Published on: March 13, 2024

This Sustainable Investing Policy highlights the principles that underscore Addenda Capital’s commitment to being a Canadian leader in sustainable investing and provides a framework for implementation. Through the application of this policy, Addenda Capital will work with clients, employees, our shareholders, and other stakeholders through an interactive process to better optimize long-term investment returns for our clients.

Definitions

We define “sustainable investing” as an investing approach that integrates environmental, social and governance (ESG) matters into investment and stewardship activities to enhance long-term investment performance for our clients (1). Sustainable investing for Addenda also includes developing innovative investment products and solutions related to impact, climate change, and the United Nations Sustainable Development Goals (UN SDGs), which coupled with our stewardship activities, aim to provide both financial and positive sustainability outcomes.

“Stewardship” is a core component of our effort to enhance long-term investment performance and positive sustainability outcomes for our clients. We define it as active engagement with public policy and standard setters to promote sustainable financial markets, as well as engagement with investee companies and exercising proxy voting rights. These efforts are integrated to promote the sustainability of the economy, society, and investment performance. Our stewardship efforts are either directly with the target entity or in collaboration with investor initiatives and other stakeholders, especially when this is the most effective way our perspective is considered, and we can drive positive change.

We define “impact” as an investment approach that intentionally seeks to create both compelling financial returns and measurable positive social or environmental outcomes. Addenda’s impact criteria and approach are through a proprietary framework and process that leverages globally recognized principles and guidelines.

2. Principles

Addenda Capital’s purpose, vision, and values are aligned with those of our parent, Co-operators, who focuses on providing financial security for Canadians while being a catalyst for a resilient and sustainable society (2).

We embrace our Canadian roots, including the diverse languages, peoples, and voices. We acknowledge continued economic success happens within planetary boundaries where climate, biodiversity and natural systems are stable and resilient. Addenda is therefore committed to be at the forefront in providing innovative, sustainable investing solutions to make the world better, healthier, and more prosperous for all. The following principles therefore guide Addenda Capital’s approach to sustainable investing:

- Good sustainable investing policies, practices, and performance will help us fulfill our duty to protect and enhance the long-term value of investments for our clients.

- Our approach strives to be science-based and draws on global best practice frameworks related to governance, climate change, biodiversity, and natural capital management. In line with the best available science and our intent to stay at the leading edge of international standards and regulatory requirements related to climate change, we acknowledge there is an urgent need to accelerate the transition towards global net-zero emissions.

- Our approach strives to adhere to the United Nations Human Rights Principles (3) and the United Nations Declaration of the Rights of Indigenous Peoples (UN DRIP) (4). We are also committed to building our awareness, of Indigenous issues and reconciliation.

- We are committed to our clients, which involves partnering with those who have both financial and sustainability goals. This includes offering innovative investment strategies that provide market returns, as well as align with the UN Sustainable Development Goals (UN SDGs), impact or climate transition, and net-zero ambitions.

- We have a duty to proactively contribute to the advancement and promotion of sustainable investing practices in Canada and globally. We plan to achieve this through our stewardship activities focused on promoting sustainable financial markets.

- Cooperation with other investors and stakeholders can help us expand our knowledge, refine our strategy, and increase the effectiveness of our activities.

- We are committed to transparency and disclosure of our climate and sustainability goals and progress, and to sharing our sustainable investment approach and results with our clients

3. Policy

Our approach to sustainable investing is consistent with the framework provided by the United Nations-sponsored Principles for Responsible Investment (“PRI”). This framework enables us to apply Addenda Capital’s principles, as listed above, to our investment decision-making, investment strategy development, and stewardship practices. Therefore, where consistent with our fiduciary responsibilities and based on the principles established by the PRI, we commit to the following:

- Identify the ESG issues that could have a material impact on investment performance and incorporate these considerations into investment analysis and decision-making. Part of these considerations includes recognizing the systemic nature of the transition and physical risks and opportunities related to climate change.

- Monitor the ESG practices of the entities in which we invest and update our research or views in cases where ESG practices materially change. Part of monitoring will also include, for example, cases with risks of extreme and potentially widespread violations of human rights and global norms.

- Exercise voting rights and engage in a dialogue with the entities in which we invest in accordance with our Stewardship and our Proxy Voting Policies.

- Promote acceptance and implementation of sustainable investing, including the actions required for the transition to net-zero greenhouse gas emissions and support for enabling policies and or standard-setting initiatives.

- Collaborate with other investors to promote and enhance sustainable investing.

- Support and partner with those clients that have sustainability goals, including those related to climate, net-zero, Sustainable Development Goals (SDGs), and impact, among others, through the development of investment solutions that strive for market returns and positive sustainability outcomes.

4. Scope

Addenda’s Board and Executive Committee oversee the overall strategic direction and level of ambition of the firm on sustainability and climate change.

The Sustainable Investing Committee (SIC), chaired by Addenda’s President and CEO, and involving Addenda’s leadership from Investment, Business Development, Client Partnerships and Operations teams, oversees the Stewardship, Proxy Voting, and Controversial Weapons policies, as well as other important internal guidelines related to sustainable investing and sustainability-themed strategies. The Committee reviews and approves changes to these policies regularly. The Committee also oversees our public Sustainability and Net-Zero commitments, including collaborative initiatives, and government and industry submissions.

Addenda Capital offers a comprehensive array of investment strategies across a broad range of asset classes. Responsibility for ESG integration into investment decision making is distributed accordingly. Each investment team determines material ESG factors and includes them in their investment process and when relevant in their corporate engagements. These activities are regularly reviewed by the Sustainable Investing Committee, supported by the Sustainable Investing team, which provides best-practice recommendations to foster a commitment to excellence. Proactive communication between the investment teams and the Sustainable Investing team ensures a strong and integrated approach across the firm.

Implementation of our stewardship policy related to promoting sustainable financial markets and strategic, systemic, and long-term issues rests with the Sustainable Investing team in close collaboration with the investment teams. This includes issues such as climate transition, biodiversity, and natural capital management. Addenda recognizes the complexities of social issues including those of human rights, reconciliation, and Indigenous rights and as such is committed to building awareness and improving practices in these areas over time.

The Sustainable Investing team conducts analysis and decisions related to Addenda’s sustainability-oriented strategies such as qualifying securities as impact or climate-transition aligned. The Sustainable Investing team also provides strategic recommendations to various teams and committees across Addenda Capital.

Related policy documents:

5. Disclosure

We will report on our sustainable investing activities to our stakeholders regularly. Public disclosure will include voting and engagement activities, carbon footprints, and applicable policies. The Sustainable Investing Committee will regularly review our communication to our clients and stakeholders on our sustainability ambitions and progress.

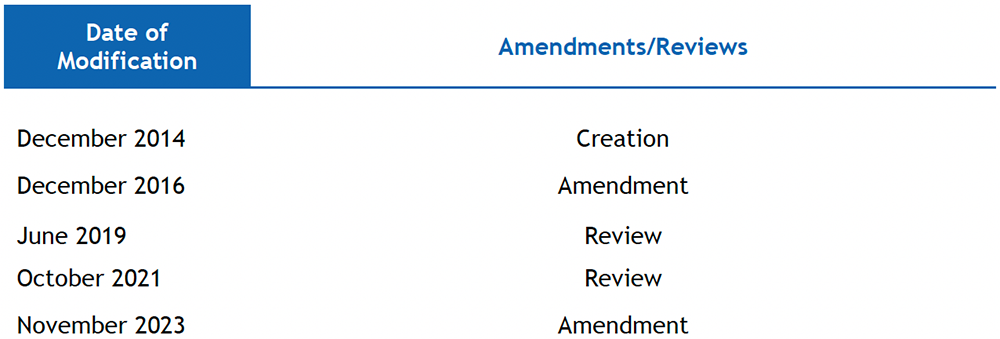

6. Amendments and Reviews

- Others may use the term ‘responsible investing’ or ‘ESG investing.’ Our approach and investment solutions align with the CFA Institute, Global Sustainable Investment Alliance, and Principles for Responsible Investment’s (PRI’s) Definitions for Responsible Investment found here

- https://www.cooperators.ca/en/about-us/purpose-vision-values

- See the Foundational Universal Declaration of Human Rights

- UN DRIP