Published on: August 6, 2020

Photo: Milla Craig, Founder & President, Millani, Sarah Thompson, Director, Sustainable Finance, RBC Capital Markets, Barbara Zwan, Canada’s Expert Panel on Sustainable Finance and Roger Beauchemin, President and CEO, Addenda Capital

Responsible Investment Association (RIA) Conference

The Responsible Investment Association (RIA) annual conference was held virtually in June. Roger Beauchemin, President and CEO of Addenda Capital, spoke as part of an opening day panel on the trajectory of sustainable investment, especially around climate change. Annie Laliberté, Senior Portfolio Manager, led two presentations on the International Equity team’s approach at the virtual Expo. One notable aspect of the conference this year, aside from it being virtual, was the focus on social issues. Some particularly interesting session topics included:

- Modern slavery and forced labor risks in supply chains across a number of goods and services sectors;

- Advancing legal and market expectations ofgender equality among investor and company leadership; and,

- Effectiveness of diversity and inclusion strategies to attract better talent and lead to improved financial outcomes in the long run.

Addenda Employee Involved in Award Winning Advocacy Work

A project previously led by Delaney Greig, Director, Sustainable Investing, received the inaugural Responsible Investment Association Leadership Award for Advocacy. Canada’s Modern Slavery Legislation Initiative, undertaken by the Shareholder Association for Research and Education (SHARE) has been working to make companies accountable for developing and disclosing due diligence measures that find and fix human rights risks in their global supply chains, and then report them to investors.

Participating in Canada Climate Law Initiative Webinars

In June, Brian Minns, Vice-President, Sustainable Investing, participated in two webinars hosted by the Canada Climate Law Initiative. During the first webinar, Brian moderated a discussion with Sean Kidney, Co-founder and CEO, Climate Bonds Initiative, on financing the transition to a resilient, net-zero emissions society by 2050. During the second webinar, Brian participated in a panel discussion on opportunities to accelerate the pace of decarbonization following the COVID-19 pandemic.

PROMOTING SUSTAINABLE FINANCIAL MARKETS — RAISING STANDARDS

Letter to TMX Group Regarding Environmental, Social and Governance (ESG) Disclosure

Together with NEI Investments, Addenda wrote and sent a letter to TMX Group encouraging it to move forward with a platform to facilitate ESG disclosure by issuers. The letter encourages TMX Group to use the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-related Financial Disclosures (TCFD) frameworks as its basis for disclosure. 26 major Canadian institutional investors agreed to sign. An encouraging response was received from TMX at the end of June.

Letter to Government of British Columbia Regarding their Rights of Indigenous Peoples Act

Addenda signed a letter from investors to the Government of British Columbia expressing support for the BC Declaration on the Rights of Indigenous Peoples Act (the Act) as a step towards reducing the uncertainty that hampers resource development in the province. The letter also emphasizes the importance of including investors as stakeholders in the implementation of the Act.

Feedback to Ontario Capital Markets Modernization Task Force

Addenda collaborated with the Shareholder Association for Research and Education and other investors to provide some sustainable finance recommendations to Ontario’s Capital Markets Modernization Task Force, which could improve investor experience and protection.

Our recommendations were the following:

1) require ESG disclosure using the TCFD and SASB frameworks;

2) introduce time-limited safe harbour provisions for climate-related disclosures; and

3) require annual greenhouse gas (GHG) emissions reporting from all companies over a certain size.

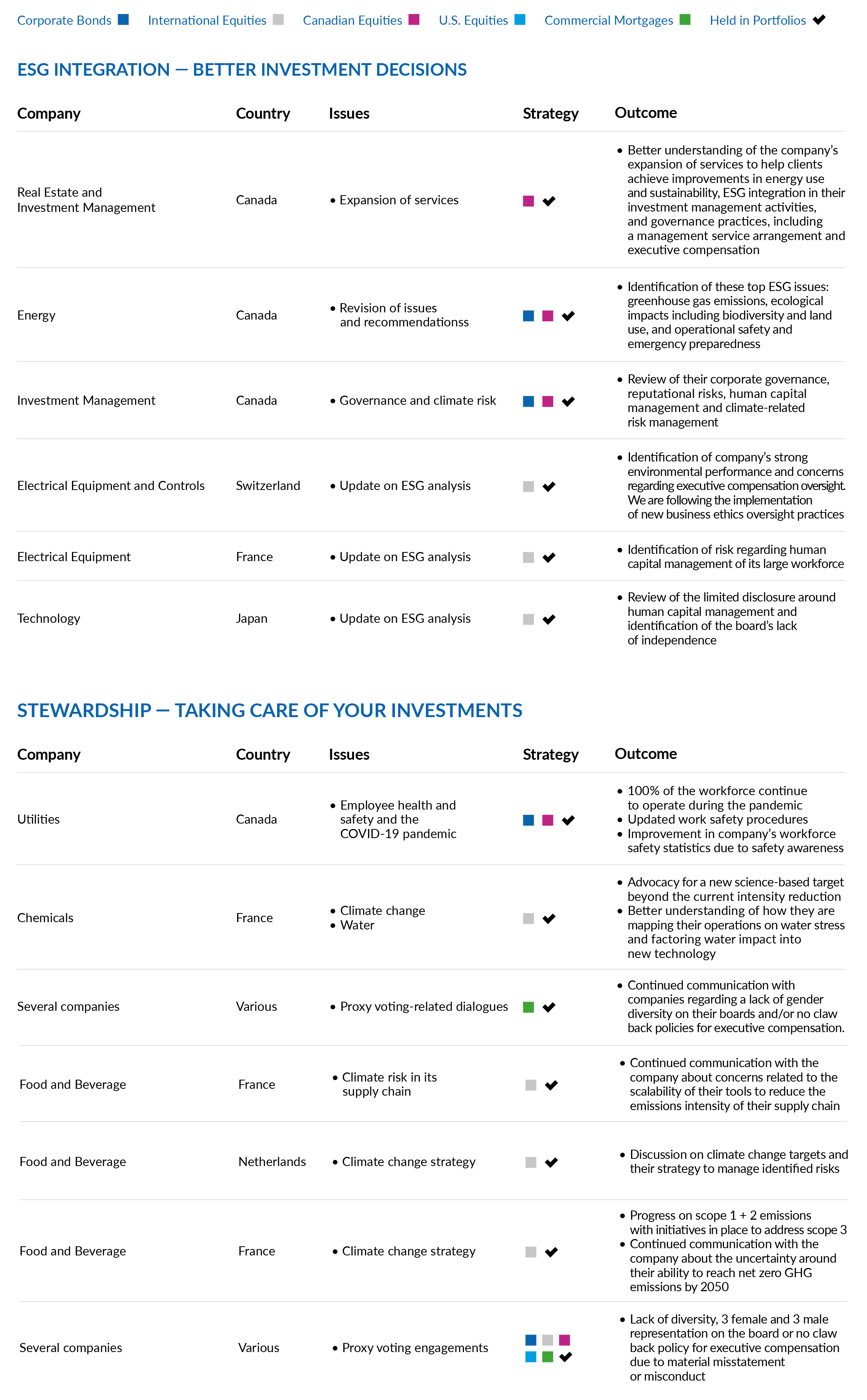

| PRODUCT-SPECIFIC INITIATIVES |

|