Alda PavaoSenior Portfolio Manager, Canadian Equities

On behalf of our clients, Addenda Capital recently met with four energy infrastructure companies to discuss the most material environmental and social issues that they face and their related management practices. We undertake meetings like these as part of our approach to sustainable investment.

We monitor the environmental, social and governance (ESG) practices of the entities in which we invest. For important ESG issues, we engage in a dialogue with companies to encourage them to address the issues in a manner that will help them optimize their long-term value. Our discussions with companies also help us to incorporate ESG issues into our investment analysis and decision-making at the industry and company levels.

Overview of environmental and social issues that energy infrastructure companies face

Energy infrastructure companies face a variety of environmental and social issues. Some of the most material issues include health and safety, environmental concerns like spills, air emissions or land disturbance, stakeholder relations, human capital and climate change. Table 1 below lists these issues along with examples of some of the questions we may have discussed with management.

Table 1

Key environmental and social issues

| Issue |

Description |

Sample Questions |

| Health and safety |

Health and safety incidents can lead

to operational disruptions and cause

liabilities and companies with good

safety records may find it easier

to recruit good employees. |

What safety metrics are reported to senior

management and how frequently? |

| Environmental concerns |

Companies in this sector can have a large

impact on the environment and operate

in heavily regulated industries. |

What single environmental issue is expected

to have the most material financial impact

over the next 2-3 years? |

| Stakeholder relations |

Local communities and stakeholders need

to be effectively engaged with during each

stage of an energy infrastructure project. |

How does the company measure its

relationships with the communities where

it operates and how can these results be

communicated to investors? |

| Human capital |

Human capital risk is the risk of a negative

impact on the company due to the

company’s inability to attract and retain

qualified employees or engage existing

employees. |

How successful have efforts been to engage

employees and what effect has that had

on financial or operational performance? |

| Climate change |

Companies in this sector are very likely

to face higher operating and capital costs

related to compliance with greenhouse gas

related regulations and operational issues

related to physical climate changes. |

How does the company prepare for changing

regulations in its long-term strategic

planning and capital allocation?

|

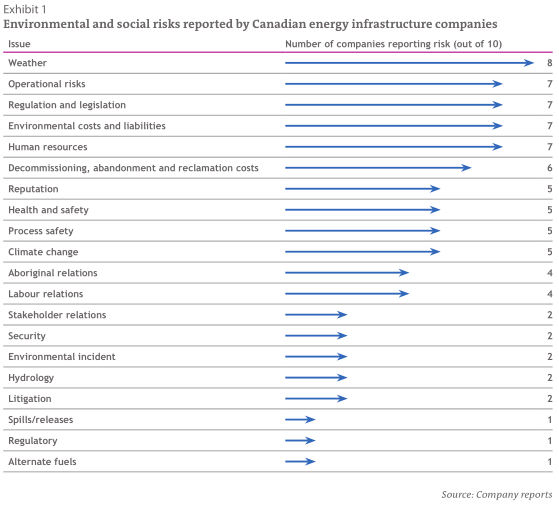

In addition to meeting with companies, we also review the reporting provided by companies to investors and other stakeholders. For example, Exhibit 1 highlights the environmental and social risks that the ten largest Canadian energy infrastructure companies include in their annual reporting.

Focus on spills, leaks and releases

A dominant issue raised in our discussions with companies were spills, leaks and releases from their hydrocarbon transportation systems.

Prevention

Most companies acknowledge that it is their goal to prevent all releases from their transportation systems. A lot of time and money is invested each year in pipeline safety on a wide variety of initiatives, including:

- Promoting a safety culture and reviewing progress

- Providing input into the design phase of projects on a variety of issues from welding practices to routes that can be fully inspected

- Reviewing risk management practices outside of the industry (for example, how does the airline industry maintain a high level of perceived safety)

- Development of new crack inspection technology

Detection

When hydrocarbons are being transported, it is essential that companies have the facilities to detect spills, leaks and releases. Some of the activities the companies undertake include:

- 24-hour monitoring of service lines through the use of remote flow, pressure and temperaturemeters in control centresRegular physical inspections

Response

In the unlikely and unfortunate event that there are spills, leaks and releases of hydrocarbons, companies must be able to respond quickly and effectively. Companies prepare for these situations by:

- Training local first responders on how to deal with various situations

- Making redundant spare parts available throughout their network

- Maintaining a detailed response plan for each facility

- Establishing shared response capabilities with other companies

- Undertaking desk and field exercises to check on the ability to execute response plans

Investment considerations

Environmental and social issues have the potential to be very costly for energy infrastructure companies. Meeting with the companies allows us to gather information that supports our analysis of these issues. This analysis can help us have a better understanding of the companies, which can in turn help us predict various potential implications for the companies ranging from higher operating costs to project delays. We will continue to monitor the environmental and social practices of the companies in which we invest. Through proxy voting and meetings with management, we will continue to engage in a dialogue with companies to encourage them to address these issues in a manner that will help them optimize their long-term value.

© Addenda Capital Inc., 2014. All rights reserved. This document may not be reproduced without Addenda Capital’s prior written consent.