Published on: October 18, 2021

Yanick Desnoyers, Vice-President and Senior Economist

In collaboration with François Desjardins, Editor

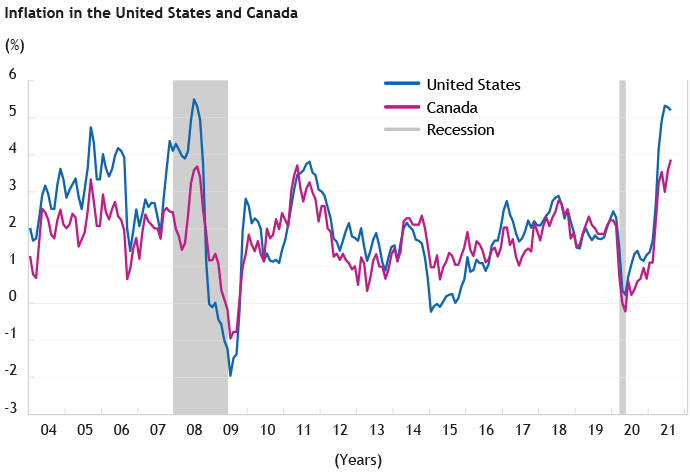

Changes in the inflation rate play a prime role in how financial markets assess the United States Federal Reserve’s monetary policy. In Canada, inflation even made an appearance in the recent federal election campaign.

While every week brings its share of economic indicators capable of shaping the way that monetary policymakers and markets build their analysis, Addenda Capital felt it worthwhile to pause on a freeze-frame and reflect on fundamental aspects of the situation to offer some perspective.

Q: How big of a threat is inflation at this moment?

A: It is a serious threat. It can’t be taken lightly because an upward change in inflation isn’t systematically followed by a decrease.

Inflation is dependent on the evolution of the economy and on the amount of monetary stimulus that is applied by the Federal Reserve of the United States. What we are witnessing at the present time is extreme monetary stimulus combined with a supply shock in the economy. In other words, the supply side is congested, for all sorts of reasons: the pandemic, direct financial support to citizens which is a disincentive to work, a new wave of COVID in Asia that is disrupting global supply chains, the cost of transporting goods, labour shortages due to an aging population in developed countries, etc.

The result is that prices have increased and that we are dealing with a rise of inflation in the short term. And according to our simulations, inflation should be less transitory than what the Fed is claiming.

Sources: Refinitiv, Addenda Capital

Q: How can the Fed bring down inflation?

A: The way to succeed is by putting the brakes on wage increases, which is achieved through an increase in the unemployment rate. However, in an economic cycle, the unemployment rate rises only during a recession. So there’s a problem.

How will the Fed find its way out? By increasing its interest rates to bring back economic growth just below the potential GDP growth rate while avoiding growth so weak that it might then result in a recession. As such, engineer a soft landing of the economy. It is a perilous exercise. And what’s more, the Canadian economic cycle is dependent on the cycle in the United States. A misguided monetary policy south of the border can bring about a recession in Canada.

Let’s keep in mind the current backdrop. With monetary and budgetary stimuli provided by central banks and governments, the growth in GDP is way above its long-term growth, also known as potential GDP. This has not only brought down the rate of unemployment, but at a much faster pace than during the previous economic rebounds. This will continue.

However, there is a lack of workforce. In the United Kingdom, in Canada, in the United States, the balance between supply and demand in the labour market isn’t there. We are seeing a situation where GDP growth is going to be strong, but in a world where labour supply isn’t able to keep up.

Q: What should we bear in mind when assessing this trend?

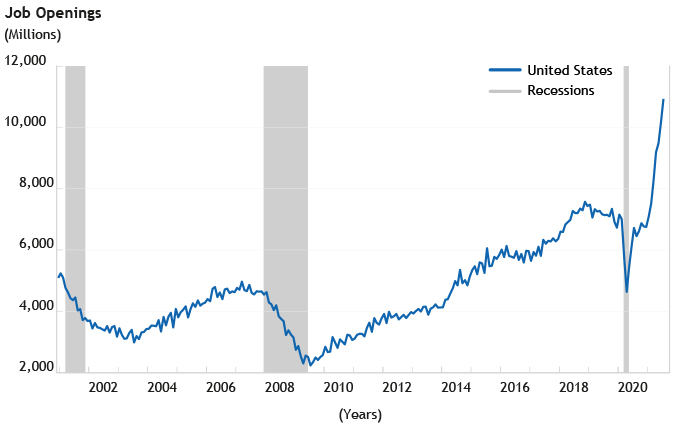

A: When the rate of unemployment hits a low point next year, what sort of wage growth will we be witnessing? In a situation, in fact, where there are going to be many available jobs and a record labour shortage? In this scenario, we can expect that the rates of wage growth will be stronger than usual. Fluctuations in the dollar, import prices, prices associated with oil… These factors have temporary effects on inflation. But wage increases have permanent impacts.

Those who say that the rate of inflation will come back down are concluding, implicitly, that there will be no wage growth. We do not share that view. Eleven million job openings in the United States is without precedent, as are the 800,000 in Canada and 1 million in the United Kingdom.

Sources: Refinitiv, Addenda Capital

At the end of the day, central banks are very good when it comes to getting us out of recessions, but the scorecard is not as stellar when it comes to preventing recessions. Recessions are a passageway to foster the return of an economic balance. The Fed is creating one of the largest imbalances in the history of the labour market, an imbalance which will be compounded by structural phenomena in the ageing of the population.

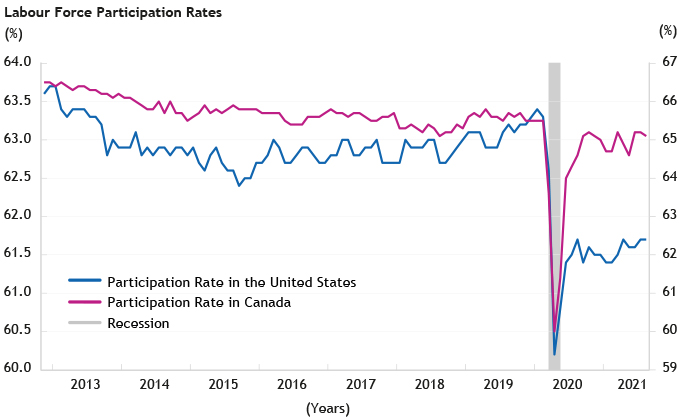

Q: What can be said of the situation in Canada?

A: It is a bit less concerning, because people have come back to the labour market in greater numbers than in the United States. The participation rate in Canada is higher than it is in the United States. For this reason, we are witnessing stronger wage growth in the United States than here.

Sources: Refinitiv, Addenda Capital

Q: What has changed since the beginning of 2021?

A: People didn’t think that there would be so few workers coming back to the labour market. Governments offered financial support to households, and the savings rate is high. Therefore, there is available money to be spent. But we have seen a new wave of COVID, which is disrupting the supply side. And the pandemic is not only causing problems in the United Stated, but in Asia as well.

To recap, there have been three shocks since the beginning of 2021. First, demand is surprisingly strong. Second, the response on the supply side has been weak because of a shortage of workers. And lastly, observed inflation has risen very strongly.

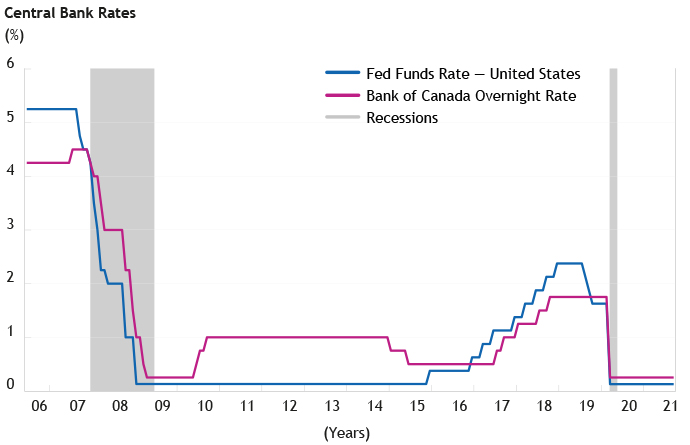

Q: How many rate increases will it take for the inflation rate to be brought down?

A: That is a big question. The relationship between the Fed Funds Rate and inflation isn’t so clear. An important change occurred in 2020. The Fed essentially said that instead of hiking rates before seeing a rise in inflation, it would wait for inflation to rise before changing its rates. This is also known as a change in the reaction function.

In the absence of a recession, job creation has been very persistent. Even if the Fed raised its rate several times — for a total of 100 or, let’s say, 150 basis points — the unemployment rate would not increase. That has never happened in past cycles. The jobless rate would continue its downward trend. The only thing that pushes the unemployment rate upward is a recession. If the inflation rate refused to budge, what would the Fed have to do after having allowed such massive stimulus? In other words, if a central bank takes the wrong approach by overstimulating growth, it is forced to be more aggressive afterward when it’s time to tighten monetary policy.

Sources: Refinitiv, Addenda Capital