and households. We developed two scenarios to assess the repercussions. In the first scenario, 50% of the tax is absorbed by companies’ margins, while the remaining 50% is passed on to consumers through increased prices. In the second scenario, companies make no concessions on their profit margins and households absorb 100% of the bill.

The results on real GDP growth and inflation are acute. In the first scenario, inflation increases to 4.5% year-on-year in the US and to 6% in the scenario where households absorb the entire shock.

The figures in the table are slightly lower, as they are expressed as an annual average. In terms of real GDP, the US economy narrowly avoids a recession in the second half of the year if companies absorb half of the bill, but the economy cannot avoid a downturn when the bill is fully passed on to households. The tax amounts to almost 5700 dollars per household in the second scenario. As a result, the economy is plunging into a major consumer recession. In Canada, the economy is also entering a major recession in the scenario that suggests the economic cycle is coming to an end south of the border.

These two scenarios consider monetary policies that are highly contrasting. In the second scenario, the US Federal Reserve is forced to lower its policy rate to 1.5% in 2026, while the Bank of Canada must reduce its rate to 1.0% over the next year as well.

A Questionable Rationale

It is difficult to grasp the United States’ reciprocal tariff strategy. It is not defendable because the dominant factor in creating trade deficits stems from the fact that American households are richer than their counterparts in other countries. As a result, their demand will necessarily be higher when measured in dollars. Moreover, the savings rate of US households tends to be lower compared to households in other countries. For example, in China, the lack of social security for Chinese households explains to a large extent their very high savings rate. The triggering of this global trade war by the US administration seems to be based on false premises and a lack of understanding of the dynamics of international trade as a whole.