Published on: November 2014

There are barriers in current market practices, structures and regulation that undermine the interests of investors and the systems within which they operate. These barriers must be removed and reshaped over time in order to enable the development of a fi nancial system that supports sustainable development. Overcoming these barriers will allow investors to allocate capital effi ciently and in the most productive manner.

Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.

Addenda Capital is committed to playing an active role in promoting sustainable fi nancial markets. We see promoting sustainable fi nancial markets as a way to address systemic concerns that might aff ect all companies in a sector, all companies in a market or a group of investors. We are focused on trying to improve the practices, structures and regulation that might hinder the performance of the entities we invest in because our approach to sustainable investing is intended to enhance the long-term investment returns of our clients. We are guided by the evidence that shows that good environmental, social and governance (ESG) policies, practices and performance have a positive infl uence on long-term fi nancial and investment performance.

We promote sustainable fi nancial markets in two primary ways:

- Supporting and participating in collaborative initiatives

- Participating in the development of policy, regulation and standard setting

Supporting and Participating in Collaborative Initiatives One of the cornerstones of Addenda Capital’s approach to promoting sustainable fi nancial markets is the belief that the eff ectiveness of our activities can be enhanced by collaborating with other likeminded investors and stakeholders. In light of this belief, Addenda Capital has become increasingly involved in a number of collaborative investor initiatives. Table 1 (below) demonstrates how we have been increasing our involvement in formal collaborative initiatives.

Table 1

Addenda Capital’s Participation in Collaborative Initiatives

| Initiative |

2009 |

2010 |

2011 |

2012 |

2013 |

2014 |

| Carbon Disclosure Project (CDP) |

Yes |

Yes |

Yes |

Yes |

Yes |

Yes |

| CDP Water Disclosure |

|

|

Yes |

Yes |

Yes |

Yes |

| Principles for Responsible Investment |

|

|

|

Yes |

Yes |

Yes |

| CDP Carbon Action |

|

|

|

|

Yes |

Yes |

| CDP Forests Program |

|

|

|

|

Yes |

Yes |

| Canadian Bond Investors Association |

|

|

|

|

Yes |

Yes |

| International Corporate Governance Network |

|

|

|

|

|

Yes |

| Investor Network on Climate Risk |

|

|

|

|

|

Yes |

Collaboration allows us to leverage our internal resources, lend our credibility and gravitas to the good work of others, share tools and pool resources. Our commitment to these collaborations also underscores our commitment to sustainable investing.

Below, we have provided a brief overview of some of the key collaborative initiatives we are involved in and how we think our involvement benefi ts our investment processes and our clients.

| Carbon Disclosure Project (CDP) |

| Description |

Requests information on risks and opportunities related to climate change as well as greenhouse gas emission data from Canadian, US and international companies.

https://www.cdp.net/en-US/Programmes/Pages/CDP-Investors.aspx

|

| Participants |

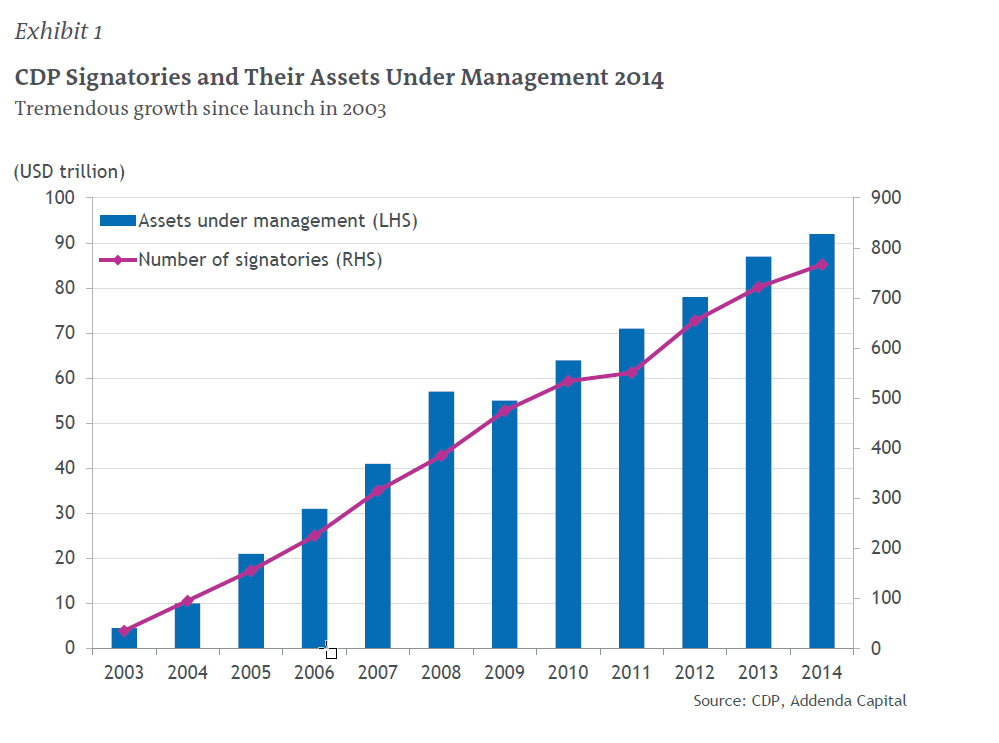

767 investment organizations with US$92 trillion under management (including Addenda Capital). See fi gure 1 below that demonstrates the growth of the initiative over time. |

| Benefits |

- Free access to all corporate responses to CDP that detail information on the risks and opportunities that companies face and management discussion and analysis on strategies to address climate change.

- Public demonstration of our understanding that climate change issues can aff ect the performance of investment portfolios and that we are seeking to monitor the climate change related risk exposure and management practices of our investee companies.

|

| CDP Water Disclosure |

| Description |

Requests information on risks and opportunities related to water as well as water data from Canadian, US and international companies.

https://www.cdp.net/en-US/Programmes/Pages/cdp-water-disclosure.aspx

|

| Participants |

573 investment organizations with US$60 trillion under management (including Addenda Capital). |

| Benefits |

- Free access to all corporate responses to CDP Water Disclosure that detail information on the risks and opportunities that companies face and management discussion and analysis on strategies to address water related issues.

- Public demonstration of our understanding that water issues can aff ect the performance of investment portfolios and that we are seeking to monitor the water related risk exposure and management practices of our investee companies.

|

| Principles for Responsible Investment |

| Description |

A network of international investors working to implement six principles related to ESG issues:

- Incorporate ESG issues into investment analysis and decision-making processes

- Be active owners and incorporate ESG issues into ownership policies and practices

- Seek appropriate disclosure on ESG issues by the entities in which we invest

- Promote acceptance and implementation of the principles within the investment industry

- Work together to enhance eff ectiveness in implementing the principles

- Report on activities and progress towards implementing the principles

http://www.unpri.org/

|

| Participants |

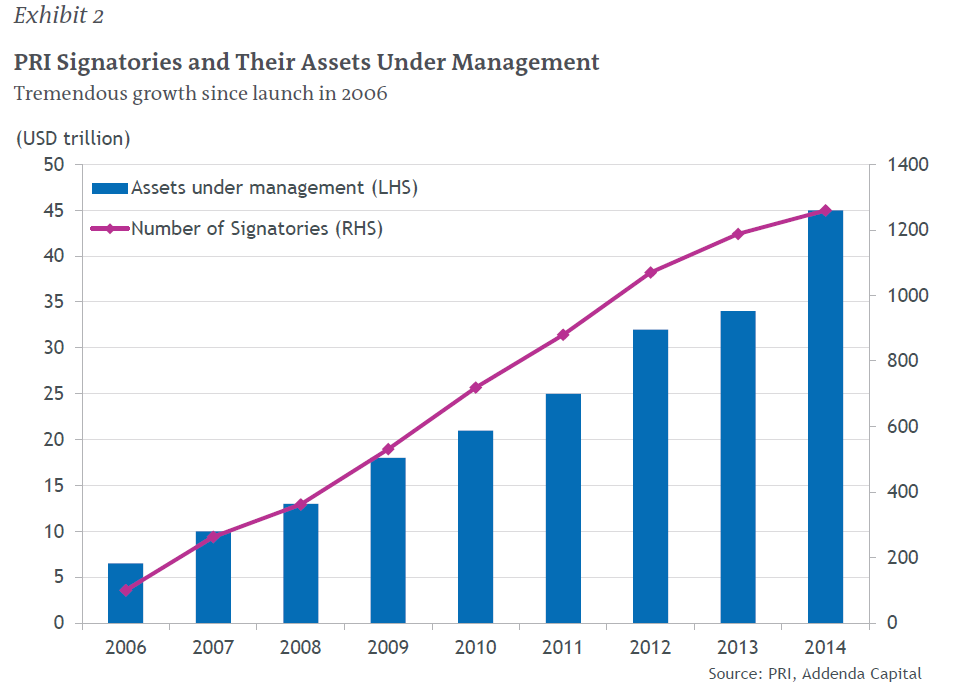

1,314 signatories (284 asset owners, 847 investment managers, 183 service partners) with US$45 trillion under management. See fi gure 2 on the following page that demonstrates the growth of the initiative over time. |

| Benefits |

- Access to webinars and seminars on important ESG issues provided by investment specialists.

- Access to Engagement Clearinghouse which facilitates collaborations among institutional investors on ESG issues.

- Access to implementation tools and capacity building off ered by the PRI Secretariat including listed equities and fi xed income work streams.

- Annual benchmarking of implementation of sustainable investing activities.

- Public demonstration of our belief that ESG issues can aff ect the performance of investment portfolios and our determination to develop our approach to sustainable investing.

|

| CDP Forests Program |

| Description |

Requests information on operational, reputational and regulatory risks and opportunities related to deforestation from Canadian, US and international companies.

https://www.cdp.net/en-US/Programmes/Pages/forests.aspx

|

| Participants |

240 investment organizations with US$15 trillion under management (including Addenda Capital). |

| Benefits |

- Free access to all corporate responses to CDP Forests Program that detail information on the risks and opportunities that companies face and management discussion and analysis on strategies to address deforestation related issues.

- Public demonstration of our understanding that deforestation related issues can aff ect the performance of investment portfolios and that we are seeking to monitor the deforestation related risk exposure and management practices of our investee companies.

|

| Canadian Bond Investors’ Association |

| Description |

A group of Canadian fi xed income institutional investors advocating for positive changes in the Canadian fi xed income market.

http://bondinvestors.ca/

|

| Participants |

30 investment organizations with $550 billion in fi xed income assets under management (including Addenda Capital). |

| Benefits |

- Market information and expertise for fi xed income investors.

- A forum for discussion of key issues and ideas relevant to the Canadian fi xed income market.

- Access to educational opportunities on important fi xed income issues.

- Opportunities to provide input on position statements regarding developments in the Canadian fi xed income market.

|

| International Corporate Governance Network |

| Description |

A geographically diverse network of investors and other stakeholders interested in inspiring and promoting eff ective standards of corporate governance worldwide.

https://www.icgn.org/about-icgn

|

| Participants |

600 individual participants from investment managers and pension funds with US$18 trillion under management as well as business leaders and academics (including three members from Addenda Capital). |

| Benefits |

- Regular communications on global corporate governance issues.

- Access to members in other jurisdictions that could help us better understand local governance issues.

- Opportunities to provide input to the committees that present members’ views to regulators on corporate governance issues.

|

| Investor Network on Climate Risk |

| Description |

A North American group of investors committed to addressing the risks and seizing the opportunities resulting from climate change and other sustainability challenges. The group is supported by Ceres, a non-profi t organization advocating for sustainability leadership.

http://www.ceres.org/investor-network/incr

|

| Participants |

100 investment organizations with US$11 trillion under management (including Addenda Capital). |

| Benefits |

- Regular communications on US and global climate change and sustainability issues relevant to investors.

- Access to stakeholder engagement meetings with companies like Coca-Cola and Walt Disney.

- Opportunities to provide input to the working groups that advance members’ priorities like enhanced sustainability disclosure and improved public policy.

|

Participating in the Development of Policy, Regulation and Standard Setting

When it makes sense we try to directly contribute to the development of policies, regulations and standards that will enable the development of a fi nancial system that supports sustainable development. Our contributions are intended to help raise standards which in turn should help the companies we invest in maximize their fi nancial performance over the long term. In some instances, we develop our own response and feedback in house and in other instances, we lend our credibility and gravitas to the good work of others.

Below, we have provided a few examples some of our submissions to regulators and some examples of our collaborative actions with other investors.

Submissions to Regulators

Guidance for Proxy Advisory

Firms We submitted comments to the Canadian Securities Administrators (CSA) on proposed National Policy 25-201 Guidance for proxy advisory fi rms. We welcomed the CSA’s focus on proxy voting and were pleased that the nature of the proposed policy was guidance that is “not intended to be prescriptive or exhaustive.”

Gender diversity on Boards and in Executive Officer Positions

We submitted comments to the Ontario Securities Commission regarding proposed disclosure requirements regarding the representation of women on boards and in executive offi cer positions. We expressed our interest in seeing increases in many types of diversity among corporate directors and executive offi cers. We view gender diversity positively as well as diversity in professional experience, education and ethnicity that can enhance board eff ectiveness and corporate decisionmaking.

Security Holder Rights Plans

We submitted comments to the CSA on proposed National Instrument 62-105 Security Holder Rights Plans and proposed Companion Policy 62-105CP Security Holder Rights Plans. We were supportive of the CSA’s eff orts to help ensure the equal and fair treatment of all shareholders in the event of a takeover bid and allow a company enough time to consider alternatives to a bid.

Early Warning Reporting Regime

We submitted comments to the CSA on proposed amendments and changes to the early warning reporting regime in Canada. We were supportive of the CSA’s eff orts to provide greater market transparency and investor confidence.

Collaborative actions with other investors

2014 Global Investor Statement on Climate Change

Addenda Capital, along with nearly 350 other investors with more than US$24 trillion signed this statement that was released at the UN Secretary-General’s Climate Summit on September 23, 2014. The purpose of the statement is to urge stronger national and international policy action on climate change and clean energy, and it outlines steps investors are taking and intend to take to scale up low-carbon investment, given the right policy signals.

Letter to International Organization of Securities Commissions to Encourage Better ESG Disclosure

We, along with many other investors signed a letter that was presented to the International Organization of Securities Commissions (IOSCO) earlier in 2014. The letter aims to highlight investors’ need for consistent and material disclosure of corporate sustainability information to inform their investment decisions.

Investor Statement Regarding Green Bonds and Climate Bonds

We signed this statement focused on the green bonds and climate bonds market because it makes suggestions for action needed by stakeholders to support further growth of and investor interest in this market. The statement was also released at the UN Secretary-General’s Climate Summit on September 23, 2014 and it will also be presented at the Lima Climate Change Conference in December which is part of the United Nations Framework Convention on Climate Change negotiations.

Investor Call to Action: Anti-Corruption and the Global Development Agenda

We signed an appeal from the private sector to governments calling for a commitment to strengthen anti-corruption measures and provide greater transparency, and aiming to integrate anti-corruption and good governance into the post-2015 UN development agenda.

Conclusion

By participating in collaborative initiatives and contributing to the development of regulation we hope to promote sustainable fi nancial markets that will enable our clients to achieve superior long-term investment performance. We continue to look for opportunities to enhance the system in which we operate and we are always open to hearing from clients about issues that concern them.

© Addenda Capital Inc., 2014. All rights reserved. This document may not be reproduced without Addenda Capital’s prior written consent.