Published on: May 4, 2022

Ian McKinnon, Executive Vice-President, Core Fixed Income and Chair of the Asset Mix Committee

In collaboration with François Desjardins, Editor

We recently wrote about how Addenda Capital assesses risk with clients, a diligent process whose outcome provides us with the insight needed to help our clients achieve their financial objectives. In this article, we offer a bird’s eye view of how we design our asset allocation model to manage the aggregate portfolio risk level.

Before digging into the different steps leading to the model design, let us first present an outline of its current rendition. At the end of the first quarter of 2022, our asset allocation model, which may be adjusted to meet specific requirements and goals of clients, was the following:

- Our target for total fixed income was at 40%, which includes 36% in Canadian fixed income (underweight) and 4% in cash (overweight).

- Our target for total equity was at 60%, which includes 36% in Canadian equities (overweight), 12.0% in U.S. (underweight), and 12.0% in International (underweight).

A Systematic Approach

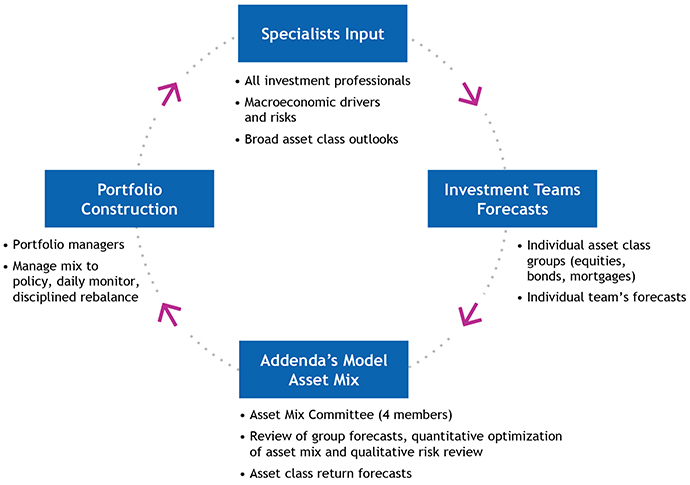

Disciplined and collaborative, our asset allocation strategy is based on our quarterly forecast meeting process, which comprises four steps involving investment teams specialized in fixed income, equities, mortgages, as well as our team of economic experts.

The process begins with specialist presentations, as shown in the illustration below. Held on a quarterly basis, these cover such areas as economics, commodities, oil and energy, developments in equity markets, interest rates, preferred shares, bonds, and market and technical indicators. These presentations are sought after as they offer a comprehensive understanding of crucial areas and allow cross-pollination of ideas and expertise among professionals.

Following these quarterly briefings, our investment teams (Canadian and global equities, fixed income and commercial mortgages) review the information and evaluate how to integrate these insights into their own process. We believe this phase is crucial as teams can build a shared perspective, which helps develop outlooks and allocate portfolio risk specific to their asset class.

Generating a Forward-Looking Narrative

This stage is where the Asset Mix Committee comes into play. The Committee’s role involves collating the various outlooks produced by the investment teams and pulling all relevant information and risks into a cohesive, single story. Such an exercise also includes incorporating certain team ideas and inputs that may enhance the Committee’s assessment of specific situations.

The Asset Mix Committee uses a principal component analysis approach. In a nutshell, this involves looking at drivers of market returns to ultimately forecast our expected returns for different asset classes. This forward-looking narrative is what allows Addenda to design its asset mix model, which for instance might include decisions such as overweighing or underweighting asset classes in reaction to factors ranging from market trends to economic developments.

While our approach to asset allocation is strategic, the Committee may adopt a tactical stance when opportunities arise. A perfect example is the turmoil that engulfed markets in March 2020, leading to a series of ad hoc meetings to keep abreast of a quickly changing landscape. Once markets seemed to have found a bottom, the Committee reallocated some risk, namely into equities and preferred shares. Lately, given uncertainty due to the war in Ukraine and the central banks’ approach to fighting inflation, we felt it was best to raise our cash position and look for tactical opportunities. Market selloffs, for instance, may provide such opportunities should they meet our investment criteria.

Adjusting for Client Needs

The final step of our process pertains to portfolio construction, which is carried out by portfolio managers according to investment policies, clients’ requirements and valuations while keeping in mind the overall asset mix model and its underlying assumptions. Managers monitor markets on an ongoing basis, relancing portfolios as needed in a disciplined manner.

In conclusion, our process which is both rigorous and agile, built on systematic assessments involving multiple teams of professionals. Addenda Capital seeks to focus on the longer term. This is the guiding light in our approach as we seek to help our clients achieve their financial objectives. To learn more, please contact our Business Development and Client Partnerships team: https://addendacapital.com/contact-us.