Published on: June 26, 2019

Abdullah RahmanSenior Analyst, Business Intelligence and Quantitative Research

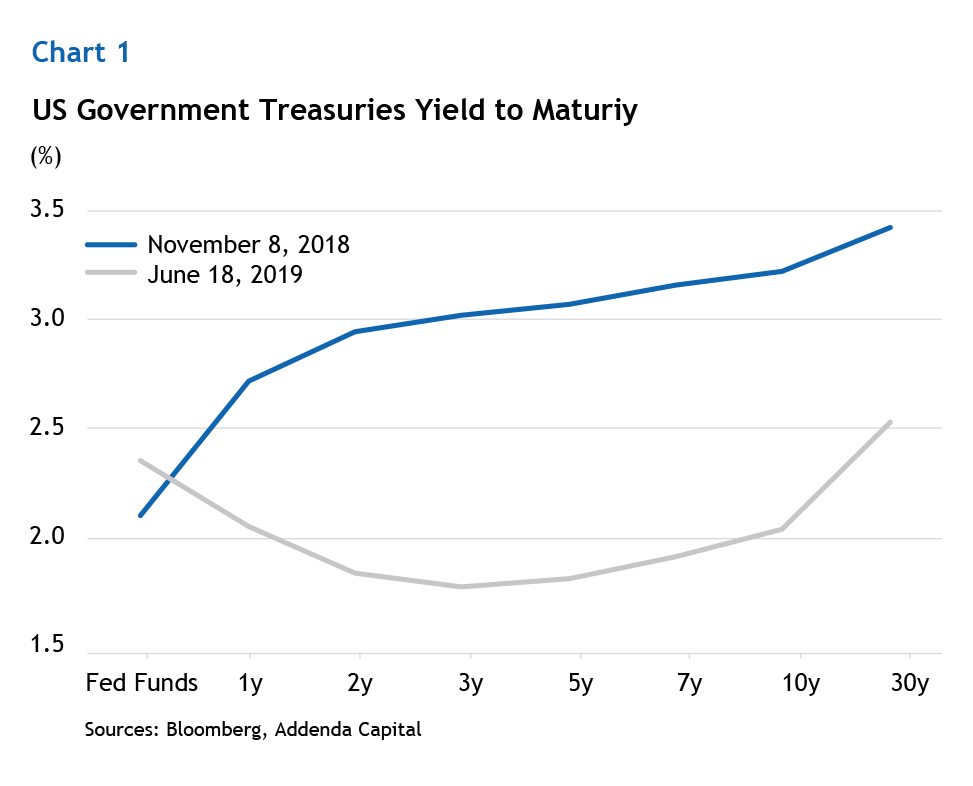

Since the U.S. mid-term elections, 2-year, 10-year, and 30-year Treasury bond yields have decreased

by 1.16%, 1.21% and 0.93% respectively. They currently stand at 1.81%, 2.03% and 2.53% (chart 1).

In the background, the Federal Reserve target rate stands at 2.375%, unchanged since the last December

hike. The current term structure extrapolates that the monetary policy rate will be reduced by 0.66%

by year-end 2019 and that the drop will amount to 1.0% by October 2020. At its June 19, 2019 meeting,

the Fed hinted that it might initiate an easing cycle soon. The market narrative underlying these moves

centers around two themes: the deleterious impact of the trade war on global growth and the fear

of a monetary policy error.

After providing nearly limitless support to pull the economy out of the Great Recession, the Fed decided

to raise the target rate back to its estimated neutral level, i.e. where it is neither restrictive nor simulative

for the economy. In early January, just a few weeks after the last hike in the target rate, the Fed assessed

that the rate now stood at the lower bound of its estimated band for the neutral rate. From there on,

it intended to patiently monitor the outlook before deciding on any further adjustments to rates.

Some bond investors remain convinced that the Fed overestimated the level of the neutral rate. They posit

that the last two hikes were uncalled for and risked triggering a recession. To this day, economic data does

not support the markets thesis. Rate hikes have indeed impacted some components of GDP: residential

investment and auto sales have been drifting for a few quarters but without additional weakness. When

monetary policy is truly restrictive and about to trigger a recession, these components collapse, which

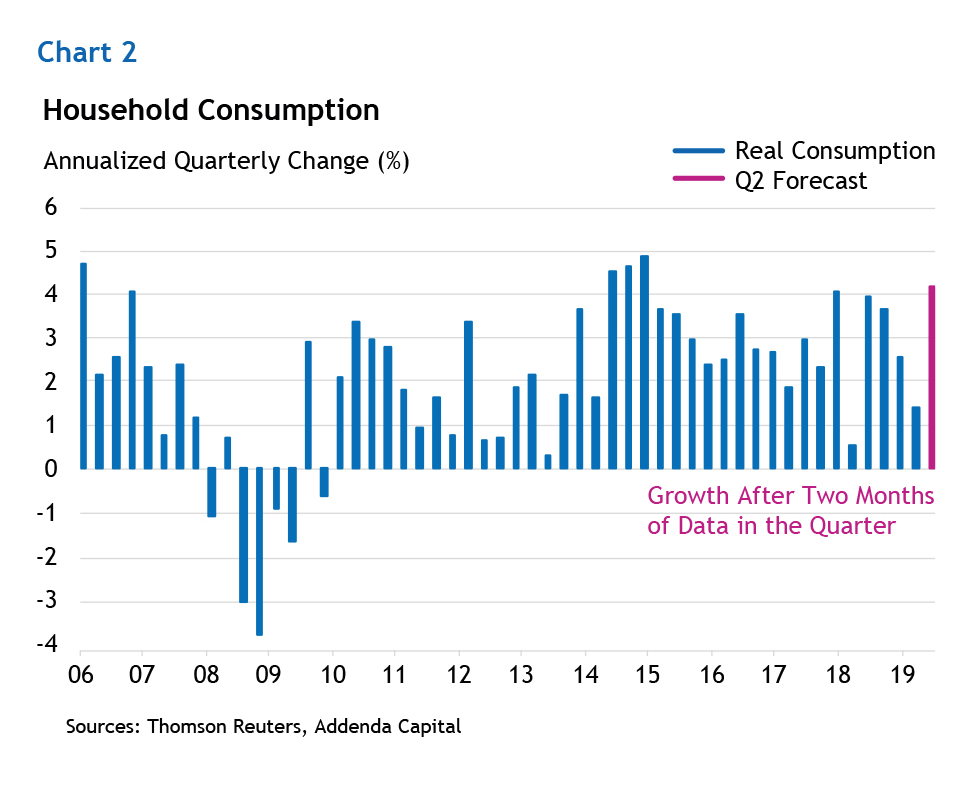

is far from the current environment. Moreover, household consumption slowed in the first quarter but this

seems to have been weather-related. In the second quarter, with two months of data released, we estimate

that consumption has surged, which contradicts the thesis that rates are already dangerously undermining

growth (chart 2). From this evidence, the current level of rates does not seem to impede the extension

of the cycle.

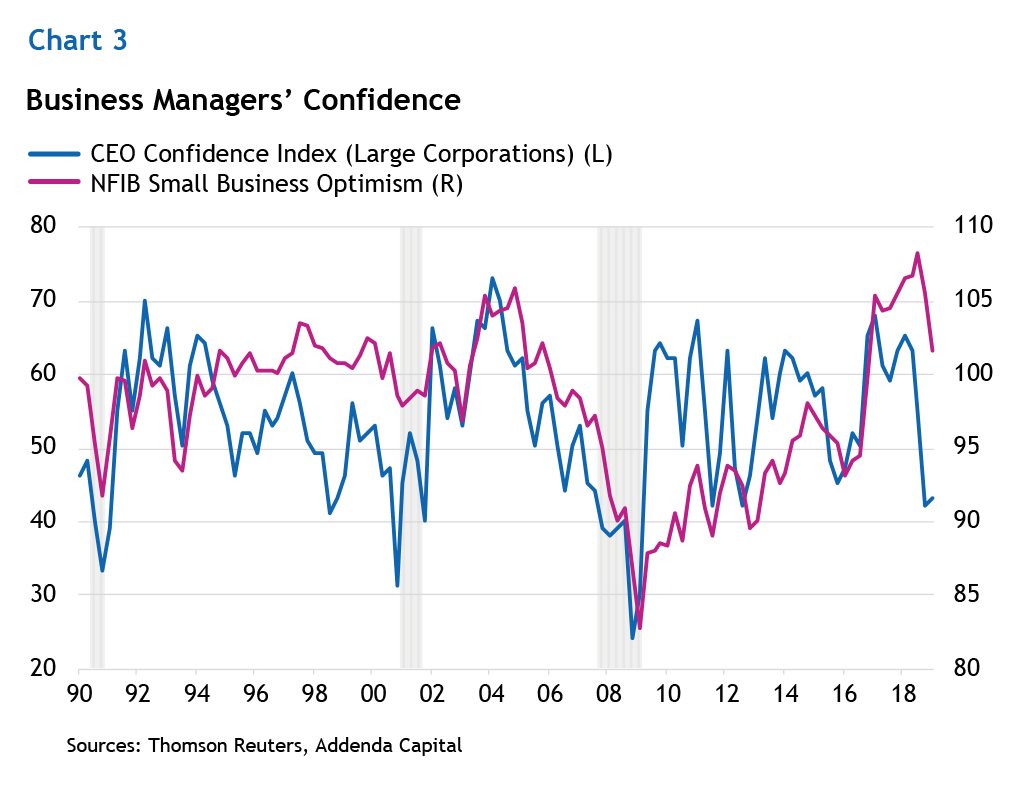

The other theme, the trade war, remains a threat. Each tantrum of President Trump resulting in the

imposition of tariffs, retaliation and frequent escalation threats has undermined business leaders’

confidence. Here, a clarification is needed. It is the confidence of large corporations’ CEOs, which is

affected. As for small and medium-size businesses, typically more focused on the domestic economy,

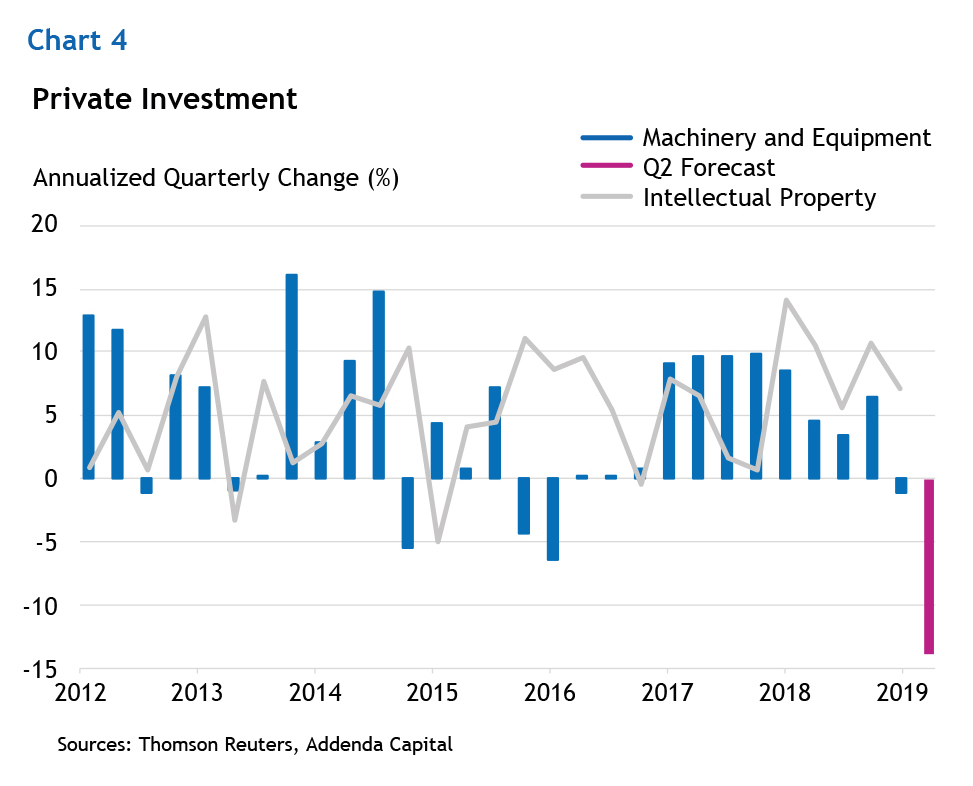

the confidence of entrepreneurs remains on balance elevated. In terms of impact on the outlook, the drop

in confidence of large enterprise CEOs explains the setback of investment in machinery and equipment

in the first quarter, which seems to be deepening in the second quarter (Chart 4). This aggregate demand

component will subtract a lot from growth in the current quarter. Having said this, the United States enjoys

a large and diversified economy in which manufacturing jobs only represents 8,2% of total employment.

The net impact for the total economy would be a temporary growth pace slowdown.

The malaise currently afflicting international trade is a self-inflicted wound resulting from the United States

administration’s protectionist actions. This malaise will only dissipate if the protagonists decide to act and

defuse the conflict. In our opinion, the drop in confidence of large corporation CEOs and in the investment

momentum have nothing to do with the current posture of monetary policy.

This situation creates a significant dilemma for the Federal Reserve. Market pressure for the Fed to reduce

rates is very strong but decreasing rates may not be an effective remedy to restore business leaders’

confidence. At this advanced stage of the business cycle, it is even possible that this wrong prescription

could lead to problems for financial stability and future inflation. However, core inflation is currently

running at 1.8%, slightly under the 2.0% target and the central bank seems to fear that inflation expectations

could move even lower. Weak inflation persists because even if wages are increasing by 3.2%, the recent

productivity surge is keeping unit labour cost growth at close to 0%, which prevents inflation from reaching

its target. If productivity gains are sustained, cyclical inflation will stay dormant and the central bank’s

dilemma will persist. If not, the feared monetary policy mistake may not turn out to be the one markets

are pricing today.