Published on: September 20, 2018

Climate-related risks and uncertainties are material and climate change is likely to have an impact on investment returns across asset classes over the long term. As an asset manager, the better we understand those risks, the better we can help our clients meet their objectives.

The Climate is Changing

About 97% of climatologists agree that climate change is happening and that human activity is the most significant cause. The global average temperature has already risen more than 1°C since 1880 and warming is likely to exceed 2°C unless mitigating mesures are put in place. Cumulative emissions of carbon dioxide (CO2) and other greenhouse gasses and their concentration in the atmosphere largely determine how much the global average temperature will rise and most aspects of climate change, will persist for many centuries even after emissions are capped.

Climate Risks and Opportunities for Investors

Investors are exposed to climate change related risks through entities they invest in. Meanwhile, opportunities abound for investments that will help with a transition to a low-carbon climate-resilient economy.

Carbon Footprints

A carbon footprint is a measure of the greenhouse gas emissions of an individual, an organization, or of an investment at a particular point in time. Carbon footprints help us evaluate some elements of climate change related risk, namely policy and regulation, reputation, litigation and quality of corporate policies and performance. A portfolio carbon footprint also allows investors to understand the contribution the entities they invest in are making to the increasing concentration of CO2 in the atmosphere and to global climate change.

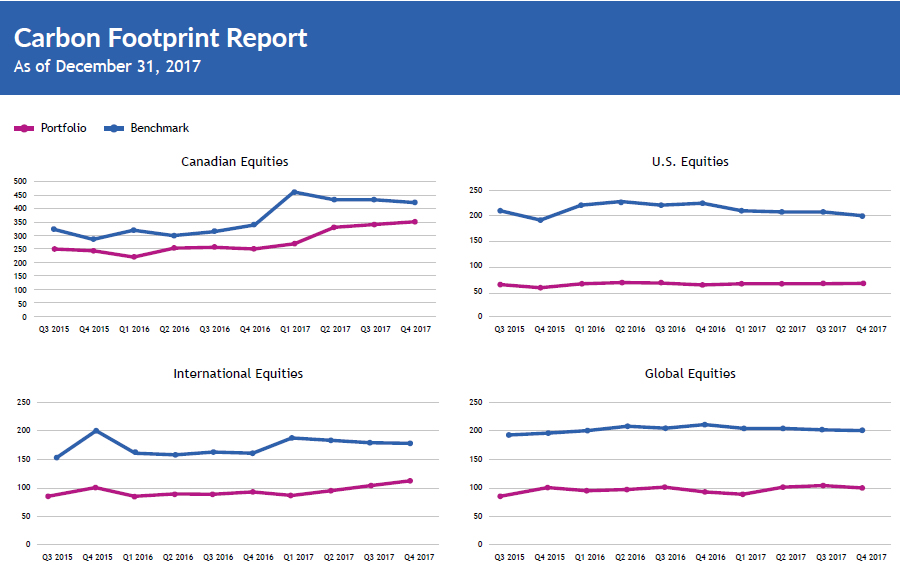

A carbon footprint helps identify which companies within a portfolio are contributing most to the footprint of the portfolio. We also compare the carbon intensities of our portfolios to the intensities of their respective benchmarks.

As Addenda Capital is a signatory to the Montréal Carbon pledge, we have committed to measure and publicly disclose, at least annually, the carbon footprint of the investment portfolios we manage. This disclosure is also consistent with one of the Task Force on Climate-related Financial Disclosures' final recommendations.

Methodology

At Addenda Capital, we calculate the carbon footprints of our pooled funds on a quarterly basis as described below.

1. Determine the greenhouse gas emissions of each company in the portfolio (unit = t CO2-eq/year)

2. Normalize each company's emissions by dividing by their revenue (unit = t CO2-eq/year/$M revenue)

3. Multiply each company's normalized emissions by the company's weight in the portfolio and add them all together (unit = t CO2-eq/year/$M revenue)

In calculating the carbon footprint of Addenda's pooled funds, we use data regarding the scope 1 (direct greenhouse gas emissions) and scope 2 (greenhouse gas emissions from acquired electricity, steam, heat and cooling). Scope 3 emissions (other indirect emissions) are not included in the calculation.

For companies that do not disclose their carbon emissions, an estimate is used. The estimate is based on the emissions of industry peers with adjustments for size of the company. Addenda is involved in several initiatives (e.g. CDP and dialogues with the Canadian Securities Administrators) that aim to improve the quality and quantity of greenhouse gas emissions data disclosed by companies.