Addenda Capital’s experienced Commercial Mortgage team invests in, and manages, portfolios of high-quality commercial mortgages. The team manages mortgage investments of more than $2 billion associated with retail, industrial, multi-residential and office properties.

We review approximately $2.5 billion in mortgage applications each year and from that we acquire $250 to $500 million of new mortgages for our clients. The properties that are the security for the mortgages are owned and managed by the borrowers and most are already operating with tenants.

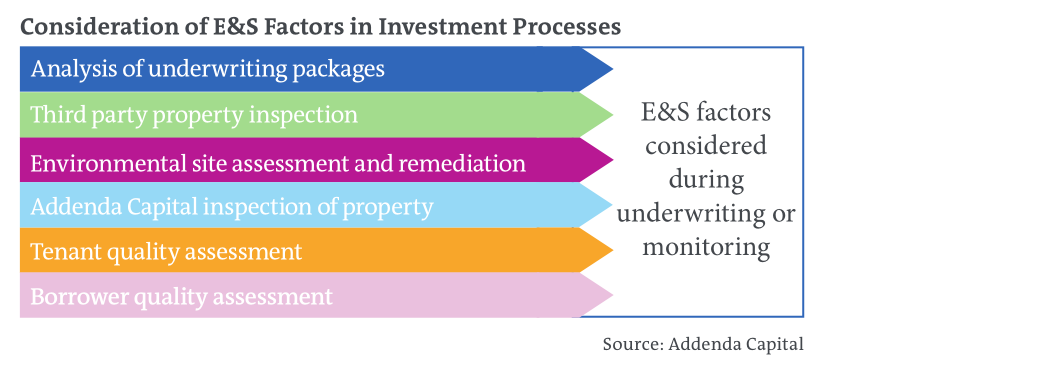

During underwriting, we are focused on the value of the property and the quality of the borrower. Our team believes that applying a sustainable investing approach that considers environmental and social (E&S) factors when underwriting a mortgage and during the ongoing monitoring of investments will add value for our clients.

Environmental and social factors can affect a property in many ways, including:

- Occupancy (rental price, time to market, tenant retention time)

- Current and future use and operation of the property

- Operating costs

- Vulnerability to extreme weather events

- Market value

- Potential legal conflicts

Analysis of Underwriting Packages

Most of the loan applications we receive include complete underwriting packages. If a loan looks promising from a client perspective, we undertake an analysis of the application including a review of lease documents, the physical location and market information to ensure that the loan meets our internal criteria. We then risk rate the loan against benchmark property-specific criteria developed in-house.

Possible E&S considerations:

- Does the property have sufficient public transportation access?

- Is the building’s energy performance consistent with similar buildings?

- Will there be onsite storage of potentially hazardous materials?

Third Party Property Inspection

Before making an initial investment, most properties older than 15 years are inspected by an independent third party that provides a property condition report. The inspector is tasked with identifying any concerns regarding the building’s structure and roof and its mechanical systems as well as identifying any significant deferred maintenance. Generally the inspections are undertaken by engineering or specialist firms (for example roofing or mechanical/electrical) with expertise in the area they are evaluating.

- Is the heating, ventilation, and air conditioning equipment old and inefficient?

- Does the building have a green roof?

- Are there solar panels to augment heating or generate electricity?

Environmental Site Assessment and Remediation

A licensed environmental engineer undertakes an environmental assessment of each property. Every property has a phase one assessment, which includes a records review, interviews and a site visit. Depending on the outcome of the phase one assessment, a phase two assessment may also be needed.

If the engineer identifies a potentially contaminating activity on the property or the property has ever been used for an industrial use such as a gas station or dry cleaning, a phase two assessment will be undertaken. A phase two assessment is intended to determine the location and concentration of contaminants and to assess the related risks and includes field sampling. If contaminants are identified, the engineer will often provide a preliminary scope of work for remediation and a cost estimate.

If minor remediation is required, Addenda Capital might fund the mortgage but hold back a portion of the funding until an environmental engineer confirms that the remediation is complete.

- Is the building on a redeveloped contaminated site?

- Are there oil storage tanks onsite?

- Could the existing tenant use present an environment risk (such as a gas station) and if so have we received environmental insurance to offset the risk?

Example: A redevelopment that required environmental remediation

A borrower redeveloped an industrial property into a mixed use commercial/warehouse property through the demolition of 50% of the building and remediation involving the removal of holding tanks and some contaminated soil. The amount of funds initially advanced was based upon the value of the remaining property, the tenants and the land value less the cost to remediate. Once the remediation was complete and verified through a phase 3 environmental assessment, the remediation holdback amount was released to the borrower, and then an additional advance was released when the new tenants were in place. The end result was an excellent new commercial development with no remaining environmental issues.

Addenda Capital Inspection of Property

An Addenda Capital portfolio manager or our agent inspects every property that exceeds $1 million in person before we advance the funds for any mortgage. Our inspection supports our analysis of the physical location and supplements the third party property inspection and the environmental site assessment. Based on our understanding of the borrower’s intention for the property, we may be looking for evidence of the remediation process and the general upkeep and condition of the property.

- Is any required environmental remediation underway?

- Does the current state of the property match what was provided in the application?

Other Property Considerations

Green buildings: A growing number of tenants are seeking properties that have green building characteristics such as improved energy efficiency, more natural daylight and better air ventilation. As such, we look for and support where possible, properties that have Leadership in Energy and Environmental Design (LEED) certification or Building Owners and Managers Association of Canada Building Environmental Standards (BOMA BESt) certification.

Solar panels: A small but growing number of properties that we are considering financing have solar panels on their roofs. These installations may be owned by the landlord or be part of a roof top space lease. In some instances, we are able to include the income generated by the solar panels in our financial assessment of the property.

Tenant Quality

Assessment Addenda Capital carefully considers the tenants occupying the properties that we finance. As a mortgage lender rather than a landlord, we have little control over which tenants occupy properties. As such, our evaluation of tenants mainly takes place when we are considering funding or renewing a mortgage. We consider the potential for the tenants and the related lease agreements to provide reliable revenues for the building owners as well as the potential impacts of the tenants’ activities on the value of the property. Many tenants are related to national brands.

Less than 2% of our overall portfolio includes any manufacturing, and if this manufacturing involves any hazardous products, we insure that sufficient liability/environmental insurance is carried both by the tenant and the borrower. Should the Environmental Report show that the tenant is incapable of properly handling of the hazardous materials, we would not proceed with the loan.

- Do the business activities of any tenants have a history of environmental contamination?

- Would the presence of any tenants make leasing more difficult in the future due to E&S reasons?

Borrower Quality Assessment

We meet with many borrowers over the course of a year and many have become repeat borrowers. In addition to a credit check, we may also conduct background checks on potential borrowers to make sure that they have a history of being a reputable landlord or developer.

- Does the borrower have a record of poor landlord behaviour?

- Is there anything to suggest anything unlawful about the way cleaning services are provided?

Sustainability Considerations

During Annual Risk Rating In addition to ongoing monitoring, Addenda Capital annually risk rates each loan over $1 million against product-specific risk rating criteria. Mortgage loans are evaluated using a numerical rating system, weighting the scores for the different risk factors. If loans fall below a minimum standard, we will contact the borrower to determine what corrective measures can be implemented, increasing our monitoring efforts until the situation improves, or we will mark properties for payout and non- renewal.

- Do the business practices of any new tenants raise any E&S concerns?

Conclusion

Environmental and social factors can affect a property in many ways. From underwriting through to the ongoing monitoring of mortgages, our experienced team considers the environmental and social factors that might have a material impact on property values or a borrower’s ability to repay their mortgage.

© Addenda Capital Inc., 2015. All rights reserved. This document may not be reproduced without Addenda Capital’s prior written consent.