Published on: August 2016

An increasing number of investors are seeking to achieve something more than a financial return from their investments. Recognizing the powerful role they can play in dealing with some of society’s issues, they look towards companies that turn a profit while also doing good for the community, the environment, and society at large.

According to the Global Impact Investing Network (GIIN), the market for impact capital could grow to $2 trillion, or 1% of global invested assets, over the next decadei. While the momentum around impact investing continues to grow, the idea of what is considered an impact investment remains relatively undefined. This article provides a primer on Addenda Capital’s view on impact investing: its definition, the challenges it seeks to address, the products through which they can be met, along with examples.

What is Impact Investing?

Addenda Capital defines impact investing as an investment approach that intentionally seeks to create both financial return and positive social and/or environmental impact that is actively and adequately measured. Impact investing is not philanthropy, nor is it an asset class of its own. It is a method for achieving positive social impacts that also provides a financial return. Impact outputs or outcomes must be measured, tracked and reported to be considered an impact investment. Furthermore, the intention to generate that impact must also be a driver of the investment decision on the part of the investor.

Impact investing goes beyond sustainable investing, which is an investment approach that integrates long-term environmental, social and governance (ESG) criteria into investment and ownership decision-making with the objective of generating superior risk-adjusted financial returns. ESG factors such as climate change, biodiversity, air and water pollution, bribery and corruption, or executive remuneration are material issues that should be integrated into investment decision making processes. These ESG factors can have a substantial effect on investment performance, and including a proper analysis of these factors results in a more complete assessment of potential investments.

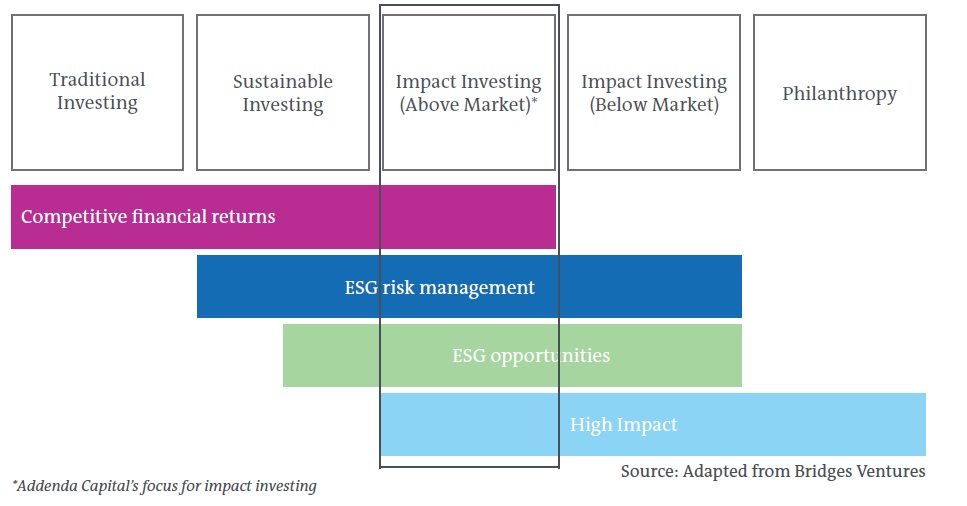

The key differences between sustainable investing and impact investing are intentionality and measurability. Investments across all asset classes at Addenda Capital are made with ESG risks and opportunities in mind. A summary of the capital deployment spectrum, from traditional investing without regard to ESG factors, through to pure philanthropy, is shown in Exhibit 1 below. When it comes to impact investing, Addenda Capital’s focus is on achieving above market rates of financial return—for the asset class of the investment—rather than the below market rates of return that some impact investors accept. We believe that high impact and competitive returns are not mutually exclusive, and so we seek investments that provide measureable impact without sacrificing return.

Exhibit 1: Capital Deployment Spectrum

Turning Need into Opportunity

Society’s most difficult issues are not limited to any single sector. From venture investments in clean technologies to commercial mortgages for affordable housing developments, the opportunity for positive impact spans many actionable themes. While there are countless ways to slice and dice the various opportunities in the impact space, we at Addenda Capital have defined three broad areas of focus, both with regards to the quality of impact possible as well as to the quantity of investments available.

Climate change mitigation and adaptation

The International Energy Agency recently updated their outlook on world energy investment and noted that the total spending required to meet the global demand for energy would need to be US$48 trillionii. However, they also examined the cost required to meet global energy demand and meet the consensus emissions reduction path that would result in a global warming of no more than 2°C above pre-industrial levels. The investment in that case increases to USD54 trillion, of which USD14 trillion would be needed for energy efficiency efforts alone. The federal government has established a target of 90% of Canada’s electricity to come from zero-emitting sources by 2020iii.

Health and wellness

Healthcare spending in Canada continues to rise, and is projected to reach $219.1 billion in 2015iv. The Mental Health Commission of Canada noted in a recent publication that mental health issues cost the Canadian economy around $50 billion each year which was based on two separate academic studies with a similar total figurev. In 2001, the figure was approximately $42.3 billion and over the next 30 years, without action, the cost could be more than $2.5 trillion. There is also a strong need for affordable housing. The aggregate number of affordable and supportive housing units needed in Canada alone is over 1 millionvi, and with an average capital cost per unit of $200,000vii, this equates to over $200 billion required to meet this need.

Food, agriculture, and natural resources

The Food and Agriculture Organization of the United Nations (FAO) noted that an increasing amount of arable land is becoming or is already degraded. It estimated that 25% of land is in this categoryviii. The FAO note that despite significant improvements in crop yields, which have grown faster than land use, the efficacy of land use is decreasing which can have negative effects on the environment and the future usability of the land. For example, it noted that while rangelands have the potential to sequester up to 2,000 megatons of carbon dioxide worldwide, the current use of such lands is inhibiting this potential. In 2012, 58% of Canadians reported buying organic groceries on a weekly basisix.

Impact Investment Product Structure

With most investing decisions, there is a fundamental choice between investing directly into companies or deals, and investing through a managed fund. The usual trade-offs between the two approaches apply to impact investing as well. With funds, there is an additional level of due diligence and fees required at the fund level, but the benefits are the ability to make larger capital contributions while gaining diversification within a particular fund’s strategy. Investing directly avoids those extra fees, but small deal sizes continue to be a limiting factor for the meaningful positioning of impact investments in a total portfolio. The various impact investing product structures are summarized on the following page, with examples.

Exhibit 2: Impact Investment Structures

Direct

Provide capital directly to the organisation that will have a positive environmental or social impact and provide a market rate of return

Examples include:

- Green bonds are debt securities that fund climate-related and environmental projects

- Mortgages for co-ops and non-profits

Fund

Provide capital to a fund manager that has experience investing in organisations that will have a positive environmental or social impact

Examples include:

- Private equity funds that invest in sustainable food

- Venture capital funds that invest in early-stage, high-impact clean technology companies

Fund of Funds

Provide capital to a fund of funds manager that has experience investing with fund managers seeking positive environmental and social impact

Examples include:

- Private market fund of funds that will invest in 10-30 unlisted private market funds focused on sustainable opportunities

Impact Investing Spotlight: Ontario’s Green Bonds

On October 2, 2014, Ontario successfully launched a Green Bond program, with an inaugural global Canadian dollar bond of $500 million, making it the first provincial government in Canada to issue green bonds. Ontario green bonds are used to finance projects that promote environmentally friendly projects (mainly infrastructure) across the province that mitigate or help adapt to the effects of climate change. Projects in the following sectors will generally be considered eligible:

- Clean Transportation – e.g. funding of public transportation projects

- Energy Efficiency and Conservation – e.g. public sector building energy efficiency improvement

- Clean Energy and Technology – e.g. smart grid infrastructure and energy storage

- Forestry, Agriculture and Land Management – e.g. sustainable forest management

- Climate Adaptation and Resilience – e.g. flood protection and storm water management

The proceeds from the first Ontario Green Bond is being used to expand mass transit in Toronto with the construction of the Eglinton Crosstown LRT transit expansion project. The Crosstown LRT vehicles will be electric powered and will produce near-zero emissions. The Eglinton Maintenance and Storage facility aims to achieve Silver level certification of the LEED® green building rating system.

Estimated environmental benefits for the Crosstown LRT project includex:

- A reduction of 490,000 tonnes of CO2 emissions by 2031

- Transit user time savings of CAD 810 million by 2031

- Auto user time savings of CAD 103 million by 2031

- CAD 97 million in auto operating costs savings

- Projected ridership is 5,400 passengers per hour in the peak direction by 2031

Impact Investing Spotlight: Housing First Support Program

In 2012, the Province of Alberta ran a housing program that gave homeless people a permanent home, the end goal being that they would eventually become self-supporting. Studies have shown that even getting the homeless off the street and providing them with a permanent address could help them qualify for government assistance. In the long run, the cost of this program is much lower than the cost of emergency, shelter and hospital services for the homeless. The program required that there could not be more than one such unit within a project – thereby avoiding a ‘ghetto’ and also providing a positive environment for the tenant/client.

Addenda Capital was approached by a property manager and real estate investor that it had worked with for over 20 years who needed a lender willing to put a blanket mortgage on several units around the city. The rental payments are paid by the provincial government if a tenant/client is available, and if not, the borrower can lease to a market tenant. The impact of this investment is measured by the number of units occupied by persons in the program, which excludes those units leased to a market tenant in the event that a program participant is unavailable.

The Case for Making an Impact

While it may seem at times that society is facing an ever increasing number of environmental and social challenges, many of these challenges present an opportunity to invest in enterprises that are working to solve these problems while achieving a financial return. The creation of financial value and social value do not have to be mutually exclusive. It is not only possible but important to invest in companies that make money while also making a difference.

iJ.P. Morgan, the GIIN. “Eyes on the Horizon: The Impact Investor Survey” (2015)

iiInternational Energy Agency. “World Energy Investment Outlook” (2014)

iiiEnvironment Canada. “Planning for a Sustainable Future: A Federal Sustainable Development Strategy for Canada” (2010)

ivCanadian Institute for Health Information. “National Health Expenditure Trends, 1975 to 2015” (2015)

vMental Health Commission of Canada. “Making the Case for Investing in Mental Health in Canada” (2013)

viRBC Social Finance. “Financing Social Good: A Primer on Impact Investing in Canada” (2014)

viiNelles, H. & Spence, A. “Blended Financing for Impact: Opportunity for Social Finance in Supportive Housing” (2013)

viiiFood and Agriculture Organization of the United Nations. “The State of the World’s Land and Water Resources for Food and Agriculture” (2011)

ixEnvironment Canada. “Planning for a Sustainable Future: A Federal Sustainable Development Strategy for Canada” (2010)

xOntario Financing Authority. “Ontario Green Bond Newsletter” (2015)

xiScott, Susan. “The Beginning of the End: The story of the Calgary Homeless Foundation and one community’s drive to end homelessness” (2012)