Published on: August 22, 2024

After publishing a case study on our Impact investing strategy a few weeks ago, we are presenting another one, this time focusing on our Climate Transition approach.

More than ever, investing in companies aligned with the climate transition is a crucial step in helping steer the economy toward lower carbon emissions. With this in mind, a few years ago we developed a Climate Transition framework to help our clients meet their own net-zero goals. This strategy has attracted interest ever since, which is why we want to explain our approach.

When we created our two Climate Transition Equity Pooled Funds, focusing on Canadian and international equities, our goal was to drive decarbonization across all sectors of the economy through strategic investment decisions and proactive engagement. With careful analysis, our strategy consists of assessing companies making climate transition commitments and tracking their progress. Since the funds’ launch, we have seen examples of companies advancing in their climate practices, notably by setting greenhouse gas emissions reduction targets and integrating climate transition plans into their business strategies.

Analyzing an Investment Opportunity

One of the companies we invested in, Schneider Electric, is a French multinational specializing in energy management and automation solutions for application across industries.

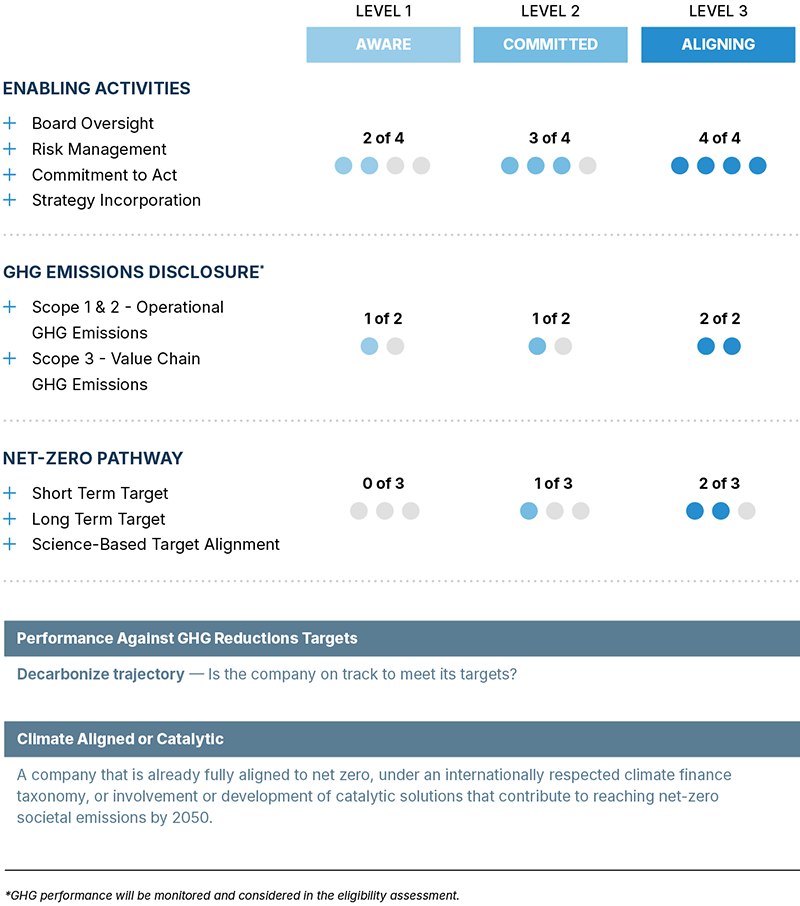

We chose to invest in Schneider for several reasons. First, within our Climate Transition maturity criteria (see table from our Sustainable Investing Report), the company qualifies as Level 3 due to the strength of its leadership on climate governance, its disclosures, and its commitments.

For example, the company has set ambitious net-zero targets validated by the Science Based Targets initiative (SBTi), including reducing absolute emissions across its entire value chain. Its plan involves a 90% reduction in Scope 1 and 2 emissions by 2030 (compared to 2017). From 2021 to 2023, these emissions declined by 31%. Schneider also aims to achieve an end-to-end carbon neutral value chain (including CO2 offsets) by 2040. Furthermore, it is dedicated to doubling its energy productivity by 2030 compared to 2005 levels.

Supporting the Larger Transition

An important element of our Climate Transition strategy is identifying how companies are contributing to the climate transition within their sector and the broader economy. In addition to the company’s commitment to reduce its operational impacts, Schneider Electric has established a variety of innovative energy and sustainability services and green products. As of 2023, these have helped their customers to decarbonize and avoid over 550 million tonnes of carbon emissions since 2005 (and targeting 800 million tonnes by 2025 against 2005 levels).

Finally, through its various partnerships, Schneider Electric reinforces its commitment to supporting collective and systemic action required to facilitate the global energy transition.

Our Climate Transition equity strategy focuses on companies that are making net-zero commitments and demonstrating steps to align their governance, strategies, and businesses toward a net-zero pathway. However, we recognize that climate transition is a journey, which is why we will continue collaborating with peers, investee entities, industry sectors, governments and leading organizations to accelerate and support efforts to achieve net zero by 2050.

Further Reading

Case Study: Supporting Development of Clean Energy

Case Study: Supporting Development of Clean Energy