Published on: July 22, 2021

Launch of Climate Transition Funds

On May 19, Addenda Capital launched two climate transition strategies, one for Canadian Equities and one for International Equities. These funds are designed to support Canadian and International companies that are taking the necessary steps to reduce their greenhouse gas (GHG) emissions in pursuit of a net-zero emissions society by 2050. Recognition to Drive

Sustainability Forward

Roger Beauchemin, President and Chief Executive Officer has been named a recipient of Canada's Clean50 Awards and, as leader in the finance category, has earned a Canada's Clean16 Award. Canada's Clean50 Awards are announced annually to recognize those 50 individuals or small teams, from sisxteen different categories, who have done the most to advance the cause of sustainability and clean capitalism in Canada over the past two years.

New Impact Focus Area: Indigenous Economic Opportunities

Addenda added a new impact focus area to our Impact Fixed Income Fund: Indigenous Economic Opportunities. This focus area will include investments in activities that support Indigenous social or economic development, infrastructure, and Indigenous-owned businesses that contribute to long-term social and economic prosperity. For example, it may include financing for Aboriginal Economic Development Corporations, Indigenous financial institutions, as well as public services and utilities for First Nations. We will also invest in businesses that are recognized as Indigenousowned and managed and committed to Indigenous advancement under criteria developed by Indigenous Peoples such as the Canadian Council for Aboriginal Business.

Responsible Investment Association (RiA) Conference

The Responsible Investment Association virtual conference took place in June. Addenda representatives spoke at two sessions. Diane Young, Senior Portfolio Manager, Fixed Income and Co-Head, Corporate Bonds, participated in a plenary panel alongside other impact investing experts on the evolution of impact investing, challenges in measuring impact, and the future for impact investing in public markets. Alda Pavao, Senior Portfolio Manager, Canadian Equities, and Delaney Greig, Director, Sustainable Investing, led a session at Addenda’s virtual booth on climate transition and the approach to achieving climate outcomes in Addenda’s new climate transition funds.

Photo: RiA Conference

PROMOTING SUSTAINABLE FINANCIAL MARKETS — RAISING STANDARDS

Ontario Capital Markets Modernization?

Addenda met with the Minister of Finance of Ontario, Provincial Officials and Senior leaders at the Ontario Securities Commission (OSC) to encourage implementation of the Ontario Capital Markets Modernization Taskforce’s recommendations on ESG disclosure and enhanced board diversity requirements. Due to our efforts alongside responsible investor peers, the OSC has added both issues to its statement of priorities for 2021-2022.

Federal Modern Slavery Act

Together with a small group of investors, Addenda drafted and submitted a letter in support of Bill S-216, the Modern Slavery Act, to the Canadian Parliament. If passed, the law would set a common disclosure standard for large companies doing business in Canada on forced and child labour risk prevention. The letter expressed investor interest in the issue and recommended improvements to align with international law and ensure adequate disclosure.

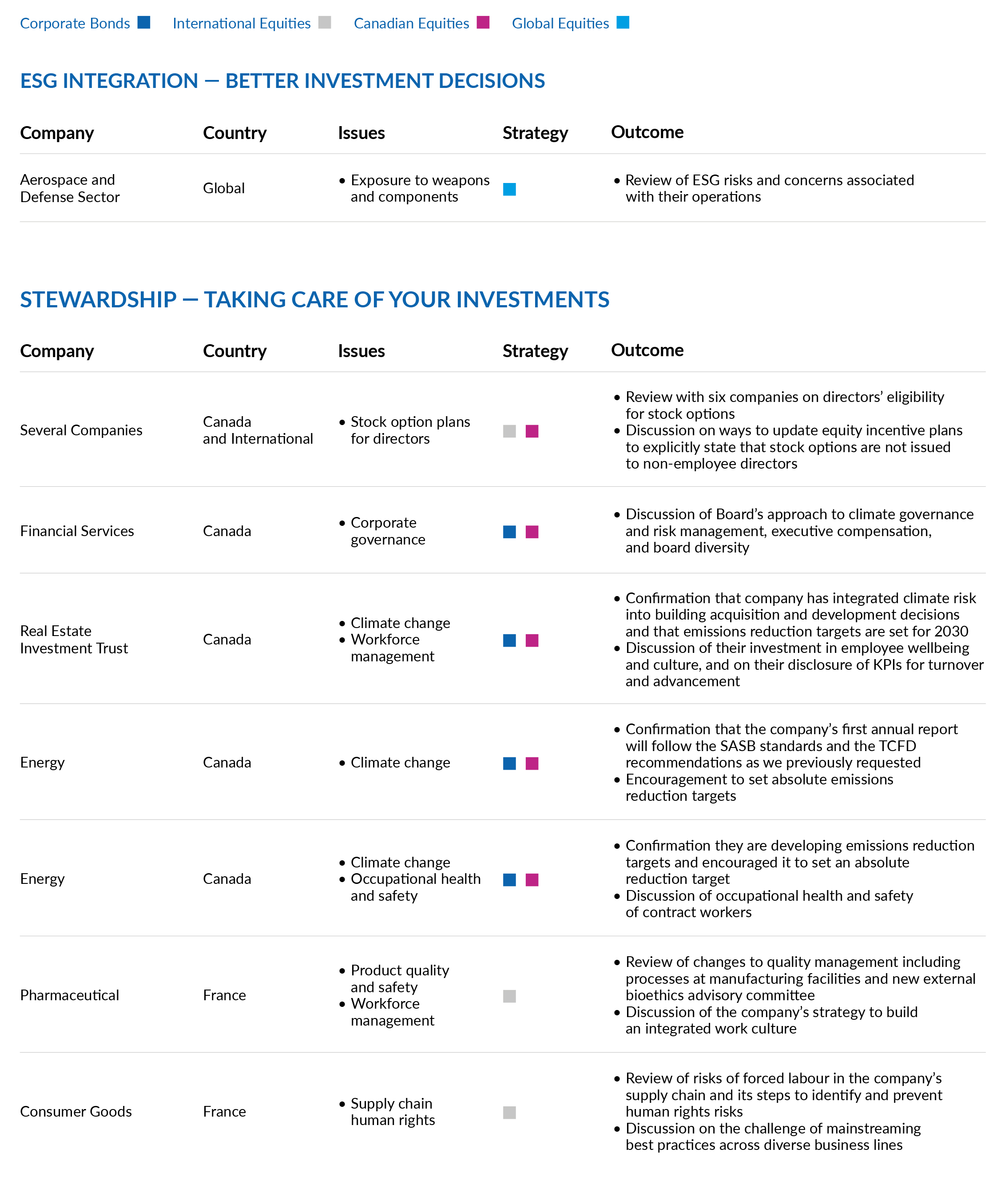

| PRODUCT-SPECIFIC INITIATIVES |

|