Published on: October 26, 2020

There’s More to Impact Investing than Green Bonds

Green bonds, which are generally raising funds for climate change or environmental purposes, are typically issued by government and corporate issuers in Canada. In the decade since green bonds were introduced, the pace at which they’re issued has gone up, particularly from the EMEA and Asia-Pacific regions, however Canada remains a small player on the global stage. Despite green bonds’ continued growth, Canada ranked 9th in overall issuance in 2019 with minimal issues in the corporate sector1. Given that the Canadian economy relies heavily on the energy sector, it may take time to find environmentally friendly alternatives to maintain exposure, while still investing “green”. Furthermore, standards and validation processes aren’t formally set or managed by a governing body or organization, which can cause uncertainty for issuers and investors alike.2

Impact investing is about delivering compelling returns, while also helping to make the world better. The investment challenges we face for the future are often in line with many of the social challenges on which we will have to focus. By aligning with the United Nations 17 Sustainable Development Goals3, this investment philosophy and process — which we, at Addenda Capital, believe in — goes beyond green.

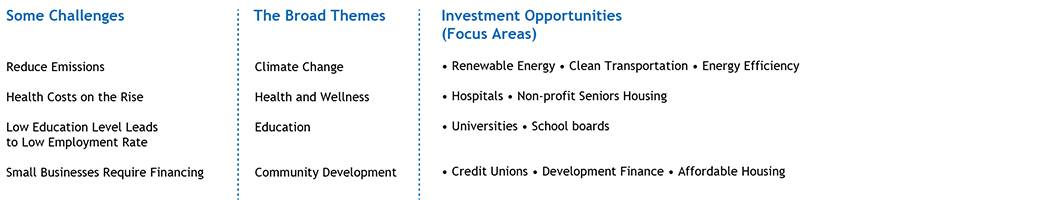

Health and wellness, education and Community development are also major themes that require attention, not just from a philanthropic standpoint, but as investment opportunities as well.

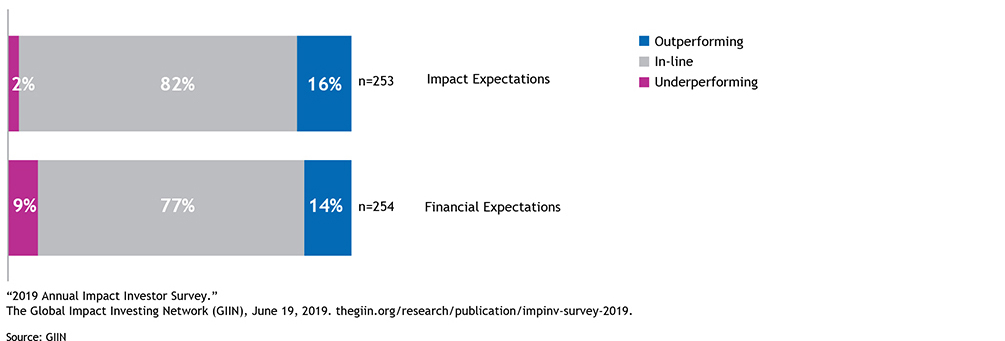

High Impact and Compelling Returns are not Mutually Exclusive

In addition to the positive environmental and social impacts, impact investing supports investors that also enjoy compelling financial returns. In a recent survey, over 90% of respondents reported performance in line with or exceeding both their impact and their financial expectations. About 15% indicated outperforming their expectations since inception.

Performance Relative to Expectations

Number of Respondents Shown at the End of Each bar; Some Respondents Chose ‘Not Sure’ and are not Included.

Profit with Purpose — The Addenda Approach

With a focus on Canadian bonds, the Addenda Impact Fixed Income Strategy can be considered a core fixed income allocation within an investor’s portfolio. By focusing on a broad universe of companies and not one singular theme, we invest our clients’ money in assets which are designed to make a greater impact here at home, irrespective of their industry. This is not only good for society but is also a sound long-term investment strategy. We invest in the public markets to ensure liquidity and private markets for broader opportunities. We practice stewardship, thus monitoring investments and being involved as investors to further influence positive change.

Addenda’s Focus Areas

Our research and portfolio management teams conduct their own independent due diligence and have proprietary ways of measuring impact, ensuring that these outcomes are intentional, sustainable and quantifiable.

Seeing Environmental and Social Challenges as Investment Opportunities

At Addenda Capital, impact investing is an important part of our approach to sustainable investing and we believe this extends beyond green bonds. We’ve followed this investment approach since 2015 and have built a team specialized in impact investing. With the support of one of the largest fixed income teams in Canada, as well as our equity teams, our depth of research and analysis in impact investing is unparalleled in the industry.

Addenda is committed to a resilient future for all by managing an impact investment portfolio designed to bring meaningful change while delivering compelling returns.

1 2019 Green Bond Market Summary

2 DBRS Commentary (May 13, 2019). Green with Envy: Canada’s Green Bond Market Is Growing into a Global Player.

3 United Nations 17 Sustainable Development Goals