Published on: September 22, 2021

| |

Enhancing Investments' Long-Term Value Through Voting and Engagement |

Addenda Capital is committed to active investment management and so effectively monitors investee entities, including their ESG (environmental, social, governance) practices. This oversight allows us to actively protect and enhance the long-term interests of shareholders and other stakeholders through stewardship activities that fall under two categories: proxy voting and corporate engagement. Please consult our Proxy Voting Policy and our Stewardship Policy for further details. |

Regulatory Changes Affecting

Proxy Voting or Stewardship

Beyond proxy voting and corporate engagement, we also try to help support the development of policy, regulation and standard setting to better enable our stewardship activities. Our contributions are also intended to help raise market-wide standards which in turn should promote the long-term performance and sustainable success of the companies we invest in. Below are a few examples of activities we undertook in 2020 that relate to proxy voting.

Recommendations Submitted to the Ontario Capital Markets Modernization Taskforce

The Sustainable Investing (SI) team, with institutional investor peers, met with the Ontario Capital Markets Modernization Taskforce several times in 2020 to discuss ESG-related requirements we would like to see in the market. We presented our ideas to the Taskforce and collaborated with a group of institutional investors to develop input on the ESG-related recommendations and questions posed in their consultation document.

The Taskforce issued its final recommendations for market reforms in January 2021. Three of the recommendations addressed key ESG issues:

- Board diversity: The Taskforce recommended expanding required disclosure and target setting for Board and executive diversity to cover women and Black, Indigenous and people of colour (BIPOC).

- Executive compensation: It recommended requiring an annual shareholder advisory vote on executive compensation at public companies, a practice we look for from investee companies.

- ESG disclosure: It recommended that disclosure in line with the Taskforce on Climate Related Financial Disclosures (TCFD) be required for TSX listed companies. This aligns with our recent outreach to the TSX and was a key priority in our meeting with the Taskforce.

The Final recommendations are expected to guide the OSC workplan for the next few years, and reforms to Securities law, regulations, and self-regulatory organizations (SROs).

Comments on U.S. Securities and Exchange Commission (SEC) Proxy Voting Rule Changes

Addenda provided comments to the SEC in response to a consultation regarding two proposed rule changes that would impact Addenda and its clients.

The first was a proposed change to the rights of U.S. company shareholders that would significantly increase the ownership thresholds necessary to file a shareholder proposal and the support thresholds required for resubmission of a ballot item in subsequent years.

The second was proposed amendments to rules for proxy voting advisors that would require proxy advisory firms, like ISS and Glass Lewis, to allow companies to review and comment on their advice on votes before they are provided to their shareholder clients.

The SEC received thousands of submissions from investors around the world. Both changes were ultimately adopted by the SEC in 2020, but are subject of litigation and under review by the Biden administration.

Our submission identified how the existing processes have strengthened capital markets and improved corporate practices on environmental, social and governance (ESG) matters. It also highlighted how the proposed changes identified above would negatively impact market participants, particularly shareholders.

|

Voting

A Key Component of Sustainable Stewardship

The right to vote at annual and special meetings is one of a shareholder's most important rights and responsibilities. By voting at shareholder meetings, Addenda aims to affect governance, communicate preferences, and signal confidence or lack of confidence in a company's management and oversight.

Evidence shows that companies that have good corporate governance are likely to sustainably generate more long-term value for their shareholders and other stakeholders.

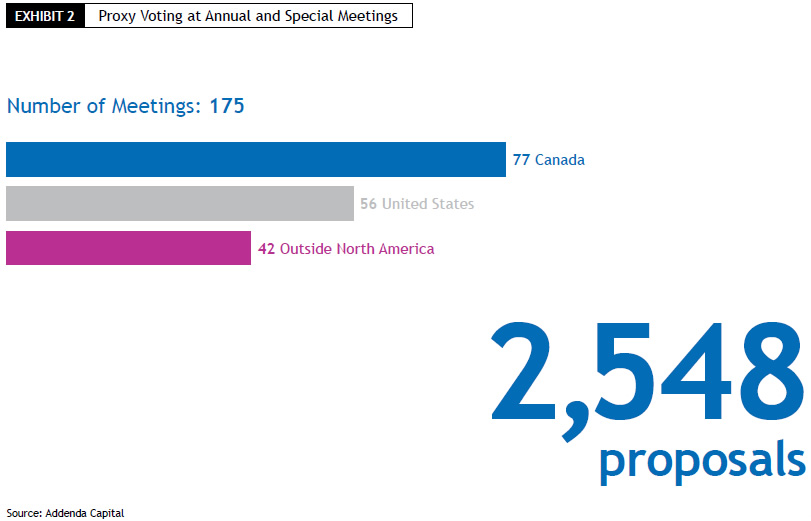

The majority of annual meetings take place during the first half of the calendar year. For example, between July 1, 2019 and June 30, 2020, Addenda voted at 175 meetings and of these over 87% took place between January and June.

|

|

|

|

|

Proxy Voting: Our Process

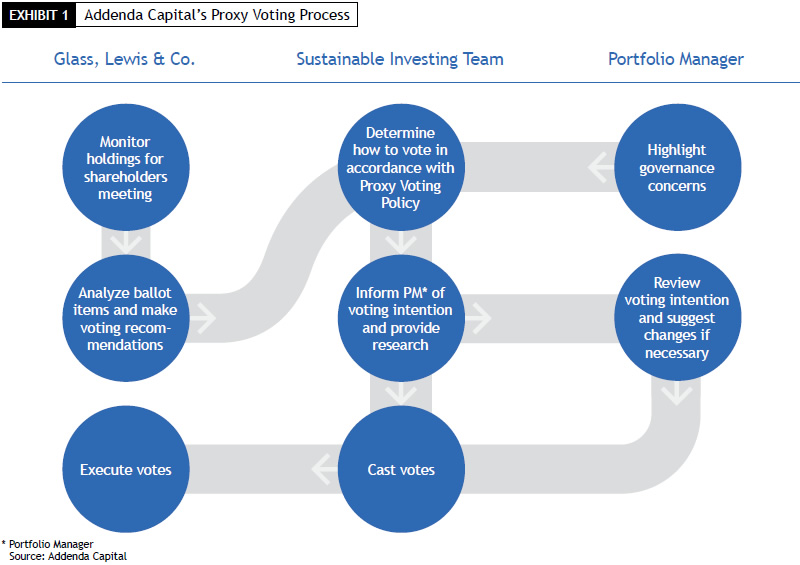

Addenda usually votes "by proxy" by instructing a service provider to vote our clients' shares in accordance with our instructions which are based on our Proxy Voting Policy. We will, if necessary, attend a meeting to vote in person.

All year long, we monitor the environmental, social and governance ("ESG") practices of the entitles in which we invest. During voting season, we enlist the help of Glass, Lewis, & Co., an independent investment research firm that provides global proxy advisory and voting services.

We consider each ballot item and determine how to vote in a manner consistent with our Proxy Voting Policy according to the process outlined in Exhibit 1 (see below).

|

|

|

Highlights From

the 2020 Voting Season

During the 12 months ending June 30, 2020, Addenda voted at 175 meetings. 77 of those meetings were held in Canada, 56 in United States (76% in North America), and 42 outside North America (Exhibit 2).

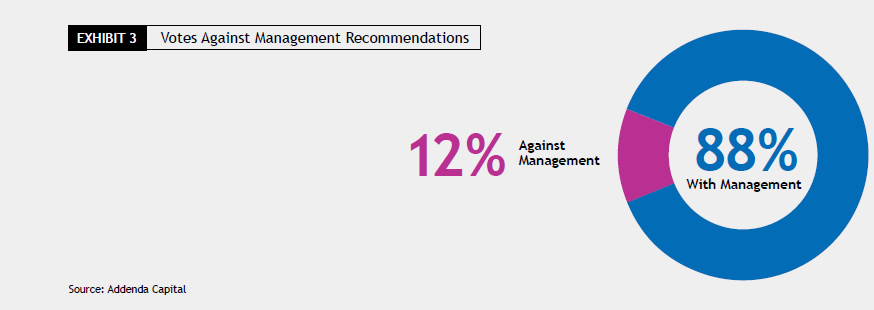

In total, we were presented with 2548 proposals. We voted against management or board recommendations on 12% of all ballot items, (see Exhibit 3). Voting against management recommendations is not in itself an effective measure of our voting process. It does, however, highlight our willingness to vote in the best interest of our clients and our ability to effectively and critically analyze each ballot item.

|

|

|

|

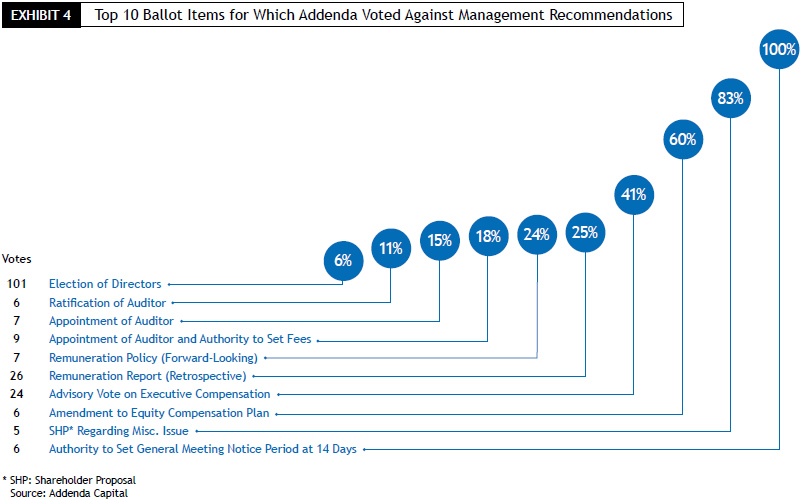

Most often, when we voted against management recommendations, the proposal was about the election of directors (Exhibit 4). For this type of ballot item, we cast 101 votes against management recommendations, which corresponds to 6% of a total of 1,428 nominees that we voted on. We opposed the nominees for various reasons including a lack of independence on a board or the appearance of too many commitments to fulfill their duties as a director.

|

Votes on

Shareholder Proposals

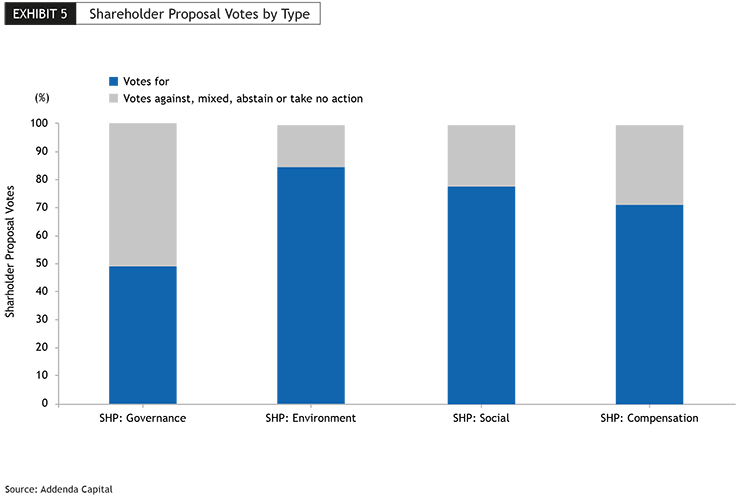

Exhibit 5 shows how we voted on shareholder proposals by type of proposal. We voted for 49% of governance-related shareholder proposals, these proposals include those on board composition, separation of Chair and CEO, and other governance topics. We voted for 85% of environment-related shareholder proposals, these include proposals on reporting greenhouse gas emissions, reporting and/or taking action on climate change, recycling, and other environmental topics. We voted for 78% of social-related shareholder proposals, these proposals include ones related to lobbying, human capital management, human rights, and other social topics. We voted for 71% of compensation-related shareholder proposals, these proposals include ones on race and/or gender pay equity reporting, linking executive pay to social criteria, and other executive compensation related proposals.

|

|

|

Vote Examples

Below are two examples of votes from this past voting season.

Election of a Board Member

| Company |

|

Distribution Company |

| |

|

Addenda's Proxy

Voting Policy

|

|

Oppose the election of the chair of the board and the chair of the committee responsible for director nominations when the board of directors is not at least 2/3 independent.

Oppose the election of the chair of the board and the chair of the committee responsible for recommending committee memberships if any of the following committees are not 100% independent: nominating, governance, compensation, and audit.

Oppose the election of the chair of the board committee responsible for director nominations when:

- There are not at least 3 male and 3 female board members; or

- The company has not publicly disclosed a board gender diversity policy that includes the goal of having at least 3 male and 3 female board members within a reasonable period of time.

|

| |

| Addenda's Vote |

|

Vote Against |

| |

|

Rationale

|

|

We opposed the election of the chair of the board/chair of the committee responsible for director nominations because the board of directors is not at least 2/3rds independent.

We also opposed the election of the chair of the board/ chair of the committee responsible for director nominations because the nominating committee is not independent.

We also opposed the election of the chair of the board/ chair of the committee responsible for director nominations because:

- There are not at least 3 male and 3 female board members; and

- The company has not publicly disclosed a board gender diversity policy that includes the goal of having at least 3 male and 3 female board members within a reasonable period of time

|

| |

| Result |

|

10.81% of votes were cast against this director's election. |

Shareholder Proposal on Climate Risk Report

| Company |

|

Insurance Company |

| |

|

Addenda's Proxy

Voting Policy

|

|

Support reasonable requests for increased disclosure of risks and management practices related to or arising from social, environmental and ethical issues.

|

| |

| Addenda's Vote |

|

Vote for (Against Management) |

| |

|

Rationale

|

|

The company has some reporting regarding climate-related risks, however, improved disclosure on this topic would allow shareholders to better understand the risks facing the company and how the company is managing the risks.

|

| |

| Result |

|

73.63% of Votes Were Cast for this Proposal. |

|

Engagement Examples

Taking Care of Your Investments

Our corporate engagement activities involve purposeful dialogue with investee entities on important matters identified through monitoring, matters that have been identified as material concern by our clients and investment professionals, and matters that are the subject of votes at shareholder meetings. In particular, we engage with companies where we have specific concerns about a company's strategy, performance, governance, compensation or approach to risks.

In addition, Addenda regularly develops a thematic engagement plan to tackle issues or market-wide concern. For example, in 2020 we executed on our engagement plans related to climate change, board and executive diversity, and ESG disclosure in line with the Sustainable Accounting Standards Board standards.

On the next page are examples of engagement activities Addenda conducted in 2020.

|

| |

| |

If a company is unresponsive or unable to address our concerns in a manner that helps to optimize long-term value, we may escalate our approach in line with our Stewardship policy, and ultimately file a shareholder proposal or sell the security. |

|

| |

| |

Climate Change

Stewardship Plan |

In 2020 we met with 20 issuers about climate change risk management and emissions reductions; seven issuers about workforce management and wellbeing; five companies on board and executive diversity; We also had written exchanges with numerous other companies on these issues as well as our concerns around executive compensation and governance.

|

| |

Board Diversity

Stewardship Plan |

In 2020 we contacted 18 companies whose boards lacked representation of at least three female and three male directors and did not have a board diversity policy with targets and timelines for improving board diversity. Following our initial outreach email exchanges, we wrote letters to the chairs of the committees responsible for director nominations at 10 companies where we determined that further discussion was required. Following additional written exchanges or meetings, eight of these companies have since appointed additional women to their boards or revised their policies to achieve gender representation in line with our targets.

More highlights of our company engagements can be found in our quarterly sustainable investing reports.

|

| |

|

Conclusion

Our stewardship activities, including sustainable markets advocacy, leveraging our proxy votes and engaging directly with companies, allows us to actively protect and enhance the long-term interests of our clients and contribute to a more sustainable society for all. |

|

|