Published on: July 25, 2024

A few weeks ago, we published an article discussing the outlook for near-cash assets such as high-interest savings accounts (HISAs) and guaranteed investment certificates (GICs). We suggested that investors may want to consider longer-term fixed income as an alternative, because policy rates would one day start declining. In this article, we will take a closer look at the benefits of a balanced portfolio.

Investing is often challenging and 2024 is no exception. Canadian equity and fixed income markets have been on diverging paths since the beginning of the year, after both producing positive returns in 2023. Meanwhile, inflation has trended downward, Canadian economic growth has picked up, and the Bank of Canada has started to ease its monetary policy. What does this mean for markets?

For many investors, this type of scenario may call for a balanced approach, aiming for an asset blend that aligns with financial needs while reflecting risk tolerance. For a timely refresher, we turned to Ian A. McKinnon, Chief Investment Officer, who recommends taking a long-term view instead of focusing on short-term market fluctuations.

Explain why investors may want to seek a balanced approach when market direction is harder to decode.

The appeal of a balanced approach is that it seeks to diversify sources of potential return within the portfolio. In other words, it’s a way of managing risk. While many investors appreciate the capital appreciation potential of equities, for instance, a fixed-income component has historically acted as a portfolio stabilizer, used as an anchor during market turbulence.

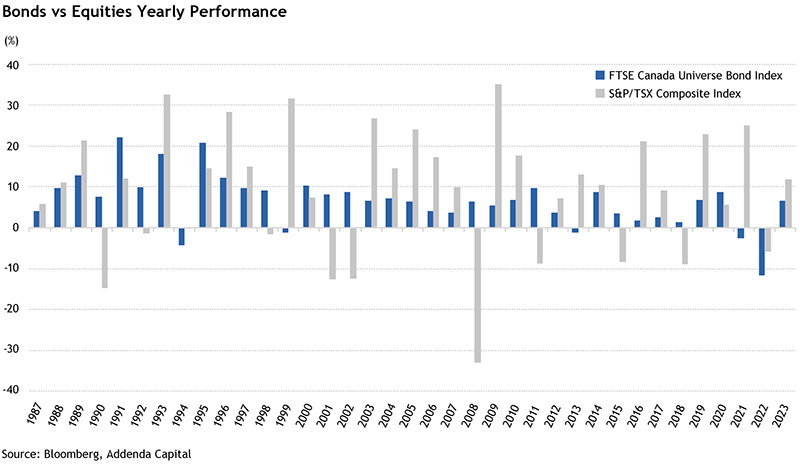

To get a sense of how fixed income and equities have coexisted in the past, let’s remember that when stocks rise, bond prices have tended to decline, and vice versa (figure 1). There can be exceptions, of course. In 2022, for example, both equities and fixed income produced negative returns as central banks tightened monetary policy to bring inflation back toward the 2% target. These rate increases led bond prices on a downward slope, but also hurt equities because higher rates can raise companies’ borrowing costs and affect profits.

Figure 1

The traditional mix of 60% equities and 40% fixed income emerged in the early 1950s. In short, the objective of a balanced portfolio is to maximize exposure to potential returns in both asset classes and help overall reduce volatility by smoothing out rough patches when they happen. You’re seeking a balance that enables the portfolio to generate returns aligned with your financial needs while taking your risk tolerance into account.

What does this mean specifically during market drawdowns?

Market drawdowns and corrections happen on a regular basis and in various contexts. These can create worries for some investors, while others see price drops as opportunities for bargain hunting. Still, opting for a balanced portfolio means that you’re providing it with an ability to create some stability and more consistent returns than you would by favouring one asset class over another.

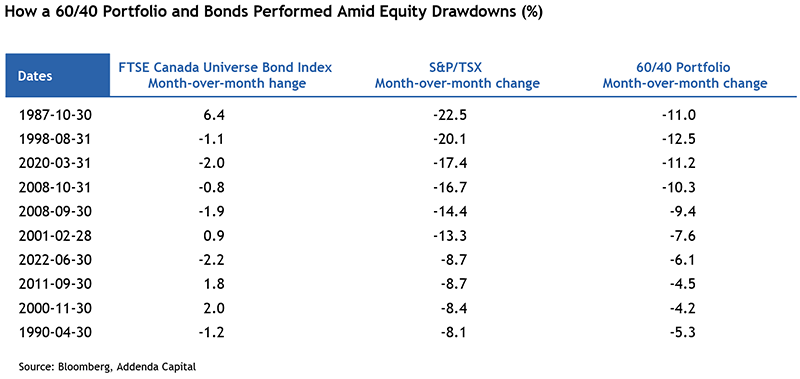

For example, figure 2 illustrates the impact of market declines on the S&P TSX index and a 60/40 portfolio. As we can see, the maximum drawdown within a balanced allocation is typically not as severe. The divergence in performance allows an investment manager to rebalance the portfolio by buying the asset class that has declined and funding it by using the asset class that has maintained its value. Over time, this kind of disciplined rebalancing strategy would then reward investors as equities recover value.

Figure 2

What specifically enables a balanced portfolio to limit large swings?

While a company’s stock price carries the potential for strong and rapid growth, one of fixed income’s main features is its relative stability compared to equities. When investors buy bonds, for instance, they are lending money to the company that issues them. The company pays regular interest to these investors until the moment that the bond reaches maturity, at which point its principal is paid back in full. The level of risk associated with this type of investment is arguably lower than buying stocks in a company. This is due to the more volatile nature of equity, whose value depends on a range of factors including performance, economic conditions, competition, company leadership, etc.

Of course, since fixed income securities can also be bought and sold among investors, their price and appeal can fluctuate as well. But due to their nature—stable interest payments until maturity—, they can provide investors with some predictability.

How important is this predictability for investors?

Very, because it helps align investors’ focus with a long-term view. It is about adopting a broader perspective. Simply put, one of the defining features of a balanced portfolio is that it allows investors to look beyond short-term returns or rough patches.

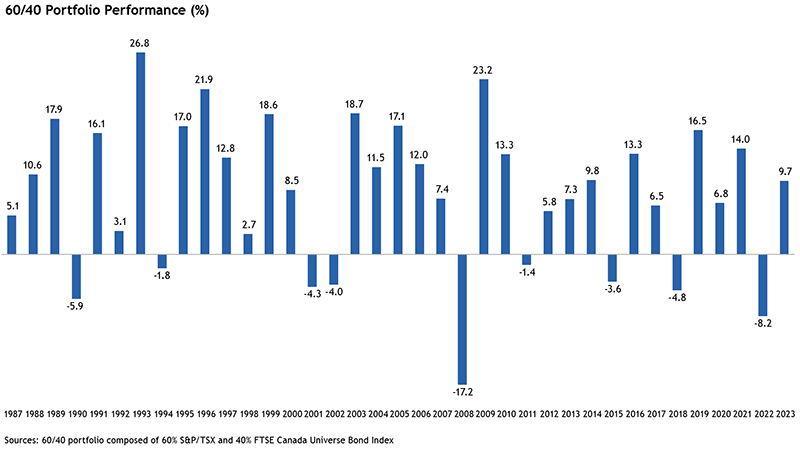

To illustrate my point, let’s take a look at figure 3, which describes a 60/40 portfolio composed of 60 % S&P/TSX and 40% FTSE Canada Universe Bond Index. During the past 35 years, investors have had many opportunities to make impulsive decisions. However, when we examine long-term returns of a 60/40 approach compared with equities or bonds, a pretty compelling narrative takes shape. That ability to see things as a marathon rather than a sprint is a key benefit. Both equities’ growth potential and bonds’ stability features play a role in a balanced approach.

Figure 3

Related Contents

Unpacking the Market: Making Sense of Canadian Equities

Carbon Footprint: Exploring Stories Behind a Number

Stewards of a Sustainable Future: Our Role in the Climate Transition