Published on: September 2014

The right to vote is one of the most important rights a shareholder has, and with that right comes the responsibility to cast votes in a manner that is consistent with the long-term interests of shareholders and other stakeholders. Voting at shareholder meetings provides Addenda Capital, on behalf of clients, with an opportunity to affect governance, communicate preferences and signal confidence or lack of confidence in a company’s management and oversight. Our emphasis on voting and corporate governance practices is based on the evidence that companies that have good corporate governance are likely to generate more long-term value for their shareholders and society than similar companies with inferior corporate governance.

What is proxy voting?

Shareholders of public companies have a right to vote on proposals brought before them at annual and special meetings (for example, the election of directors or ratifying the appointment of the auditor).

Rather than voting for clients at meetings by attending in person, Addenda Capital votes “by proxy” by instructing a third party to vote our clients’ shares in accordance with our instructions which are based on our Proxy Voting Policy.

Proxy Voting Policy

Addenda Capital casts votes according to our Proxy Voting Policy (available here). Our policy consists of voting guidelines that establish how we will vote on many commonly raised issues as well as some less common but potentially contentious issues. The guidelines do not cover all situations.

Our policy is reviewed and approved annually to keep our approach consistent with developing governance best practices. We review academic and practitioner research and the policies of peers and the leading proxy voting service providers. We then incorporate feedback from our equity teams before the policy is reviewed by our Sustainable Investing Committee and approved by Addenda Capital’s Senior Management Team.

There were a few small changes to our policy in 2014, including:

- Enhancing the disclosure expectations regarding director attendance to enable application of the guideline that each director must attend at least 75% of their board and committee meetings,

- Lowering the guideline for the number of unrelated public company boards a director can be on and still be effective to 4 for a director without a full-time job and 2 for a director with a full-time job, and

- Adding some clarification of instances where we will vote against an advisory vote on executive compensation or members of a compensation committee.

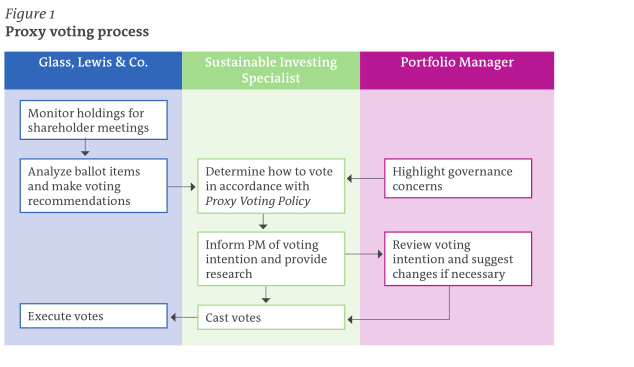

Proxy voting process

Our proxy voting process is focused on protecting and enhancing the long-term interests of shareholders and other stakeholders. We consider each ballot item, with the help of Glass, Lewis & Co., and determine how to vote in a manner consistent with our Proxy Voting Policy as shown in figure 1 below. There could be particular aspects of any given resolution which could cause us to vote in a manner different from our policy.

Glass, Lewis & Co. Glass

Lewis is an independent investment research and global proxy advisory and voting services firm, serving institutions that collectively manage more than USD 20 trillion. The company analyses governance, business, legal, political and accounting risks with a focus on the long-term impact of proxy vote decisions. Their research is provided by a group of professionals with diverse and relevant experience and education, which allows them to analyze each ballot item in an appropriate way.

Voting during the first half of 2014

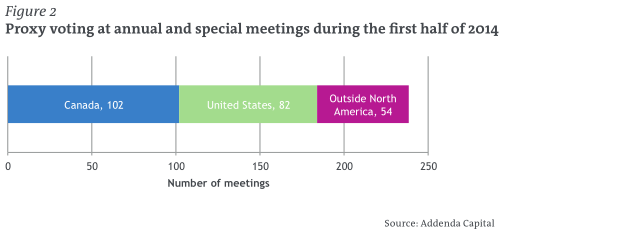

The majority of annual meetings take place during the first half of the calendar year. For example, 90% of the meetings we voted at during 2013 happened in the first 6 months of that year. During the first half of 2014, Addenda Capital voted at 238 meetings as detailed in figure 2 below.

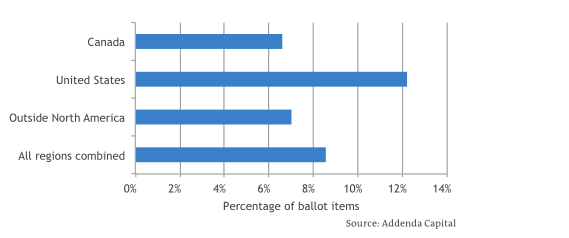

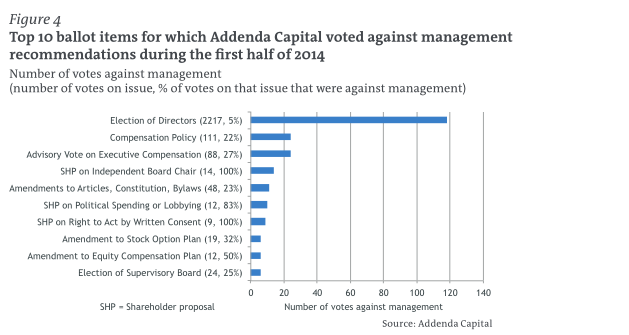

Figures 3 and 4 below and on the following page provide an overview of Addenda Capital’s voting activity. We have highlighted the votes we cast against management or board recommendations. Voting against management recommendations is not in itself an effective measure of our voting process but it does highlight our willingness to vote in the best interest of our clients and our ability to effectively and critically analyze each ballot item.

Figure 3 shows that we voted against management on about 9% of all ballot items, ranging from about 7% in Canada and outside North America to more than 12% in the United States.|

Figure 4 shows the ballot items we voted against management recommendations on the most number of times. For example, we withheld votes from or cast votes against 118 director nominees out of a total 2,217 nominees that we voted on. We did not support director nominations for various reasons including a lack of independence on a board, a nominee’s apparent lack of effective oversight on another board or the appearance of too many commitments to fulfill their duties as a director.

A lot of our votes against management relate to executive compensation whether in the form of an advisory vote on executive compensation, approval of compensation policies or amendments to equity compensation plans. In many of these cases, it was not clear that a company’s executive compensation program sufficiently links pay with performance in a manner that aligns executives with the long-term interests of their company.

We supported quite a few shareholder proposals, including proposals at 10 companies requesting enhanced disclosure of policies and procedures that govern lobbying and lobbying related expenditures. We supported these initiatives because we believe that improved disclosure of political contributions, lobbying expenditures and trade association spending and a company’s related policies and practices will help with the evaluation of related risks and opportunities.

Engagement with companies beyond proxy voting

At the beginning of 2014 we enhanced our stewardship activities for clients by expanding our engagement activities related to proxy voting. We identified 3 issues or concerns that have caused us to vote against management recommendations in the past and contacted companies in advance of a vote in an attempt to gather more information or we will be contacting them after the vote to inform the company why we voted how we did. The 3 items we selected were:

- Directors that appear to have too many commitments to fulfill their duties as a director of that company;

- Shareholder proposals regarding environmental best practice or environmental disclosure; and

- Shareholder proposals regarding enhanced disclosure of corporate lobbying or political expenditures.

Appearance of too many commitments

It is our general policy to oppose the election of directors who appear to have so many commitments that it would be difficult for them to effectively represent shareholders on a board. As with all ballot items, we consider these votes on a case-by-case basis depending on the circumstances of each company and director. Our Proxy Voting Policy states that directors appear to have too many commitments if they sit on more than 4 unrelated public company boards or more than 2 if they have a full-time job.

Being a director of a public company requires a significant commitment of time. For example, the 2013-2014 National Association of Corporate Directors Public Company Governance Survey indicated that public company directors in the United States averaged more than 235 hours attending meetings, reviewing reports and attending to other director related business – the equivalent of about 1 hour of every work day.

Our concerns about the ability of a director to be an effective representative of shareholders can often be addressed by a robust process for board, committee and individual director performance assessment. When we identify a board nominee that appears to have too many commitments, we review the company’s disclosure to see if their processes address our concerns. Some of the questions we are seeking to answer are:

- Is there a review of the effectiveness and contribution of each individual director?

- Does the review of effectiveness of each director assess their talents, skills and other expertise against the company’s strategic plan and current skills required and other needs of the board?

- Is a confidential peer-review survey used to help evaluate the performance of individual directors every year?

- Does the survey encourage directors to comment on the effectiveness and contribution of all of the other individual directors?

- Does the survey include open-ended questions to allow directors to suggest improvements?

- How much time do directors devote to carrying out the duties and responsibilities of board membership?

If we cannot find answers to our questions or if the answers do not address our concerns we will write to the company. In the first half of 2014 we wrote to 27 companies that had directors that appeared to have too many commitments to fulfill their duties as directors and insufficient disclosure regarding board performance assessment. 15 of the companies responded to our request for more information and 8 of those provided sufficient information to allow us to support the election of the director in question. 7 of the companies responded but failed to address our concerns while a further 12 have yet to respond. We will be undertaking further follow-up with some companies as necessary.

Shareholder proposals

We will be writing to 5 companies regarding shareholder proposals on environmental issues and 9 companies regarding shareholder proposals on corporate lobbying. We supported these proposals despite the management or boards of the companies recommending that we vote against them. We will be writing to the boards to tell them how we voted and why we voted that way.

Conclusion

Voting is an opportunity for us to affect governance, communicate preferences and signal confidence or lack of confidence in a company’s management and oversight on behalf of clients. We enhanced our stewardship activities in 2014 by going beyond voting to contact companies directly regarding important voting issues. Our stewardship activities have enhanced the quality of engagement between ourselves and companies and help us protect and enhance the long-term interests of shareholders and other stakeholders.