Published on: March 7, 2024

Carl Pelland, Vice President, Fixed Income and Head, Corporate Bonds

They are among the unsung heroes of the financial world. And yet, infrastructure bonds are at the heart of economic development, used for projects as varied as airport expansion, hospital construction and energy network expansion. The year 2023 was another important one for infrastructure financing in Canada, particularly for projects supporting the climate transition. While the need for infrastructure continues to grow in 2024, we spoke with Carl Pelland, Vice-President, Fixed Income and Head, Corporate Bonds, to see how these securities can be an interesting choice for investors seeking long-term value.

While some may see them as a niche sector, infrastructure bonds actually represent a market of significant scale in Canada. According to our own assessment, outstanding bonds in the energy sector totalled approximately $100 billion as at June 15, 2023, followed by transportation ($34B) and health care ($5B). The need for infrastructure is strong. Canada’s infrastructure investment gap is between $150 million and $1 trillion, according to a general study provided to the federal government in 2016.

Features

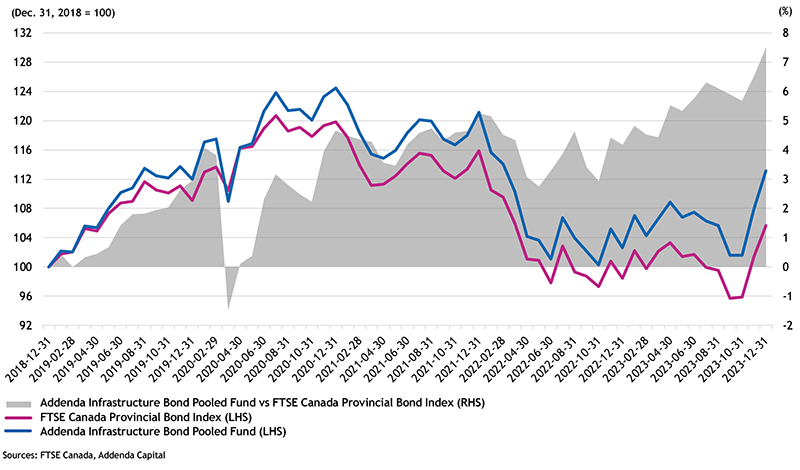

Providing fixed payments until maturity, infrastructure bonds have the benefit of being tied to physical assets that are governed by long-term contracts or subject to a regulatory framework. They may also be in a monopoly or quasi-monopoly situation, and their income is often indexed, in whole or in part. Over the long term, these characteristics help generate returns superior to provincial bonds (see following graphic), while carrying a similar level of risk. As a result, for investors with appropriate risk tolerance, infrastructure bonds may enhance a traditional fixed-income strategy. Here are examples of long-term assets:

- Utility (electricity, transport, distribution)

- Health and Social (hospitals, schools)

- Transport (roads, airports, ferries, rails)

- Energy infrastructure (oil and gas transportation; power transmission, distribution and generation)

Infrastructure Fund Performance vs FTSE Canada Provincial Bond Index: Five-year Monthly Total Return

Benefits of diversification and greater liquidity

“Infrastructure bonds help diversify a portfolio in order to perform in a variety of economic contexts,” says Carl Pelland. Added to this is the advantage of liquidity, a distinctive feature of the infrastructure bond fund that we manage. “Many investors want to invest in infrastructure. However, direct investment in a company or a project does not provide the same liquidity as an infrastructure pooled fund. For example, there can be a delay between the time investors decide to liquidate their position and the time their capital is actually returned.”

Risks to consider include project completion, credit risk, interest rate risk, and regulatory or political risk. “Among the elements we analyze when evaluating a bond are the long-term contracts underpinning the company’s operations, regulatory analysis, identity of shareholders, the company’s place in its niche and ability to recover costs. Our investment team analyzes the contracts as if executing a due diligence,” says Carl Pelland. These various elements form the basis of a rigorous credit analysis. In alignment with Addenda’s approach, the corporate bond team enhances its financial analysis by integrating environmental, social, and governance factors (ESG) to further strengthen the investment process, therefore helping to mitigate certain risks and promoting long-term value creation for clients.

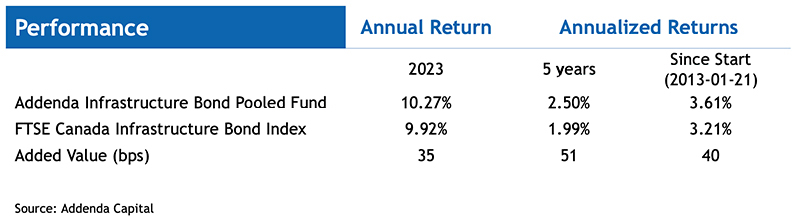

In 2013, in line with its purpose in creating long-term value to meet our clients’ financial needs, Addenda created the Infrastructure Bond Pooled Fund. Since then, it has generated an average annual return of 3.61% (as at December 31, 2023), outperforming its benchmark (FTSE Canada Infrastructure Bond Index) by 40 basis points. It returned 10.26% in 2023, 34 basis points ahead of its benchmark.

In conclusion, infrastructure bonds offer an interesting choice for investors seeking long-term value. Despite volatility that may occur from time to time, due to movement in interest rates for instance, they can present opportunities for those wishing to align risk tolerance and financial objectives.

Related contents

Infrastructure Bonds

Fixed Income

Making Sense of Trends in the Preferred Shares Markets