Published on: May 21, 2024

Category:

Ian A. McKinnon, Chief Investment Officer

With high interest rates, near-cash assets such as high interest savings accounts (HISAs) and guaranteed investment certificates (GICs) have provided many investors with compelling returns. However, it may be time to start thinking about an alternative to handle the shift resulting from the central banks’ expected decision to start lowering policy rates sometime in 2024. Against the backdrop of declining unit labour costs in the United States, now tracking 1.8% (y/y growth) and some other evidence of emerging weakness in the labour market, there is support for an easing of policy rates, particularly in the U.S., in the second half of this year.

While the Bank of Canada and the United States Federal Reserve have seen inflation moderating relative to a year ago, and signalled that policy rates may have peaked, both are awaiting more data before deciding on easing their monetary policy. In the meantime, should investors get ready to position their portfolios differently? To find out, we spoke with Ian McKinnon, Chief Investment Officer, who suggests taking a fresh look at longer-term fixed income. A forthcoming article will focus more specifically on the benefits of a balanced portfolio.

What should investors that chose HISAs or GICs think of the current economic situation?

The backdrop is that central banks appear to be done raising rates, meaning the next move would be to start easing monetary policy. While we are not saying that rates are going back to zero, an expected decrease in rates would mean that there is a better potential return opportunity in fixed income than near-cash instruments such as GICs.

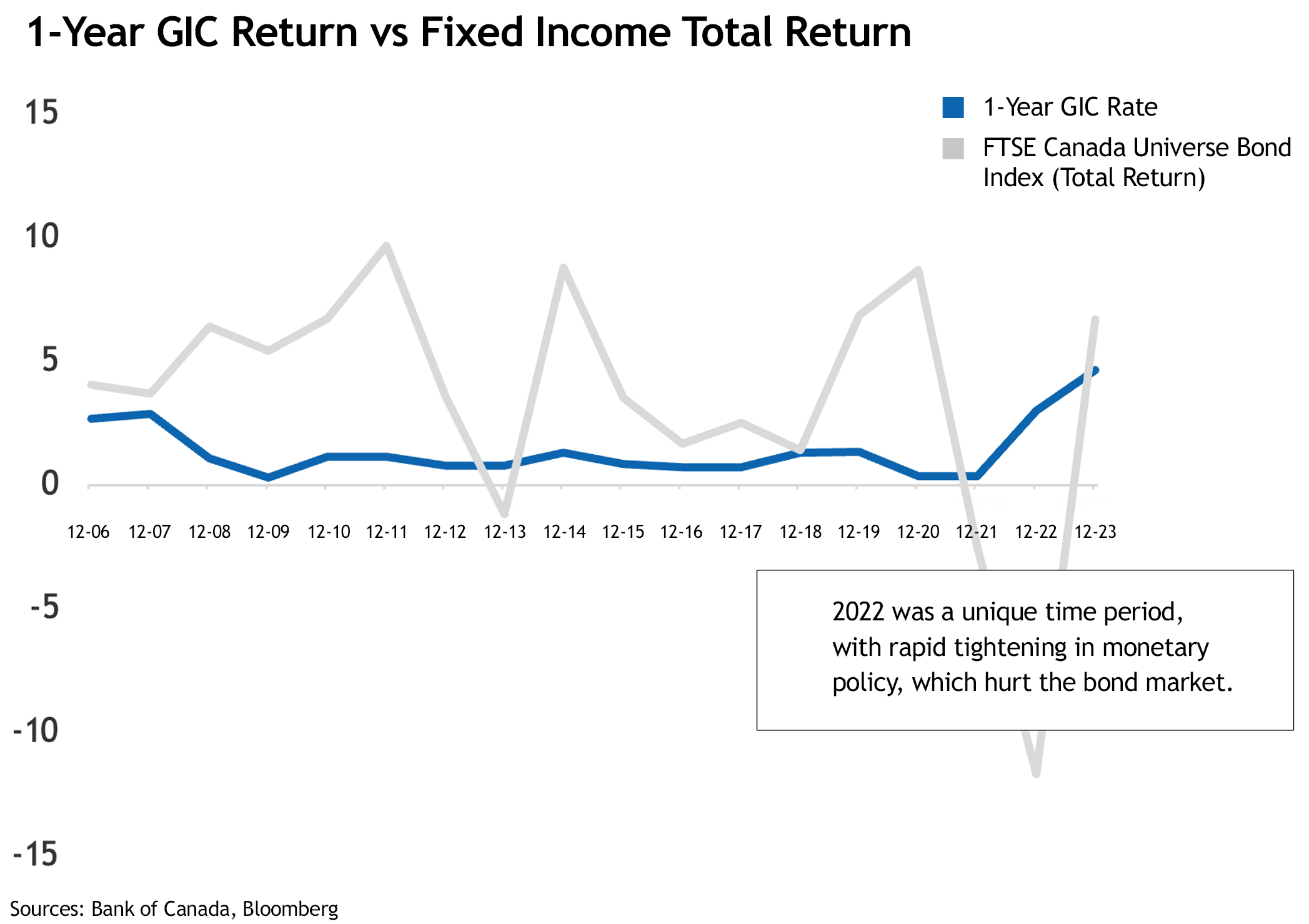

Let’s assume, for instance, that a high interest savings account features a savings rate of 6%. Your return may look great today in cash, and with limited risk, but it would underperform for two reasons if rates began to fall. Firstly, longer-term fixed-income securities may potentially produce a better return and over a longer time. There is an inverse relationship between yield and the price of a bond. As rates decrease, the price of a bond is expected to increase, resulting in capital gains for investors. Investors in short-term products such as GICs earn only interest income and would not be beneficiaries of total return (capital gains and interest income), which is the case of fixed income investing. Secondly, there is a risk-reward proposition here. If investors are in near-cash assets, this is arguably risk-free, but there is also a risk, an opportunity risk, that the return on cash is going to fall.

In other words, a reinvestment risk?

Yes. It is the classic definition. Simply put, a reinvestment risk can be described as a situation where reinvesting your savings or assets in the same vehicle comes at the price of lower potential returns.

Could you walk us through some benefits of investing in longer-term fixed income?

Sure. Fixed income securities provide steady income. Let’s say a bond’s coupon, or interest, is 4.5% on an annual basis. This is paid to investors in regular fashion. But the bond’s value can change as well. Keeping a long-term view and staying invested in a bond means that in addition to the interest payments, you may benefit from capital appreciation as well.

How would you describe the role of fixed income in a portfolio?

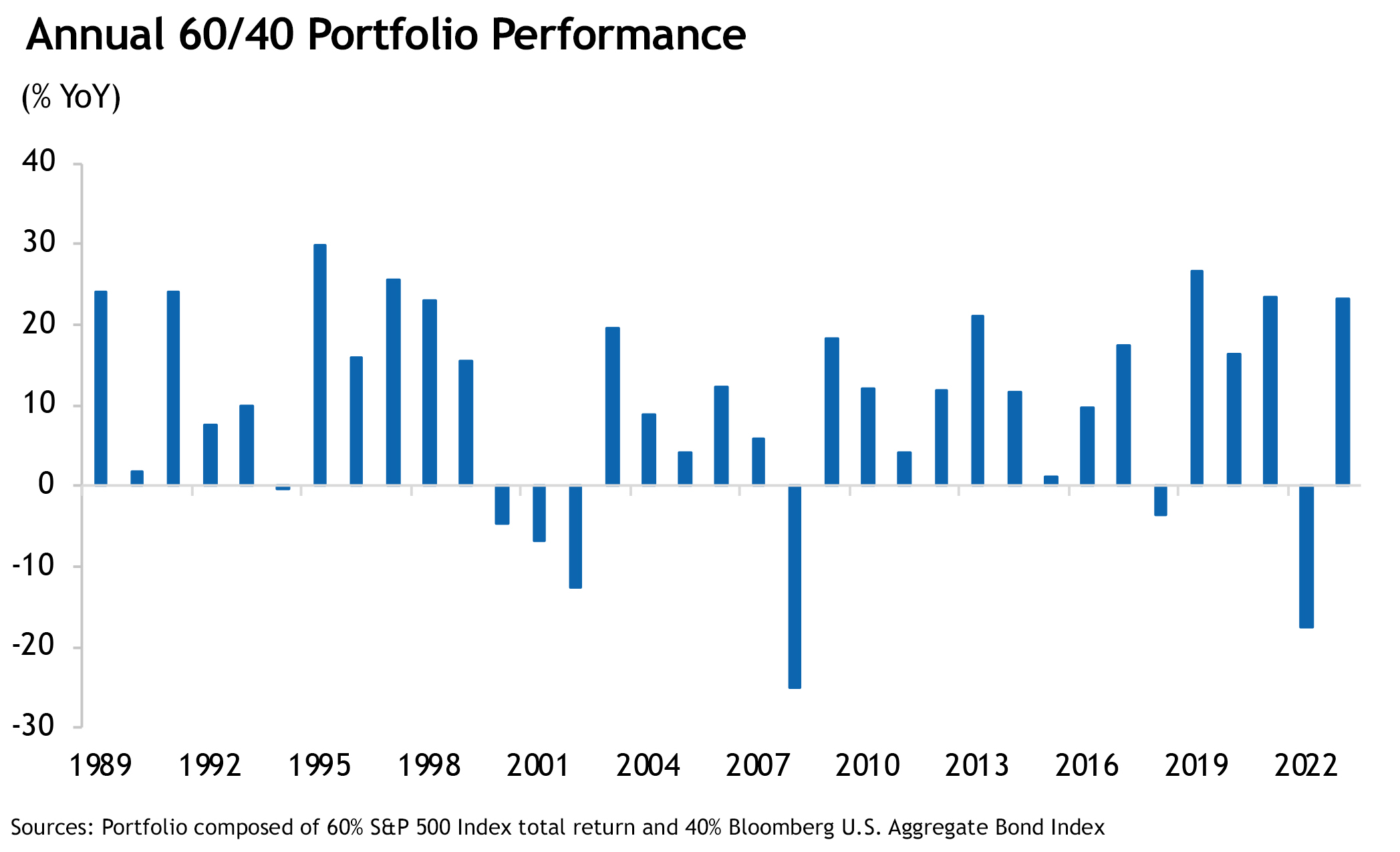

It’s a diversifier of risk. From a historical standpoint, bonds have generally been less volatile than investments such as equities. That being said, it didn’t work that way in 2022, when both equities and bonds went down. But that was arguably a unique time period, with a rapid tightening in monetary policy to combat surging inflation, which really hurt the bond market. In the meantime, the thinking in equity markets was that something was going to break and that central banks were moving too quickly with policy rate increases. As it turned out, equity markets were wrong. In reality, bonds should indeed have gone down because of rising rates, but equities should have powered through, offsetting bonds. However, equities did rally back in 2023.

Can a balanced portfolio help with optimizing returns?

Yes. As opposed to being all fixed income or all equities, having a blend of the two seeks to achieve the best of both worlds. It may give up higher total return, but it may also mitigate the more negative type returns. The diversification across asset classes aims to deliver a more consistent approach to investment returns. At Addenda, the objective is to achieve our investors’ financial goals, but with a longer-term approach to investing. Our customized balanced portfolios assist our institutional clients in achieving capital appreciation, with fewer bouts of volatility. For their part, retail clients can access balanced portfolio solutions through the Co-operators Sustainable Investment Solutions, which are supported by mutual fund offerings managed by Addenda Capital.

Related Contents

Fixed Income

The Ripple Effect: Recent Trends in Impact Investing

Seeking Returns Regardless of Main Asset Classes