Published on: August 29, 2019

Author: Adelina Romanelli, CFA, Specialist, Product Management

Investors worldwide are looking to build resilient portfolios. Some are looking to protect their fixed income exposure to rising rates while maintaining a total portfolio that offers greater resilience to drastic market movements. Could preferred shares provide unique longer-term benefits to this conundrum?

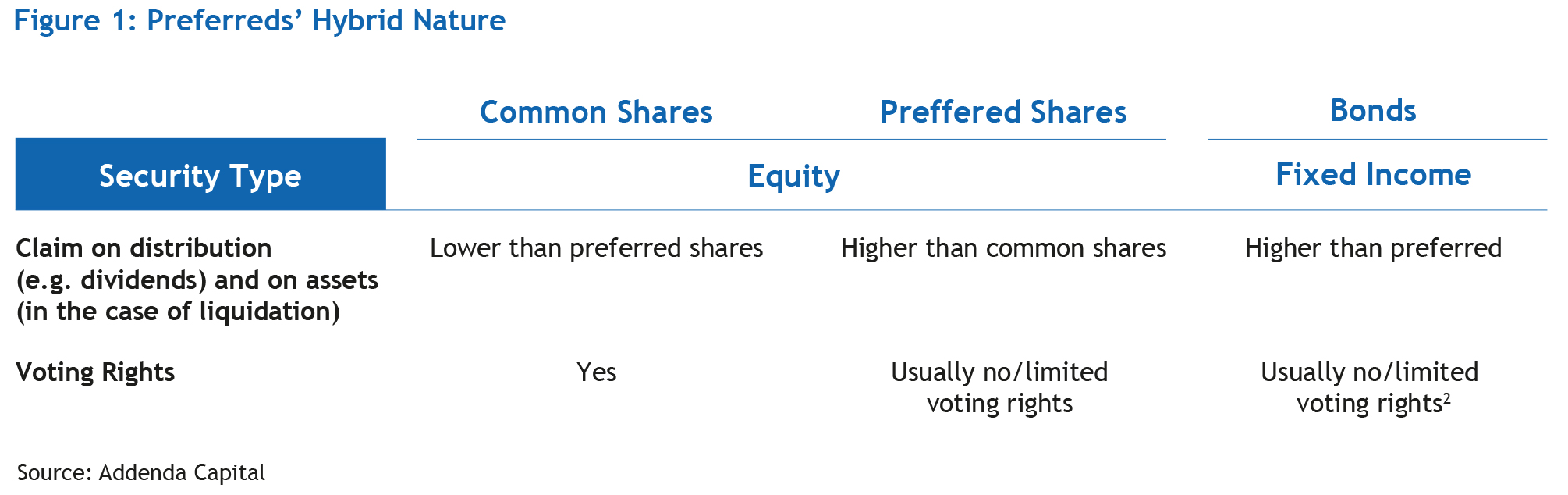

Preferred shares (also called “Preferred stock” or “Preferreds”) are dividend-paying equity securities. They are issued at a fixed par value which represents ownership in an issuing company1. Preferreds rank ahead of common shares in the corporate structure, and behind bonds. Generally, they do not carry voting rights.

Broadly speaking, companies issue preferred shares to avoid diluting voting rights and rising debt levels. Preferreds also offer companies flexibility, both in determining the terms of the issue and in deferring dividend payments if needed.

In short, Preferreds are considered hybrid securities due to their combined debt and equity attributes. They have distinct features that translate into potentially interesting longer-term investment opportunities.

At Addenda, investment teams favour an actively-managed portfolio of selective Preferreds over a passive approach. In addition, they believe Preferreds can add value over time. However, in order to fully appreciate Preferreds’ potential, one must understand their particularities and features.

Improving Diversification and Portfolio Efficiency

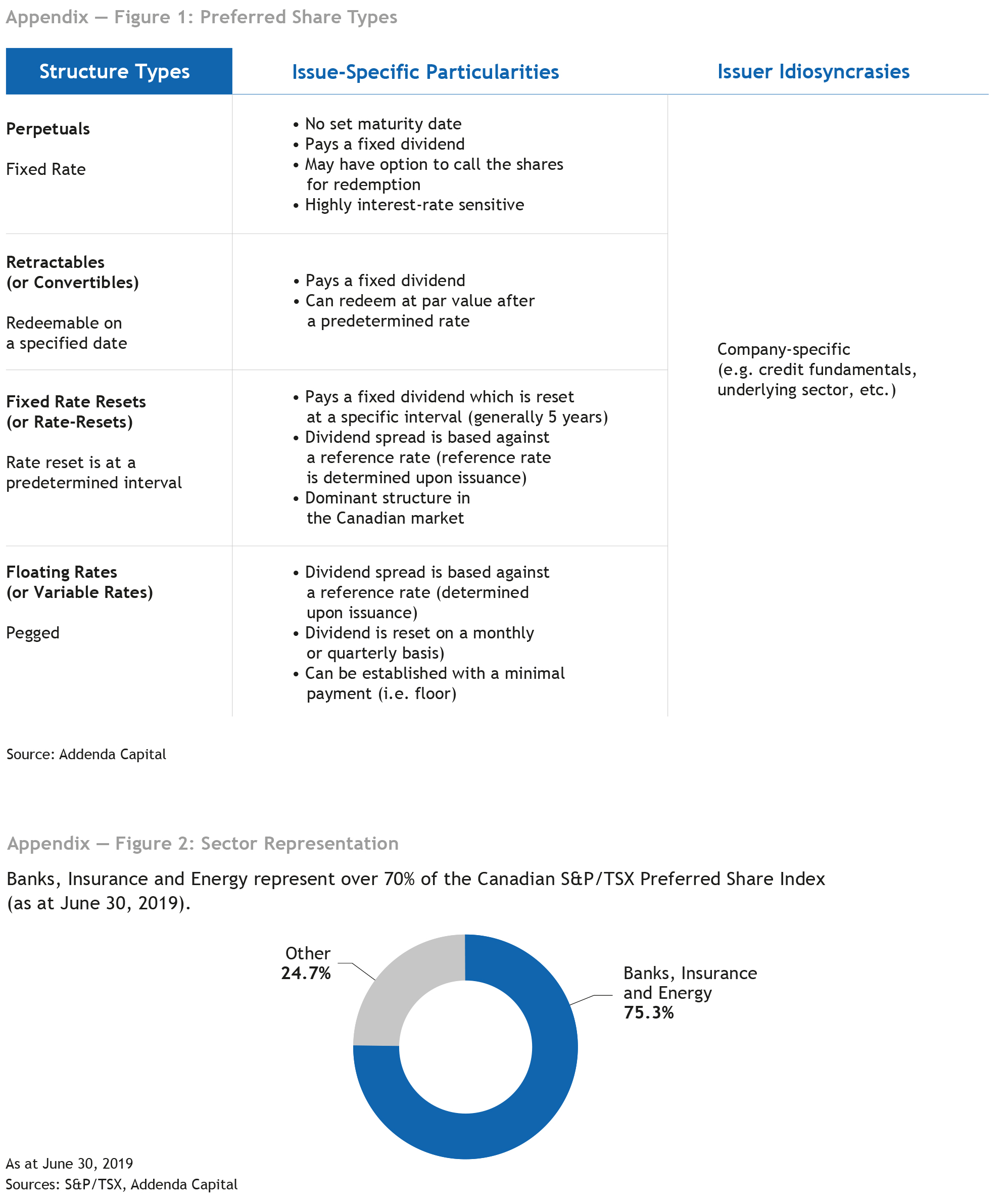

There are essentially four types of preferred shares defined by their structure type:

1. Perpetuals

2. Convertibles

3. Floating rate

4. Rate-resets

Structure types, issue-specific particularities and issuer idiosyncrasies influence each preferred share’s sensitivity to interest rate expectations, credit changes and market movements3.

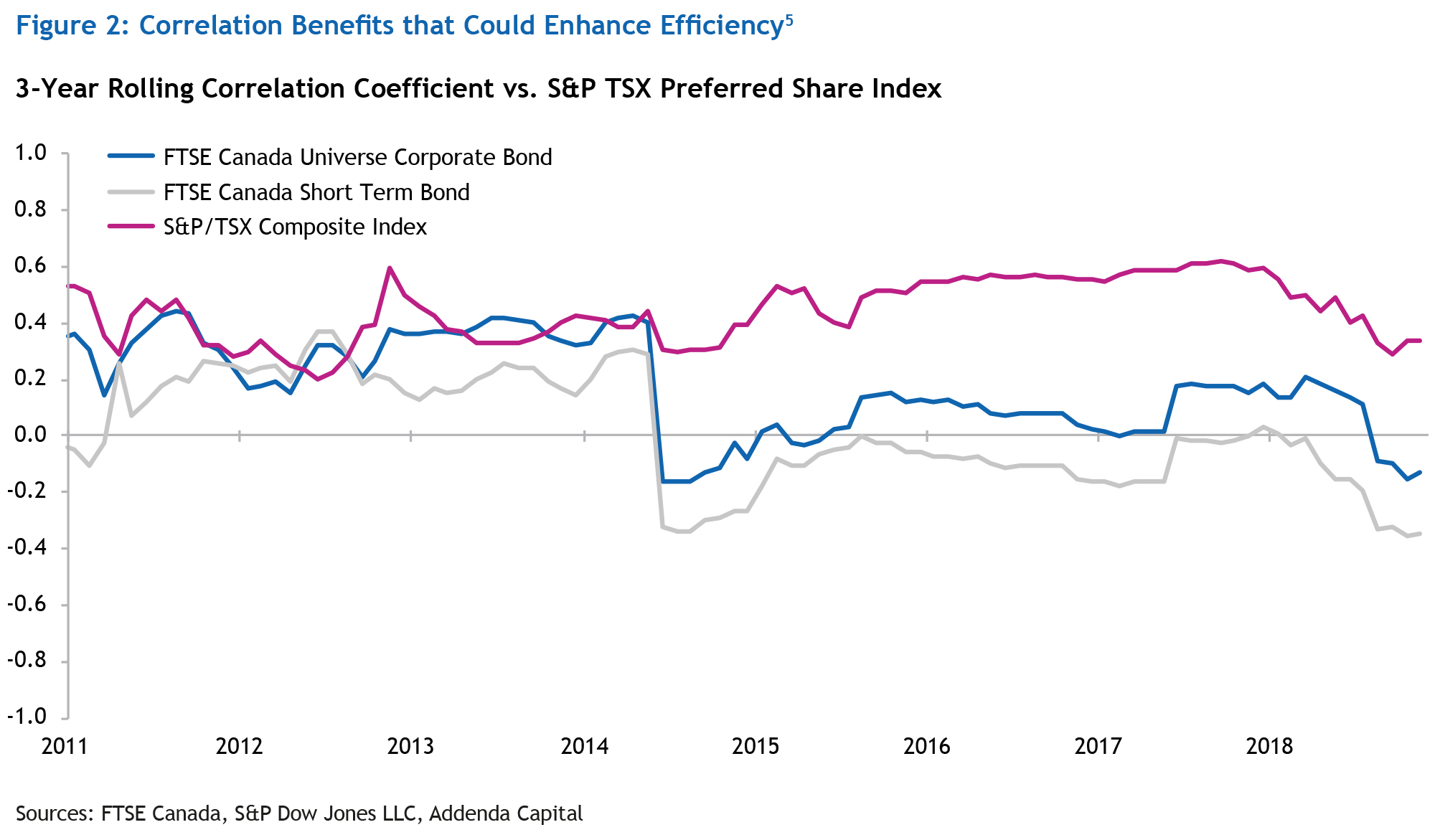

Preferreds’ hybrid nature and unique characteristics have led to low correlation of returns compared with traditional bonds’ (see figure 2 ? a perfect positive correlation lies at 1). In addition, preferred shares have a relatively low correlation with Canadian equities4. Looking forward, we believe Preferreds will continue to behave reasonably differently over time, thus making Preferreds more likely to continue enhancing a total portfolio’s efficiency.

Potential Shield From Rising Rates

The uncertainty surrounding the magnitude and the timing of interest rate increases as well as inflationary pressures could have an impact on some financial assets at varying degrees. Such uncertainty has certain investors looking into positioning their portfolios for greater resilience to possible market shocks and/or rising rates. Although Preferreds are not expected to protect against market shocks, not all Preferreds react negatively to rising rates.

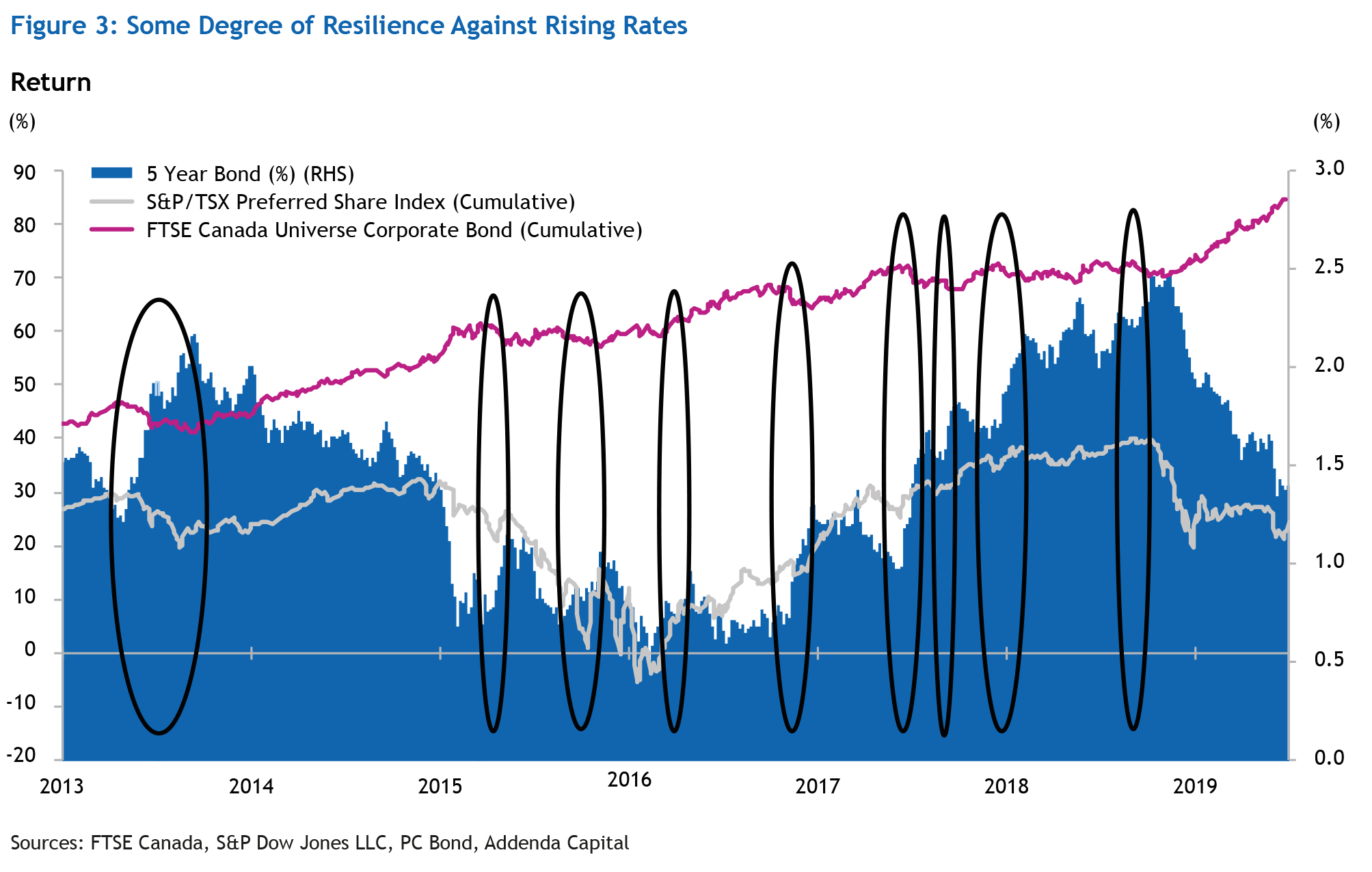

The chart below plots the evolution of the S&P/TSX Preferred Share Index (“Index”) and the FTSE Canada Universe Corporate Bond Index against the 5-year Canada bond yield6. Periods subject to notable sustained yield increases are circled in black for illustrative purposes.

Whereby bond indices react negatively to rising interest rates, Preferreds have mostly appreciated in value or remained stable, due to various factors7. In a nutshell, certain preferred share types (e.g. perpetuals) are more sensitive to rate changes. This is offset by the others’ lower sensitivity (e.g. fixed rate resets)8. By extension, positioning the portfolio defensively (against rising rates) and according to views on the trajectory of interest rates and market conditions, can reduce a portfolio’s sensitivity to rising interest rates relative to traditional bonds.

Higher Yields Compensate for Greater Risk

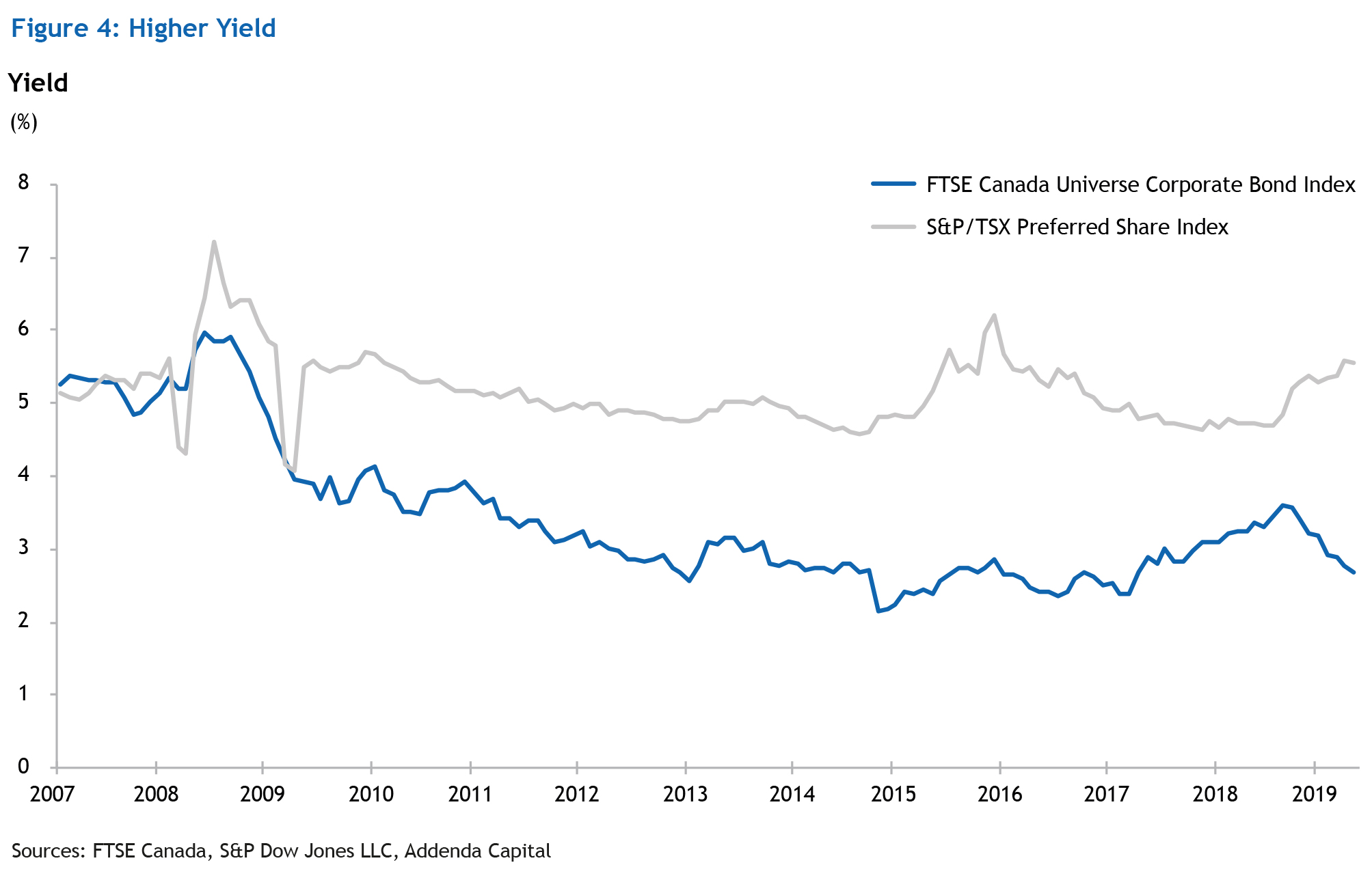

Broadly speaking, Preferreds are priced at a higher dividend yield to account for a liquidity premium, subordination risk and limited participation in the issuing company’s residual gains (when compared to equities)9. Consequently, Preferreds are expected to have a higher dividend yield compared to corporate bonds (see figure 4 on page 4).

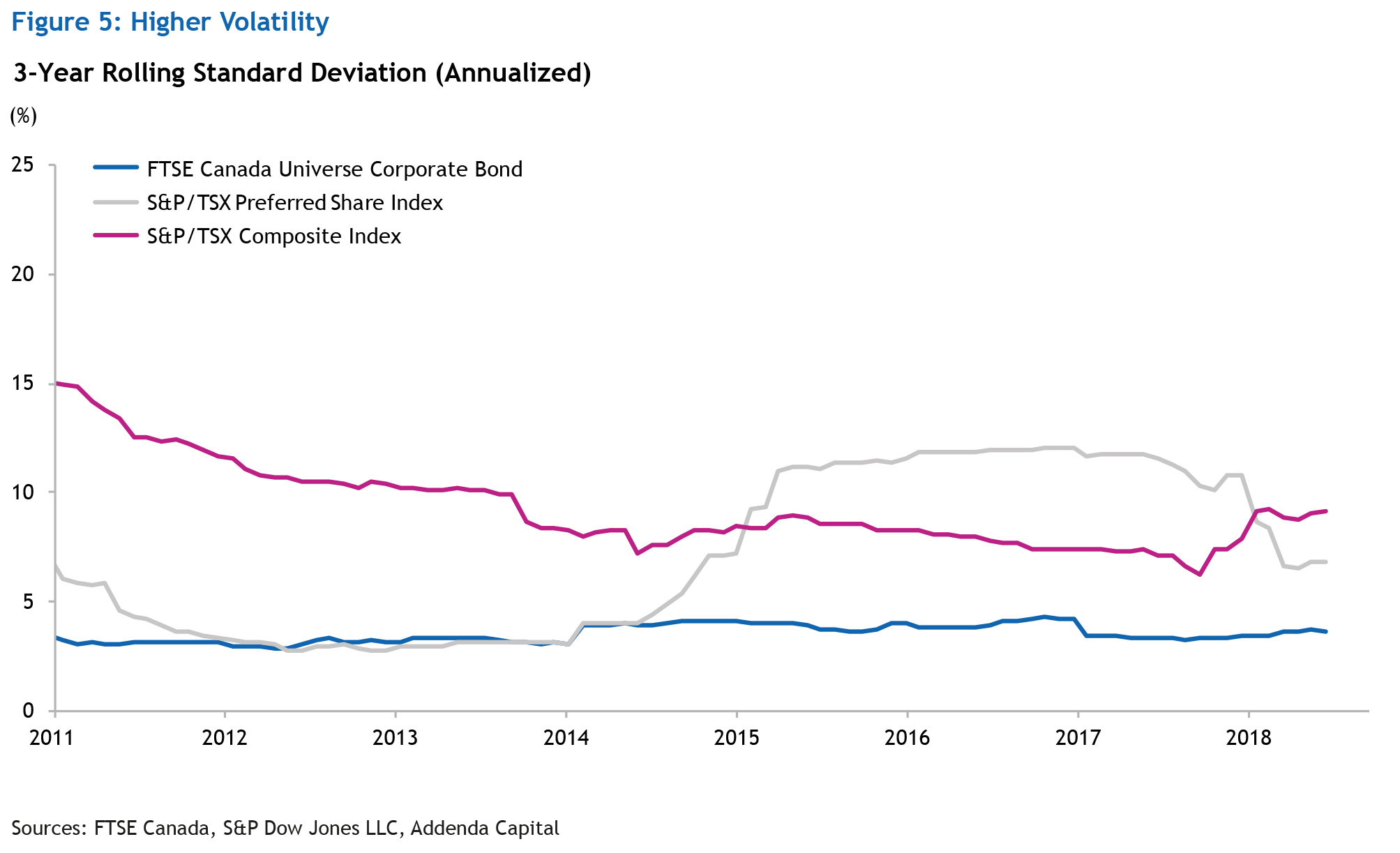

Preferred shares are generally more volatile than corporate bonds ? but less than equities (see figure 5 on page 4)10. In addition, market distortions and periods of heightened volatility are more frequent in the Preferreds’ market than in more traditional bond markets ? allowing investors more frequent potential trading opportunities.

-----

1 Preferred shares pay a dividend in the form of fixed payments whereas bonds pay interest. From a tax perspective, dividends can be a more tax efficient source of income. The terms of the dividends are set upon issuance. Preferred share dividends do not represent a mandatory obligation of the issuer. However, common equity dividends can only be paid once preferred share dividends are distributed.

2 Bondholder rights as stated in the bond indenture (and not in corporate policy)

3 The preferred type refers to the structure (e.g. perpetuals, fixed rate, etc.). Issue-specific particularities refer to specific features or terms embedded in each preferred share issuance (i.e. payment terms such as callability terms, reference rates, etc.). Issuer idiosyncrasies refers to specifics regarding the company of issuance (e.g. credit fundamentals, underlying sector, etc.).

4 The entrance of fixed rate resets in 2008 contributed to lowering the preferred share index’s sensitivity to rising rates, thereby enhancing diversification benefits relative to bonds. The Canadian preferred share market is currently dominated by rate-resets. Floating rates carry less interest rate risk but represent a small portfolio of the Canadian preferred share market. Moreover, as credit instruments, preferred share prices can be influenced by changes in credit risk.

5 Correlation coefficient is based on monthly, Canadian dollar performance data beginning May 2008 and ending June 2019. The significant drop in correlation that took place the beginning of 2015 is due to the preferred share market’s reaction to a surprise rate cut.

6 Daily total returns.

7 Barring other factors, bonds will react negatively to rising rates.

8 The rate reset feature associated with fixed rate resets, the dominant segment in the Canadian preferred share market, allow them to better capture increases in interest rates.

9 The preferred share market is a fraction of the broad Canadian Bond market. Moreover, despite being traded on an exchange, Preferreds are subject to a considerably lower number of market participants and lower trading volume.

10 The dividend yield on preferred shares was sourced by the S&P Dow Jones Indices. For quarter periods 2016-08 and prior, the yield is based on last dividend and annualized. An assumption was made that the issue would pay the stated dividend/distribution. As for 2016-09 and forward, the yield is based on the trailing 12-month dividend. All computations are relative to dividend prices. The bond yield is based on the yield to maturity. All computations are based on monthly data. The standard deviation is measured from May 2008 to June 2019.