Published on: May 2, 2024

Réjean Nguyen, Senior Director, Impact Investing and ESG Integration

Just as a pebble thrown into the water creates concentric ripples, so too do investors that seek to create positive outcomes with their investments. Imagine for a moment that these ripples could be easily measured before they even occur. That’s what impact investing is all about. Given recent developments, it appears that 2024 is unfolding under the sign of transformation. While gaining momentum, the movement has been digging deeper into specific issues within environmental and social areas, enabling investors to better align portfolios and values.

The classic definition of impact investing is that it features the intent to achieve positive, measurable social and/or environmental impacts that can be adequately measured and reported, while seeking to generate compelling returns. Many of its variations, for instance, seek to address the United Nations’ 17 Sustainable Development Goals (UN SDGs), adopted in 2015 as part of a 2030 agenda. In terms of performance, approaches typically aim to generate risk-adjusted market-rate returns.

Focusing on Specific Challenges

Impact investing is growing quickly, representing worldwide assets of $1.164 trillion in 2022, a 63% jump from two years earlier. In Canada, usage among asset owners and managers grew to 52% in mid-2023, according to a survey by the Responsible Investment Association that did not provide a specific number on AUM. What’s even more: 43% of asset managers surveyed by consulting firm Millani plan to launch an impact-oriented product this year.

The landscape has certainly transformed over time. For some that recall the emergence of green bonds in the late 2000s, impact investing may still be mostly about green projects. However, addressing other issues, it then expanded into social, sustainability, and sustainability-linked bonds. Recently, the market took another step forward with the launch of blue bonds, a new breed focused more specifically on ocean and coast-based projects. Worldwide, approximately two billion people live in coastal areas. The first blue bond, a US$15M 10-year bond developed with the World Bank, was issued in 2018 by the Republic of Seychelles as a way to expand protected areas. From 2021 to mid-2023, markets saw 12 blue bond issuances valued at $US2.9 billion, according to KPMG.

Blue bonds are one of the numerous ways to address a huge finance gap that is impeding climate adaptation efforts worldwide. For instance, developing countries’ needs are 50% higher than previously thought, now estimated to be between US$194 and US$366 billion per year, according to a United Nations Environment Programme (UNEP) report. If those figures look daunting, there’s more: to close the overall financing gap in achieving the UN SDGs by 2030, the consensus is that over US$4 trillion are needed.

Going Mainstream with Products Across Asset Classes

Other investment solutions dedicated to fostering impact are emerging under various forms as well, such as private equity and private debt funds, to tackle challenges such as affordable housing, reducing inequalities, and healthcare. If we look specifically at the private market impact and energy transition ecosystem, it has gone mainstream, a white paper published by the World Economic Forum pointed out in 2023: “Many more large and mid-sized managers are launching impact funds today than a decade ago. Even five years ago, only a relatively few existed, mostly US-based and growth equity-oriented impact funds, large enough to accommodate large limited partners”. The report added that today, “far more general partners at the higher end of the market are launching impact and energy transition products across private market asset classes and strategies.” This includes infrastructure, venture, private credit and other real assets, such as commercial mortgages.

As the investment solutions evolve, the diversity of sectors themselves, many of them aligning with UN SDGs, is increasing as well. According to a survey of 300 investors by the Global Impact Investing Network (GIIN), the sectors with the highest proportion of assets under management are energy, financial services, and healthcare, followed by microfinance and food/agriculture (see bar chart from GIIN survey).

From 2017 to 2022, housing experienced the strongest growth across all sectors, with a compounded annual growth rate of 44%. (The investors surveyed collectively managed US$317 billion, with a median of US$116 million. Roughly three quarters of those AUM were invested directly into companies, projects, and assets, with the rest flowing through intermediaries such as investment managers.)

Our impact strategy

In 2018, the SDGs served as inspiration for the launch of the Addenda Impact Fixed Income Pooled Fund, enabling investors to align their values with their portfolio. This was achieved with the strong support of our parent company, Co-operators, already committed to allocating a percentage of its assets to impact investing. Initially, the Fund's investments centered around four main themes: climate change, health and wellness, education and community development. We recently expanded these by adding “water", addressing issues related to the United Nations' Sustainable Development Goal number 6, which emphasizes clean water and sanitation.

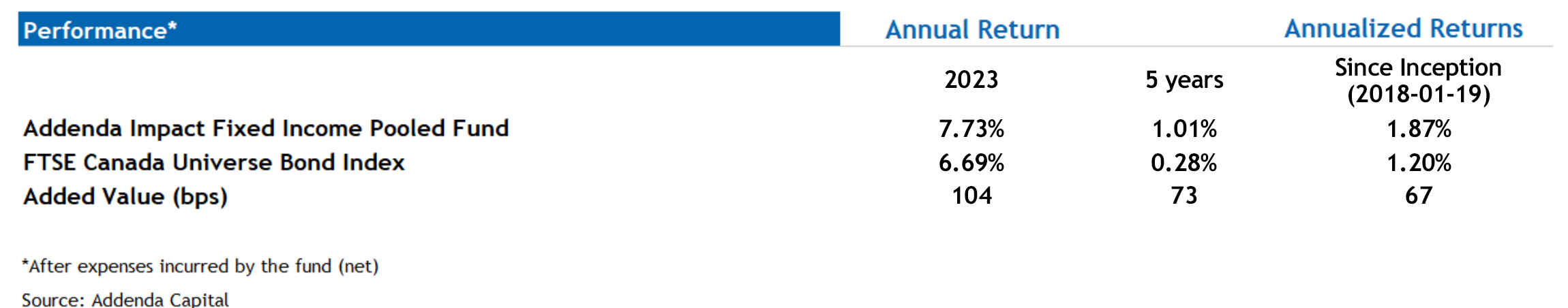

We recently celebrated the Impact Fixed Income Fund's fifth anniversary and are proud of its financial record. The Fund has grown in assets, reaching nearly $225 million as at March 31, 2024. Over these five years (see following table, as at March 31, 2024), it outperformed its benchmark, the FTSE Canada Universe Bond Index, in short- and long-term investment metrics, while delivering positive environmental and social outcomes.

Meanwhile, in 2023, Addenda became the world’s first portfolio manager to adopt the CFA Institute's Global ESG Disclosure Standards for Investment Products as part of an impact-driven strategy, a testament to our commitment to rigorous disclosure practices.

Distinct from ESG Integration

At this stage, it may be relevant to mention that impact investing is different than environmental, social and governance (ESG) integration, which does not tend to have the intent to track positive measurable impacts. Rather, ESG integration looks to incorporate a broad list of E, S and G factors into investment decision-making and risk management to improve risk/return outcomes and often features active engagement with companies on these issues to drive positive long-term value creation. In contrast, impact investing is more intentional and focused, with associated key performance indicators (KPI) reporting on specific social or environmental outcomes.

While a majority of impact investing initiatives target UN SDGs, investors may also measure the impact of their investments using a list prepared by the GIIN: the IRIS indicators, which numbers in the hundreds. In the agricultural sector, for example, one indicator focuses on pesticide use over a given period. In healthcare, indicators may target elements such as the number of people dedicated to children’s needs within an organization, or the number of employees injured during the period covered. Finally, indicators that cover the SDGs specifically include, for instance, the surface area of buildings renovated or refurbished (with an energy efficiency roadmap or an affordable housing contribution) for reallocation based on investments made over a specific period.

Measuring social or environmental performance is indeed still an arduous exercise. As impact investing grows, the challenge will be to ascertain its effect on the real economy. For example, just as the true impact of an investment should ideally be authenticated by a credible third party, the organization or company raising the capital must also commit to regular reporting. But as new sustainability standards stand to benefit investors seeking to improve analysis of risks and opportunities, they will have an effect on impact investing as well.

Related Contents

Impact Fixed Income

Seeking Returns Regardless of Main Asset Classes

Clear Rules to Speed Up the Climate Transition