The impact of climate change is not limited to the weather but increasingly exerts influence on the economy and financial markets. In a speech today by Deputy Governor Tim Lane, the Bank of Canada joined into the fray of central banks and regulatory bodies in other countries mindful of the disruptions climate change might have on the financial system. In this Flash Report, we will take a quick look at how climate change considerations could be integrated in the federal financial institutions regulatory framework.

The Federal Financial System Oversight Structure in Canada

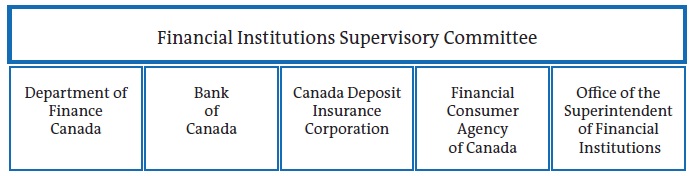

In Canada, the regulatory framework for financial institutions is more decentralized than in other countries. Indeed, there are many agencies overseeing financial institutions at the federal level in conjunction with the Department of Finance, and still many more at the provincial level.

For instance, the Office of the Superintendent of Financial Institutions (OSFI) is the main regulatory agency at the federal level and oversees banks, credit unions, pension plans and insurance companies. It “reports to Parliament through the Minister of Finance1”.

Also playing a role in the oversight framework are the Canada Deposit Insurance Corporation2, who oversees the deposit insurance program at federally-chartered deposittaking institutions, and the Financial Consumer Agency of Canada3 who makes sure, among other responsibilities, that financial institutions comply with consumer protection measures.

As for the Bank of Canada, its principal role is “to promote the economic and financial welfare of Canada,” as defined in the Bank of Canada Act4.

All of these institutions meet at least quarterly as members of the Financial Institutions Supervisory Committee to discuss issues that relate to the supervision of federally regulated financial institutions5.

A Summary of the Regularoty Framework

Insightful research: the key to our expertise

The Bank of Canada’s Focus on Climate Change-Related Risks

In his speech today entitled “Thermometer Rising – Climate Change and Canada’s Economic Future6”, Deputy Governor Lane stressed that if the issues of climate change weren’t addressed, the economic consequences would be dire. He also discussed how economics could contribute to a solution, highlighting carbon pricing and green finance. He acknowledged that the outline of the country’s strategy toward climate change, which includes these elements, could make it easier for the Bank to achieve its objectives.

Even though the Bank is not responsible for regulating financial institutions in Canada, it still carries a significant and credible voice within Canada’s financial institutions regulatory framework where it can influence how climate change risk is accounted for.

Other Financial Market Developments Related to Climate Change

Today’s announcement by the Bank of Canada joins a number of climate change-related financial market developments in Canada in recent years. Just last week, the Province of Québec issued its first green bond with the proceeds earmarked for low-carbon public transportation. Québec’s green bond followed in the footsteps of the last of three issues under the Province of Ontario’s green bond program. At the federal level, the Prime Minister’s Mandate Letter to the Minister of Infrastructure and Communities7 indicates that the Minister should prepare to launch a Canadian Green Bond in the context of working with the Minister of Finance to establish the Canada Infrastructure Bank.

Internationally, the list of central banks and regulatory bodies showing concern regarding the disruptions climate change can have on the financial system is growing. The Bank of England’s leadership on this issue has been widely reported and they have been steadily contributing to the body of knowledge since Mark Carney gave his seminal speech to Lloyd’s of London in 20158. Another central bank to advance the topic is the Dutch central bank (De Nederlandsche Bank – DNB) with their issue of a study on the transition to a carbon-neutral economy along with some related policy recommendations9. In terms of regulatory bodies, just a few weeks ago the Australian Prudential Regulation Authority (akin to Canada’s OSFI) published a speech regarding the possible impacts of climate change and stated “climate risks will become an important and explicit part of our thinking10”.

More recently, the Financial Stability Board’s Task Force on Climate-related Disclosures, chaired by Michael Bloomberg, released draft recommendations to improve disclosure of climate change-related risk.

Looking Ahead

Canada’s current financial institutions regulatory framework has proved its mettle throughout the years, particularly during the financial crisis by being able to withstand systemic financial risk. It now needs to adapt its supervisory process to make sure that the extra-financial risk brought about by climate change and other environmental considerations also be kept in check to preserve the country’s financial system stability.

The issues raised in today’s speech by the Bank of Canada could lead to the formal integration of climate change risks within Canada’s regulatory framework to ensure financial institutions and investors can make informed decisions and keep the country’s financial system sound.

1http://www.osfi-bsif.gc.ca/Eng/osfi-bsif/Pages/default.aspx

2http://www.cdic.ca/

3http://www.fcac-acfc.gc.ca/

4http://laws-lois.justice.gc.ca/eng/acts/B-2/page-1.html

5http://www.osfi-bsif.gc.ca/eng/osfi-bsif/Pages/default.aspx

6http://www.bankofcanada.ca/?_ga=1.185046957.567871208.1435864811

7http://pm.gc.ca/eng/minister-infrastructure-and-communities-mandate-letter

8http://www.bankofengland.co.uk/publications/Pages/speeches/2015/844.aspx

9https://www.dnb.nl/en/news/news-and-archive/dnbulletin-2016/dnb338533.jsp#

10http://www.apra.gov.au/Speeches/Pages/Australias-new-horizon.aspx