On behalf of our clients, Addenda Capital recently met with seven Canadian oil and gas companies to discuss the most material environmental and social issues that they face and the management practices they employ to address those risks. In addition to meeting with companies, we also review corporate reporting, specialist research and other sources of information to identify environmental, social and governance (ESG) issues that we incorporate into our investment analysis.

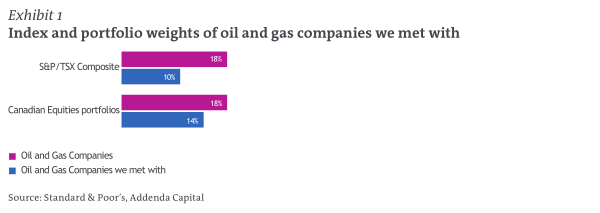

Canadian oil and gas companies are engaged in exploring for undiscovered oil and gas deposits and producing oil and gas from deposits that have already been found. Some of the companies also participate in refining crude oil into products like gasoline and jet fuel and others also produce chemicals. As of March 31, 2014, oil and gas companies represented approximately 17.5% of the S&P/TSX Composite index and the seven companies we met with represented around 9.8% of the index and 14.4% of our Canadian Equities portfolios (as shown in Exhibit 1 on the following page).

Meeting with executives of the companies in our investment universe is an important part of our Canadian Equities investment process. On average, our team engages directly with the senior management of the companies they follow more than 400 times per year to discuss strategy, operating performance and financial strength. As part of our approach to sustainable investing, we also initiate meetings focused on environmental and social issues. These meetings strengthen our investment decisions, enhance our monitoring of companies and give us an opportunity to encourage companies to address areas of concern in a manner that will promote their long-term success.

Overview of environmental and social issues that oil and gas companies face

In preparation for meeting with companies, we reviewed and analyzed the regulated and voluntary disclosure they provide to investors and other stakeholders. We also reviewed research and data provided by our partners with environmental, social and corporate governance expertise. Exhibit 2 highlights the 10 most commonly cited environmental and social risks that the 22 largest Canadian oil and gas companies include in their annual reporting.

Exhibit 2

Top ten environmental and social risks reported by Canadian oil and gas companies

| # |

Risk |

Number of companies reporting risk |

| 1 |

Environmental |

17 |

| 2 |

Climate change |

16 |

| 3 |

Regulation changes |

16 |

| 4 |

Land claims (for example: Aboriginal claims) |

14 |

| 5 |

Key personnel |

13 |

| 6 |

Operational |

10 |

| 7 |

Hydraulic fracturing |

10 |

| 8 |

Geopolitical |

8 |

| 9 |

Weather |

6 |

| 10 |

Conflicts of interest |

6 |

This review and analysis helps us develop our understanding of key issues and enhances our interactions with management teams.

With all companies, we discussed their processes for identifying environmental and social risks and then had discussions about health and safety, stakeholder relations, climate change and employee relations. We also had discussions with companies regarding risks particularly relevant to their operations, and in particular during this group of meetings, we focused on oil sands extraction.

Focus on oil sands extraction

Three of the companies we met with operate in situ oil sands facilities and two operate open pit oil sands mines (one of which we visited). Exhibit 3 provides a brief overview of the two types of oil sands production.

Exhibit 3

There are two types of oil sands production

| In situ production |

Open pit mining production |

| The bitumen is heated underground until it can flow and is pumped to the surface. Most in situ operations use steam-assisted gravity drainage (SAGD) which uses one well to pump in steam and another to bring the bitumen to surface |

Large shovels are used to dig up the oil sand that is close to the surface. The sand is then transported by trucks to a facility where it is mixed with warm water. The bitumen is then removed from the sand and prepared for shipping. |

Companies extracting bitumen from the oil sands face a variety of environmental and social issues, some of which are unique to the oil sands. Three of the most material issues are greenhouse gas (“GHG”) emissions, water use and mine tailings.

Greenhouse gas emissions

Oil and gas companies are going to face higher operating and capital costs related to compliance with GHG-related regulations. They will also face operational issues related to changes in physical climate parameters and global demand for their products might be negatively impacted by regulatory changes and technology advancements.

Changes in physical climate change parameters

The probable changes in physical climate parameters due to climate change in the oil sands region include an increase in the frequency of extreme weather events, changes in precipitation patterns and more frequent summer heat waves. These physical impacts might interrupt production or cause a company to reduce its production.

Global demand for oil

A global issue facing oil sands companies and other oil and gas companies in Canada is the long- term outlook for demand for oil. Two key issues have the potential to disrupt and reduce the demand for oil and hence could render oil deposits with higher production costs, such as the oil sands, less economically viable. These concepts are increasingly being discussed in the investment community and the terms that are often used are “stranded assets” or the “carbon bubble”.

The first issue is that global governments, through the Copenhagen Agreement, have agreed that they should try to limit the increase in global temperature to less than 2 degrees Celsius. In order to achieve this objective, scientists have suggested that the world’s economy must in large part shift away from the consumption of fossil fuels.

The second issue is that technological developments continue to lower the costs of renewable power generation. For example, in some countries, it is already more cost effective to install and generate electricity from a solar photovoltaic system than it is to pay for electricity from the local grid. These two interrelated issues could greatly reduce the demand for oil, gas and coal.

Regulatory costs in Alberta

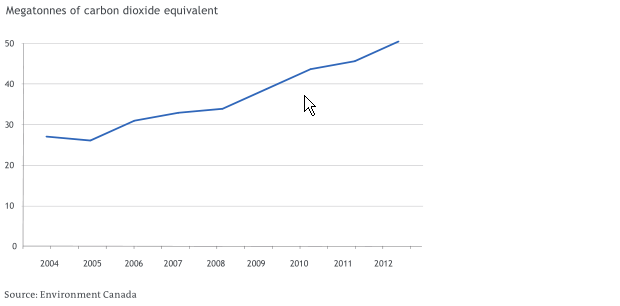

Since July 1, 2007, facilities in Alberta that emit more than 100,000 tonnes of GHG annually have been required to reduce the GHG intensity of their production by 12%. The Specified Gas Emitters Regulation allows companies to meet their obligation by 1) improving their operations; 2) purchasing Alberta-based offset credits; 3) contributing $15 per tonne to the Climate Change and Emissions Management Fund; or 4) purchasing performance credits from other facilities that had exceeded their requirements. Exhibit 4 below demonstrates the rapid growth in GHG emissions from large oil sands facilities in Alberta, of which there were 26 at the end of 2012 versus 11 in 2004.

Exhibit 4

Greenhouse gas emissions of all large oil sands facilities

Alberta is reviewing the Specified Gas Emitters Regulation in 2014 and it is likely that the reduction requirement will rise from 12% to anywhere between 20% and 40% and the highest marginal compliance cost may rise as high as $40 per tonne of GHG.

We have considered four alternative scenarios of regulatory change in Alberta and even under the most stringent scenario, oil sands companies will be facing costs of less than $1.50 per barrel for compliance. By way of comparison, one of the oil sands companies, with among the highest GHG emissions in Alberta, reported compliance costs of $20 million for 2012 or about 12 cents for each barrel of oil produced.

In the future, we will be paying special attention to:

- Proposed changes to Alberta’s Specified Gas Emitters Regulation;

- Research and analysis that uses global climate models to predict changes in physical climate parameters in the oil sands region; and

- Progress toward a global agreement to reduce GHG emissions.

Water use

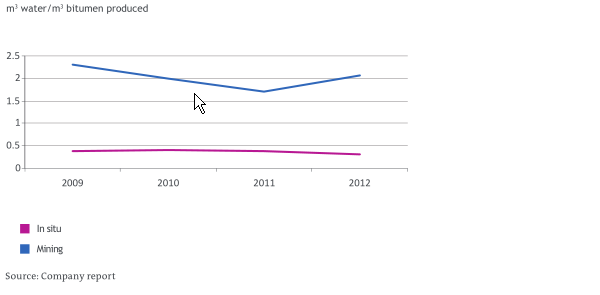

Oil sands operations use a large amount of water – for example, one company alone withdrew more than 23 million cubic metres of fresh water (enough to fill the Skydome 15 times) for use at its oil sand mine in 2012. In oil sands mining, water is used to help separate the bitumen from the sand. In situ production often involves the injection of steam into the oil sands at high pressure with much of the water flowing back to the surface with the bitumen to be used again. Exhibit 5 below highlights the relative water intensity of the two types of oil sands production.

Exhibit 5

Suncor’s water withdrawal intensity

Accessing the quantity and quality of water that they need to operate will cost companies more in the future.

Water related issues include:

- Inability to access adequate water could cause operations disruptions;

- The permitting or development of projects could be delayed if adequate water resources are not assured;

- Regulations could cause increased capital costs to prepare for the potential of reduced water availability. For example, one of the more recent oil sands mines had to build a water storage pond to enable them to maintain their production when they are not able to withdraw water directly from the Athabasca River;

- Permits for water use could become more expensive.

In the future, we will be paying special attention to:

- Changes to Alberta’s Water Act or Environmental Protection and Enhancement Act, especially those related to cumulative impact;

- Results from the Alberta Environmental Monitoring, Evaluation and Reporting Agency; and

- Pricing of water permits.

Mine tailings

When bitumen is extracted from oil sands through open pit mining, large volumes of tailings result. Oil sands tailings consist of water, sand, clay, contaminants and a little bit of leftover bitumen. While some of the particles separate from the water quickly, the smaller particles of silt and clay remain suspended in the water and can take decades to slowly settle, and even then only to the consistency of soft mud or yogurt.

In 2009, the Energy Resources Conservation Board of Alberta introduced Directive 074: Tailings Performance Criteria and Requirements for Oil Sands Mining Schemes. The purpose of the directive is to reduce the amount of fluid tailings and to speed the reclamation of mined land. The directive set performance criteria for tailings management and requires regular monitoring and approvals.

Exhibit 6

Tailings ponds must now be progressively reclaimed

A tailings pond currently in use

A tailings pond made solid enough to enable reclamation

Source: Addenda Capital visit to oils sands mine

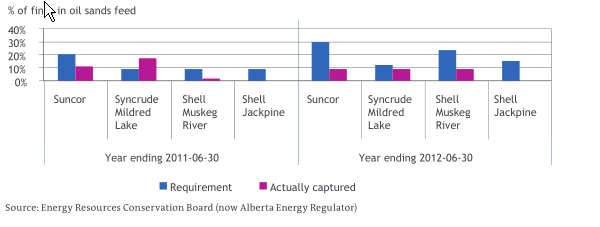

The Alberta Energy Regulator assesses the tailings management performance at each oil sands mine every three years. In the last a report, published June 2013, the regulator found that industry had not met the expectations of Directive 074 (as shown in Exhibit 7 on the following page), nor the less stringent interim requirements negotiated by the operators. Only one mine operator, Syncrude, was found to have captured the percentage of fine material from its tailings that it had agreed to over the compliance period. The regulator has declined to enforce compliance measures at this time.

Exhibit 7

Tailings management performance

The five oil sands mining companies combined are estimated to have already spent in excess of $4 billion on infrastructure and facilities to help them meet their tailings management performance requirements. The companies have also spent a lot of money on research and development to identify commercial tailings treatment technologies and they are increasingly collaborating through groups like Canada’s Oil Sands Innovation Alliance (COSIA).

Their progress to date, and our meetings with two of the companies, suggests that their related capital expenditures are not yet complete as they will have to continue to invest until they can regularly and reliably satisfy the regulatory requirements. Tailings management has also increased operating costs and to some degree has reduced operational flexibility.

In the future, we will be paying special attention to:

- Capital expenditures related to Directive 074 compliance;

- Significant changes in decommissioning and restoration costs and obligations; and

- The next assessment report from the Alberta Energy Regulator (expected in 2015), especially any enforcement of compliance measures.

Conclusion

Environmental and social issues have the potential to be costly for oil and gas companies. Meeting with the companies allows us to gather information that supports and enhances our analysis and understanding of these issues. Our meetings focused on environmental and social issues also help us develop better relationships with management teams and usually allow us to gain additional insight through interactions with managers we do not normally meet. Through proxy voting and meetings with management teams, we will continue to monitor environmental and social practices and engage in a dialogue with companies to encourage them to address these issues in a manner that will help them optimize their long-term value.

© Addenda Capital Inc., 2014. All rights reserved. This document may not be reproduced without Addenda Capital’s prior written consent.